As the international gold price approaches an all-time high of $2,800 per ounce, there is an analysis that while the upward trend remains valid, considering the burden of the peak, it is necessary to 'adjust the weighting' rather than make additional purchases.

On the 24th, Choi Jin-young, a researcher at Daishin Securities, stated in the report titled "Gold Nearing All-Time High, a Period Requiring Temporary Speed Adjustment," "Gold prices have begun to approach the all-time high of $2,800 per ounce despite ceasefire news between Israel and Hamas (Palestinian armed faction)."

The Gaza war ceasefire alleviates geopolitical risks in the Middle East, which acts as a factor causing a decline in gold prices, a representative safe-haven asset. However, Choi diagnosed that the recent approach of gold prices to the all-time high is due to "the easing of concerns about the Trump trade and changes in U.S. Treasury supply and demand, which began to be reflected since last year, partially mitigating the price discount factor caused by the rise in real interest rates (nominal interest rates minus inflation)."

In particular, Choi evaluated that since the U.S. Federal Reserve (Fed) is in an interest rate cut cycle, the upward direction of gold prices remains valid. He explained, "Looking only at the Fed's recent dot plot, it can be worrisome. Previously, the Fed adjusted the terminal rate for 2025 from 3.4% to 3.9% through the dot plot. This is clearly negative news for gold prices, which have an inverse correlation with real interest rates," but added, "If the Fed's intention to lower the elevated rates after the COVID-19 shock to normal levels remains unchanged, gold prices will also trend upward."

However, he viewed that the inflationary pressure in the first half of the year, which usually acts as a factor for rising gold prices, will be somewhat limited compared to market concerns. While pointing out concerns about the possibility of high tariffs imposed by the second Trump administration, he explained, "Most of these are conditional, such as TikTok sales, fentanyl inflow, and illegal immigration, so the intensity can be adjusted depending on the negotiation results." Additionally, he noted, "Even considering the baseline of energy prices, which are inflation-driving assets, the market's inflation pressure concerns for the first half of the year are excessive."

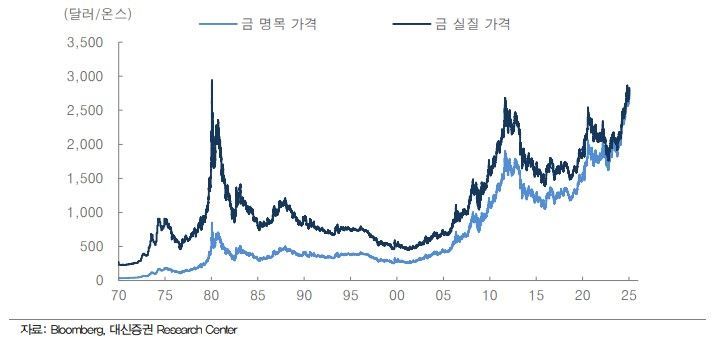

Choi said, "It is true that the current price level is burdensome," and explained, "Generally, in the commodity market, historical highs are recognized as a kind of resistance line. The gold peak is $2,800 per ounce, leaving only a 1.1 percentage point upside potential." Based on real prices adjusted for inflation, the 1980 peak during the second oil shock was $2,940, indicating an additional upside potential of 6.1 percentage points.

Choi recommended, "Given the limited ceiling, additional purchases at the current price are inevitably questionable," and suggested, "From now on, speed adjustment is advised." While supporting the long-term expectation for gold price increases due to the structural rise possibility mentioned by Ray Dalio, founder of Bridgewater Associates and a hedge fund pioneer, he repeatedly emphasized, "In the short term, at a point where level burdens are formed, it is better to adjust weighting and observe rather than make additional purchases."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.