Last Year's Growth Rate at 2.0%... Only 0.1% Growth in Q4

Recovery Compared to 2023 (1.4%), but Fell Short of Projections

This Year, Export Weakness and Construction Downturn... Growth Expected in the 1% Range

Need for Policy Shift to Boost Domestic Demand and Consideration of New Long-Term Industrial Engines

Last year, South Korea's economy grew by only 2.0%. The construction sector's downturn deepened, and the growth rate of private consumption also slowed, falling short of projections. In the fourth quarter of last year, economic sentiment weakened due to increased political uncertainty, resulting in a growth rate of just 0.1%.

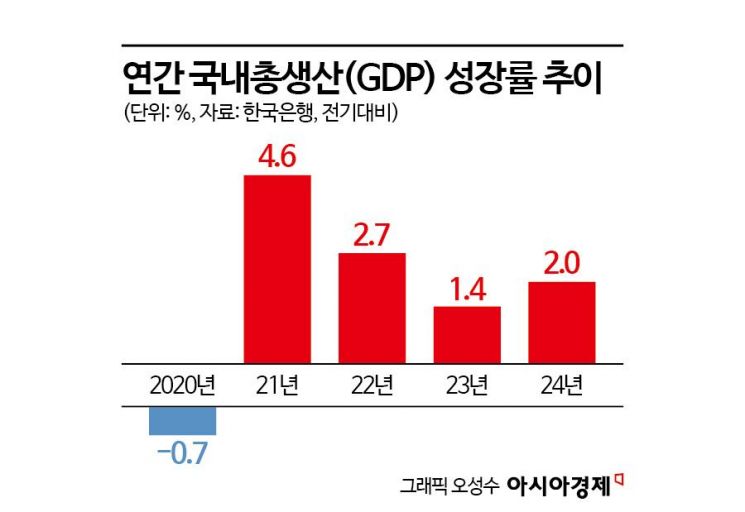

On the 23rd, the Bank of Korea announced that last year's real Gross Domestic Product (GDP) growth rate was 2.0%. This figure is below both the government's forecast (2.1%) and the Bank of Korea's economic outlook presented in November last year (2.2%). It barely met the lower bound of the Bank of Korea's updated mid-term forecast this month (2.0~2.1%). However, exports, a pillar of the Korean economy, increased significantly, surpassing the previous year's (2023) growth rate of 1.4%.

Last Year's GDP Growth at 2.0%... Export Surge Despite Weak Domestic Demand Including Construction Investment and Private Consumption

South Korea's economic growth rate declined for three consecutive years, from 4.6% in 2021 to 2.7% in 2022 and 1.4% in 2023, before rebounding to 2.0% this year. Construction investment recorded negative growth, and private consumption growth also slowed, showing weak domestic demand. However, this outcome was driven by expanded exports and increased facility investment due to growing IT demand.

The private consumption growth rate decreased from 1.8% in 2023 to 1.1% last year. Construction investment shifted from 1.5% growth to a decline of -2.7%. Exports rose sharply from 3.9% in 2023 to 6.9% last year. Government consumption increased from 1.3% to 1.7%, and facility investment rose from 1.1% to 1.8%.

By economic activity, the service sector's growth slowed from 2.1% to 1.6%, and construction turned from 3.1% growth to a decline of -2.6%. Manufacturing expanded its growth rate from 1.7% in 2023 to 4.4% last year.

Private sector contribution to growth was 1.6 percentage points last year, exceeding the previous year's 1.1 percentage points. The government's contribution also rose to 0.4 percentage points from 0.3 percentage points the year before.

The contribution of net exports (exports minus imports) was 1.8 percentage points, higher than domestic demand's 0.2 percentage points. Domestic demand, centered on private consumption and construction investment, shrank from 1.4 percentage points in 2023 to 0.2 percentage points last year. Construction investment's contribution turned negative at -0.4 percentage points. Facility investment's contribution slightly increased from 0.1 percentage points in 2023 to 0.2 percentage points last year.

Shin Seung-chul, Director of the Economic Statistics Bureau at the Bank of Korea, said, "Last year, the economy grew mainly due to exports and facility investment, but domestic demand such as private consumption and construction investment was worse than initially expected."

Q4 Growth at 0.1%... Impact of Martial Law and Deepening Construction Sector Downturn

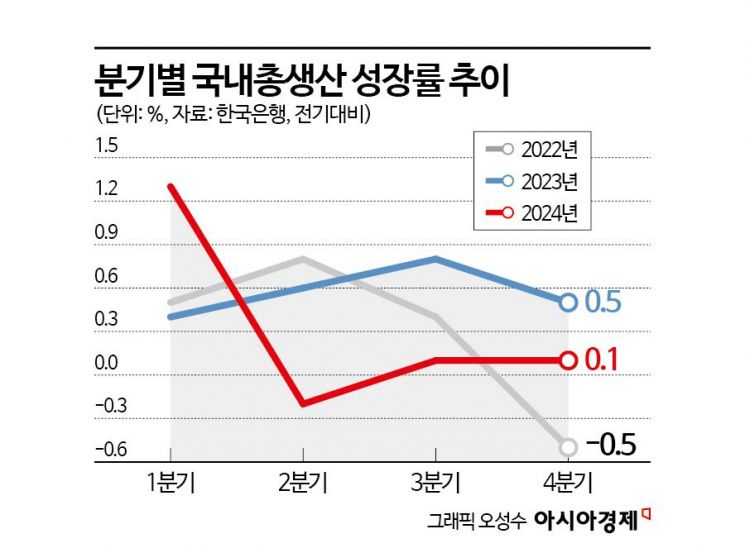

In the fourth quarter of last year, GDP grew by only 0.1% compared to the previous quarter. This was significantly below the Bank of Korea's November forecast of 0.5% and barely met this month's mid-term forecast of 0.2% or lower. Although exports rebounded positively, the domestic demand recovery weakened.

Quarterly GDP growth rates were 1.3% in Q1 last year, continuing five consecutive quarters of growth, then turned negative at -0.2% in Q2, followed by low growth rates of 0.1% in both Q3 and Q4.

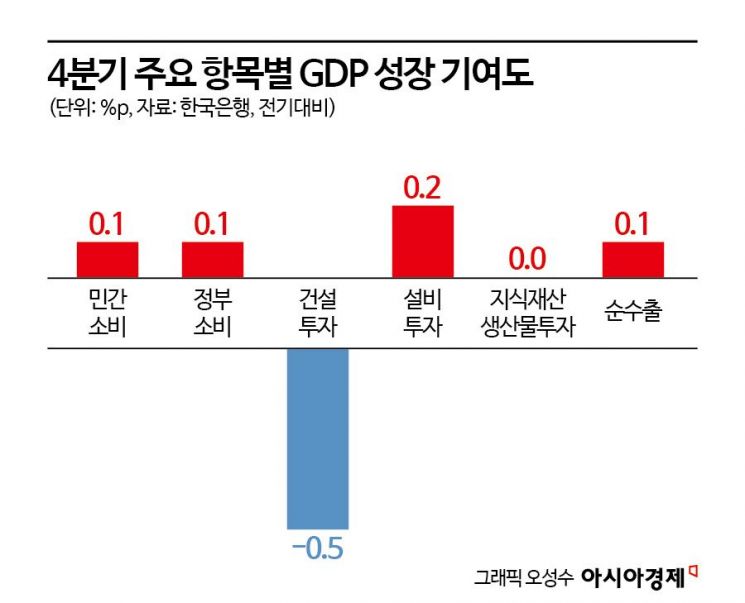

Exports in Q4 last year increased mainly due to semiconductors and other IT products, but domestic demand was a drag. Private consumption recovery weakened amid worsening sentiment due to increased political uncertainty, and construction investment remained sluggish. The growth contribution of net exports shifted from -0.8 percentage points in the previous quarter to a positive 0.1 percentage points, while domestic demand's contribution sharply shrank from 0.8 percentage points to 0.0 percentage points.

Looking at sectors, growth rates for private and government consumption and facility investment all contracted. Construction investment recorded negative growth for the third consecutive quarter. Private consumption increased by 0.2%, centered on semi-durable goods such as clothing and footwear, and services like healthcare and education. Government consumption rose by 0.5%, mainly due to social security benefits such as health insurance payments. Construction investment decreased by 3.2%, with declines in both building and civil engineering construction. Facility investment increased by 1.6%, driven by machinery such as semiconductor manufacturing equipment. Exports rose by 0.3%, mainly IT products like semiconductors, while imports fell by 0.1%, due to decreases in automobiles and crude oil.

By industry, agriculture, forestry, and fisheries declined by 3.9%, mainly in crop farming. Manufacturing grew slightly by 0.1%, despite decreases in metal processed products, supported by increases in chemicals, computers, and electronic and optical equipment. Electricity, gas, and water supply decreased by 2.9%, centered on gas, steam, and air conditioning supply. Construction shrank by 3.5%, with declines in both building and civil engineering construction. Services grew by 0.3%, with decreases in wholesale, retail, accommodation, and food services, but increases in finance and insurance, medical care, health, and social welfare services.

Director Shin said, "After the economic outlook in November last year, political uncertainty expanded in December, dampening economic sentiment and affecting private consumption. Construction leading indicators such as housing starts and orders were weak, and new housing sales and performance in December were poor, resulting in figures below expectations." He added, "Construction investment was expected to continue its downturn, but the decline was more severe than anticipated."

Real Gross Domestic Income (GDI) in Q4 last year increased by 0.6%, surpassing real GDP growth, due to improved terms of trade. Prices of export goods such as electrical equipment rose more sharply than import prices like crude oil. The annual real GDI growth rate (3.9%) also exceeded real GDP growth.

Concerns Over 'Low Growth in the 1% Range' This Year... Bank of Korea Forecasts 1.6~1.7%

Following last year's growth rate falling short of expectations, concerns have grown that South Korea's economy will again remain in the 'low growth 1% range' this year. This is due to a sharp drop in export growth and expected negative growth in construction investment amid weak domestic demand.

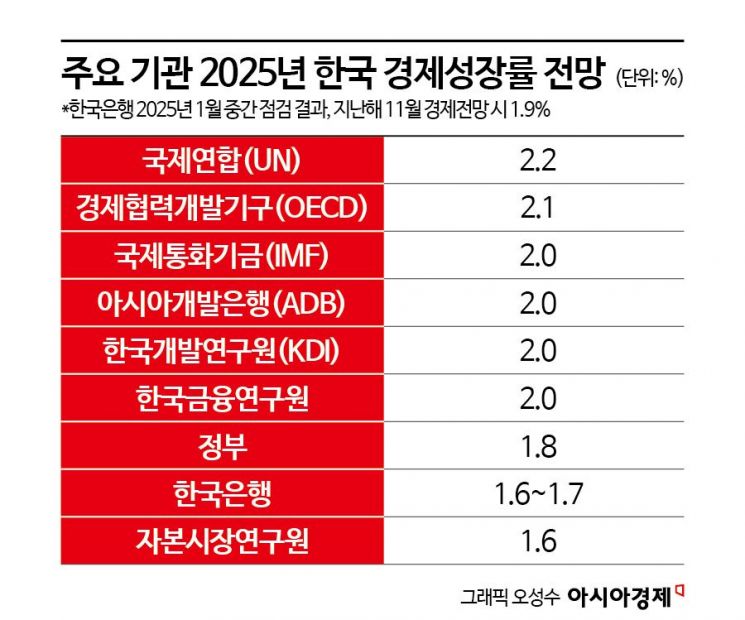

Earlier this month, the government announced the '2025 Economic Policy Direction,' projecting South Korea's real GDP growth rate at 1.8% this year, down 0.4 percentage points from the 2.2% forecast made in July last year. A growth rate in the 1% range would be the first since 2023 (1.4%). The government expects export growth to plunge to 1.5% this year, reflecting intensified competition in key industries such as semiconductors and changes in U.S. trade policy following the Trump administration. Construction investment is expected to contract for the second consecutive year.

The Bank of Korea recently lowered its forecast for South Korea's economic growth rate this year to 1.6~1.7%, down 0.2~0.3 percentage points from the 1.9% forecast in November last year. The Bank of Korea analyzed that the political uncertainty caused by the martial law incident in December last year will reduce the growth rate by about 0.2 percentage points. The Bank of Korea, which usually releases economic outlooks in February, May, August, and November, unusually shared specific figures this month as part of a mid-term review. The lowered forecast assumes that political uncertainty will gradually ease from the second quarter, leading to a recovery in economic sentiment in the second half of the year. However, if political uncertainty expands further or prolongs, the economic situation could worsen.

International organizations that made forecasts in November-December last year, including the International Monetary Fund (IMF), Asian Development Bank (ADB), Korea Development Institute (KDI), and Korea Institute of Finance, projected South Korea's economic growth rate at 2.0% this year, while the Organisation for Economic Co-operation and Development (OECD) forecasted 2.1%. The United Nations (UN) predicted a higher rate of 2.2%.

Experts unanimously agree that this year's economic growth rate will worsen compared to last year. They emphasize the need to view the slowdown not just as a short-term issue related to martial law, the new U.S. administration, or exchange rates, but to structurally examine the limitations of South Korea's economy and industries.

Kang Sung-jin, Professor of Economics at Korea University, said, "We see that the country's competitiveness is currently declining, so we need to seriously examine fundamental problems. We have relied on automobiles, steel, and petrochemicals for over 40 years, but now we face a situation where we must give up a significant portion of these industries. It is time to consider new industrial engines as a long-term structural issue."

Jung Yong-taek, Economist at IBK Investment & Securities, also explained, "There are talks that the martial law incident significantly depressed December's figures, but signals of domestic demand contraction were present even before December. Today's data is a continuation of that trend. We need to consider where the domestic demand contraction originated and make policy shifts accordingly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.