Korea Investment & Securities announced on January 23 that investments in exchange-traded funds (ETFs) through retirement pension accounts (DC · IRP) have more than doubled over the past year.

The accumulated funds in DC·IRP accounts increased from 5.8 trillion won at the end of 2023 to 8.4 trillion won at the end of last year. Of this amount, the funds invested in ETFsjumped from 752.9 billion won to 1.7513 trillion won, representing an approximately 2.3-fold increase.

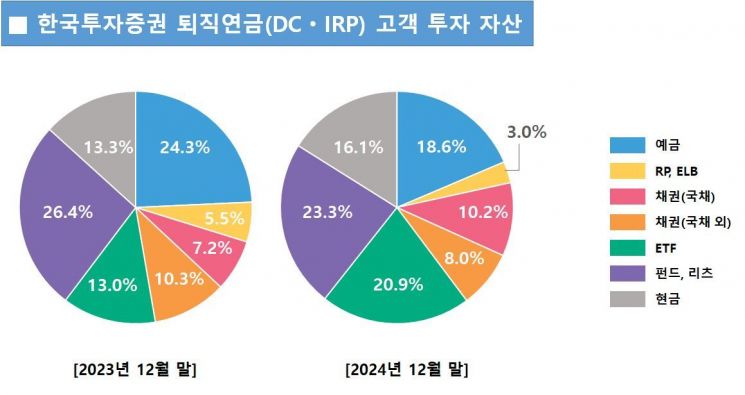

The proportion of ETFs within these accounts also rose by 7.9 percentage points, from 13.0% to 20.9%. Due to the growing popularity of bond investments, the share of government bonds also expanded from 7.2% to 10.2%.

In contrast, the proportion of deposits declined from 24.3% to 18.6%. The share of other principal-guaranteed products, such as equity-linked bonds (ELB) and repurchase agreements (RP), also decreased compared to the previous year.

This trend is attributed to the increasing number of investors seeking to enhance returns in their pension accounts through more active management. According to estimates based on Korea Investment & Securities' non-face-to-face retirement pension accounts, as of the end of last year, ETFs delivered an average return of 11.0% over their initial purchase price, whereas deposits yielded only 3.2%.

Additionally, the expansion of services aimed at improving the convenience of non-face-to-face investments-such as the industry’s first automated ETF installment investment service, launched in August last year-also contributed to this trend.

Korea Investment & Securities stated, "In the first half of this year, we plan to launch discretionary products utilizing robo-advisors (RA) within retirement pension accounts, as well as a direct bond trading service." The company explained, "By doing so, we aim to provide a variety of investment options tailored to each customer’s unique retirement timeline and investment goals, thereby taking the lead in enhancing pension account returns."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![A Woman Who Jumps Holding a Stolen Dior Bag... The Mind-Shaking, Bizarre Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)