Dong Sung Hwa In Tech's Order Backlog Reaches About 2 Trillion KRW in Q3 Last Year

Orders for LNG Carrier Insulation Materials Rise on Growing Demand for Eco-Friendly Energy

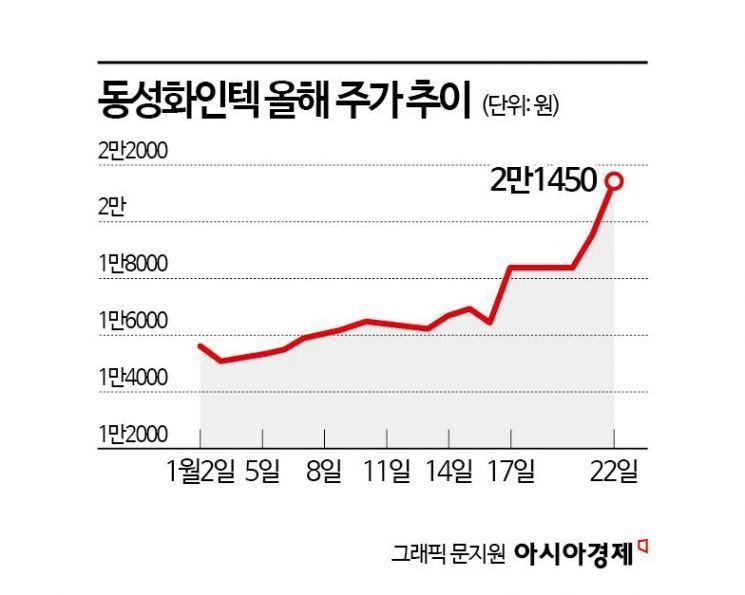

Dong Sung Hwa In Tech's stock price has risen more than 40% in just over a month. This is due to expectations of improved performance driven by increased orders amid the shipbuilding supercycle.

According to the Korea Exchange on the 23rd, Dong Sung Hwa In Tech recorded 21,450 KRW the previous day. This marks a 43.77% increase compared to the end of last year. This performance surpasses the KOSDAQ's rise of 7.98% during the same period.

This upward trend is a benefit from entering the shipbuilding supercycle. Dong Sung Hwa In Tech is a company that produces cryogenic insulation materials. These insulation materials are mainly used to maintain low internal temperatures in the cargo holds of LNG carriers. The product is benefiting from the increase in LNG carriers due to the expansion of demand for eco-friendly energy.

Brokerages expect Dong Sung Hwa In Tech to have posted strong results in the fourth quarter of last year. According to FnGuide, the sales and operating profit forecasts by securities firms for Dong Sung Hwa In Tech in Q4 last year were 159.2 billion KRW and 14.2 billion KRW, respectively. These figures have increased compared to the forecasts six months ago, which were 146.6 billion KRW in sales and 12.5 billion KRW in operating profit.

There is also speculation that recent results may have increased further. Hana Securities projected that Dong Sung Hwa In Tech's sales and operating profit in Q4 last year reached 164.7 billion KRW and 15.6 billion KRW, respectively. Researcher Wi Kyung-jae of Hana Securities said, "We believe the results will exceed consensus," adding, "Considering that insulation material sales are recognized in dollars, there is likely some performance improvement effect due to the rise in exchange rates."

Expectations for future performance are also high. The reason is the ample order backlog. As of Q3 last year, it amounted to 1.9619 trillion KRW. This is due to increased demand for LNG carriers driven by the global expansion of eco-friendly energy demand, growth in LNG demand, and the expansion of export plants, which have improved the upstream market.

Researcher Lee Sang-heon of iM Securities explained, "As of the end of Q3 2024, we have secured an order backlog worth about 2 trillion KRW, equivalent to four years' worth of volume, totaling more than 100 vessels," adding, "Based on this order backlog, sales are expected to increase year by year." He continued, "As revenue recognition from new orders reflecting product price increases begins in earnest, profitability improvement will become visible starting this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.