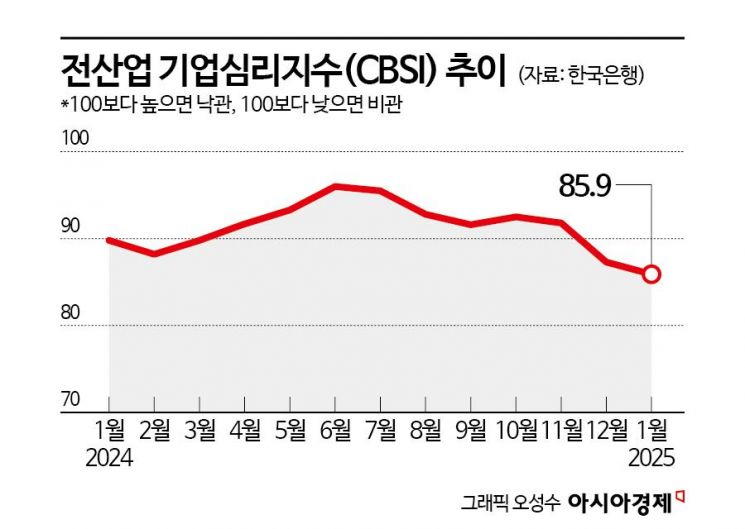

CBSI for All Industries Drops to 85.9 in January, Down 1.4 Points

Manufacturing Rises on Export Gains, Non-Manufacturing Falls on Economic Slowdown

Worst Level Since September 2020... February Outlook Turns Positive

Corporate sentiment deteriorated for the third consecutive month, reaching its lowest level since September 2020, when COVID-19 was at its peak. The manufacturing sector showed signs of improvement as exports in some industries improved, but the non-manufacturing sector weakened due to a slowdown in the construction industry. However, corporate sentiment is expected to show an upward trend in both manufacturing and non-manufacturing sectors next month.

According to the 'January Business Survey Results and Economic Sentiment Index (ESI)' released by the Bank of Korea on the 23rd, the Composite Business Sentiment Index (CBSI) for all industries this month was 85.9, down 1.4 points from the previous month. This is the lowest level since September 2020 (83.4), when COVID-19 was at its peak.

The CBSI is a corporate sentiment indicator calculated using major indices from the Business Survey Index (BSI). A value above 100 indicates that companies are more optimistic about the economic situation compared to the past, while a value below 100 indicates pessimism.

The CBSI for all industries has declined for three consecutive months through this month, following a drop in November due to policy uncertainties under the second Trump administration in the U.S., and overlapping with the impeachment political turmoil in December.

This month, the manufacturing CBSI rose 1.9 points from the previous month to 89.0. Manufacturing saw key factors such as business conditions and product inventory contributing to the increase. Manufacturing performance improved as exports improved, centered on chemicals and chemical products, electrical equipment, and primary metals. In chemicals and chemical products, exports increased mainly for synthetic resins and cosmetics. Electrical equipment saw improvements due to new overseas orders and export improvements from cable companies. Primary metals were influenced by increased exports of steel and aluminum products mainly to the U.S. and Europe.

The non-manufacturing CBSI (83.6) fell 3.9 points from the previous month. Profitability and sales were the main factors behind the decline in non-manufacturing. Performance deteriorated mainly in construction, information and communication, and transportation and warehousing industries. In construction, sales and profitability worsened due to continued slowdowns in housing construction and the real estate market. In information and communication, sales decreased mainly among system software developers. Transportation and warehousing also faced increased cost burdens due to rising oil prices and exchange rates.

Many companies expected the business climate to improve next month in both manufacturing and non-manufacturing sectors. The CBSI forecast for February was 85.4, up 2.5 points from the previous month. Manufacturing was projected to rise 3.6 points from the previous month to 89.1, while non-manufacturing was expected to increase 1.7 points to 82.6. Manufacturing in February is expected to improve mainly in chemicals and chemical products and primary metals. Non-manufacturing in February is forecasted to improve mainly in wholesale and retail trade, business facility management, business support, and rental services.

Although the February outlook turned upward compared to the previous month, optimism remains difficult. Exports are key for manufacturing, and domestic demand is crucial for non-manufacturing, but uncertainties remain due to the trade policies of the new Trump administration and the domestic political situation. Hwang Hee-jin, head of the Statistical Survey Team at the Bank of Korea’s Economic Statistics Bureau, said, "Concerns about the U.S. new administration’s trade policies have eased somewhat, leading to the rise in the February outlook, but uncertainties remain. If the U.S. government’s policies materialize in ways unfavorable to us, this could again become a negative factor at any time." Domestic demand weakness negatively affects non-manufacturing, including construction, so political uncertainties must be resolved for improvement.

The Economic Sentiment Index (ESI), which combines the Business Survey Index (BSI) and the Consumer Sentiment Index (CSI), recorded 86.7, up 3.4 points from the previous month. The seasonally adjusted cyclical component was 88.1, down 1.3 points from the previous month.

Meanwhile, this survey was conducted from the 8th to the 15th of this month, targeting 3,524 corporate entities nationwide. There were 3,312 respondents, with 1,852 in manufacturing and 1,460 in non-manufacturing.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)