Operating Profit Hits Record 23.5 Trillion Won Last Year

First Annual Surpass of Samsung Electronics DS Division, Estimated at 15 Trillion Won

Sales Reach 66.2 Trillion Won, Net Profit at 19.8 Trillion Won

All Mark Highest Figures Since Company Founding

Fifth-Generation HBM Drives Strong Performance

SK Hynix achieved its highest-ever performance last year, led by its flagship product, High Bandwidth Memory (HBM). Sales, operating profit, and net profit all reached record highs since the company's founding. Following its first-ever surpassing of Samsung Electronics' semiconductor division (DS) operating profit in Q3 last year, SK Hynix also exceeded it on an annual basis for the first time.

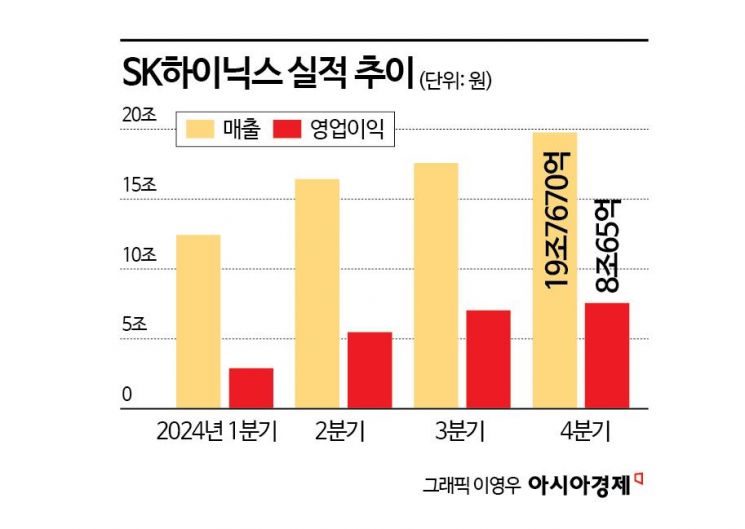

On the 23rd, SK Hynix announced that its operating profit for 2024 reached KRW 23.4673 trillion (consolidated basis), turning profitable from an operating loss of KRW 7.7303 trillion the previous year.

Last year's sales amounted to KRW 66.193 trillion, a 102% increase compared to the previous year. Net profit recorded KRW 19.7969 trillion. Sales exceeded the previous record set in 2022 (KRW 44.6216 trillion) by more than KRW 21 trillion, and operating profit also surpassed the results of the memory super-boom period in 2018 (KRW 20.8437 trillion).

The core of SK Hynix's greatest achievement was undoubtedly HBM. It accounted for more than 40% of total DRAM sales, and sales of enterprise solid-state drives (SSD) also showed strong performance.

With SK Hynix's annual performance surpassing Samsung Electronics, it has shed the label of "perennial second place." Samsung Electronics announced an operating profit of KRW 6.5 trillion for Q4 last year. The securities industry and market estimate the DS division's operating profit to be around KRW 3 trillion. It is estimated that Samsung Electronics posted approximately KRW 15 trillion in operating profit for the entire year. This is the first time SK Hynix's annual operating profit has exceeded that of Samsung Electronics' DS division.

SK Hynix also posted record quarterly results in Q4 last year, with sales of KRW 19.767 trillion and net profit of KRW 8.0065 trillion. As a result, SK Hynix's cash and cash equivalents at the end of last year increased by KRW 5.2 trillion to KRW 14.2 trillion compared to the end of the previous year. Meanwhile, borrowings decreased by KRW 6.8 trillion.

At the briefing following the earnings announcement, SK Hynix stated, "HBM sales this year are expected to grow by more than 100% compared to the previous year," adding, "The goal is to complete development and mass production preparations for the HBM4 product in the second half of this year and begin supply."

SK Hynix also added, "HBM4 is being developed using proven 1b nanometer technology, which ensures technological stability and mass production capability." They explained, "HBM4 will start with a 12-stack product, and the 16-stack product is expected to be supplied in the second half of next year, aligned with customer demand timing." They further stated, "Based on the experience of preemptively applying advanced MR-MUF technology to HBM3E, it will be possible to apply it to mass production of HBM4 16-stack." They continued, "For the first time, HBM4 will enhance performance and power characteristics by utilizing logic foundry (semiconductor contract manufacturing) for the base die, and to this end, we have established a 'one-team' system with TSMC for collaboration."

SK Hynix also mentioned, "Customer demand based on application-specific integrated circuits (ASIC) is significantly increasing, leading to an expansion of the customer base." They repeatedly emphasized that despite the memory semiconductor market's sensitivity to market conditions, SK Hynix has established a stable profit-generating structure focused on profitability centered on HBM technology.

SK Hynix stated, "With the growth of artificial intelligence (AI) memory demand, the memory market is transforming into a high-performance, high-quality, customer-tailored market," adding, "By securing competitiveness to provide products that meet customers' high demands in a timely manner, memory companies can also earn stable profits."

In fact, despite price declines in general-purpose (legacy) DRAM products, SK Hynix reported that the average selling price (ASP) of DRAM increased by 10% due to expanded sales of high-value-added products such as HBM. They said, "We have started discussions with some customers regarding HBM supply volumes for next year and expect to secure visibility for most of next year's volumes by the first half of this year," adding, "Considering the high investment costs of HBM, we plan to maintain a long-term contract structure."

They continued, "The AI market is evolving not only in learning and inference functions but also by integrating AI services into various industries, possessing growth potential beyond expectations," emphasizing, "There is no doubt about the long-term growth in HBM demand."

Regarding NAND, SK Hynix plans to continue its existing profitability-focused business operation policy. They explained, "Except for eSSD, production was maintained at a limited scale last year," adding, "Going forward, NAND will continue with the current operational policy until demand improvement is confirmed, operating flexibly according to market conditions and focusing on inventory normalization."

They added, "This year's investment scale will slightly increase compared to last year due to HBM investments for volumes already agreed upon with customers and the construction of future growth infrastructure such as M15X and the Yongin fab (semiconductor manufacturing plant)," stating, "Infrastructure investment will increase significantly compared to the previous year." SK Hynix plans to open M15X, currently under construction in Cheongju, in Q4 this year, and construction of the first phase fab in the Yongin cluster is scheduled to start this year with a target opening in Q2 2027.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.