Meritz Securities maintained its previous forecast that the Bank of Japan (BOJ) will raise its benchmark interest rate by 0.25 percentage points this week and implement two hikes within the year. The next additional hike is expected in July. BOJ's rate hikes are considered a factor for yen appreciation. However, due to BOJ's low credibility, yen buying is ultimately seen as a reactive measure.

On the 22nd, Suyeon Park, an economist at Meritz Securities, stated in the report titled "BOJ January Preview: Patchwork 25bp (1bp equals 0.01 percentage points) Hike," "As BOJ is the only major central bank raising interest rates, the key points to watch at the upcoming monetary policy meeting on the 24th are whether rates will be raised and the revised economic outlook."

Economist Park said, "Considering Japan's macro fundamentals, we maintain the previous forecast of two additional hikes this year (expected in January and July)," and "the revised economic outlook is expected to include an upward adjustment of inflation forecasts supporting further hikes." Inflation rates remain high due to yen depreciation and wage pressure, justifying BOJ's rate hikes.

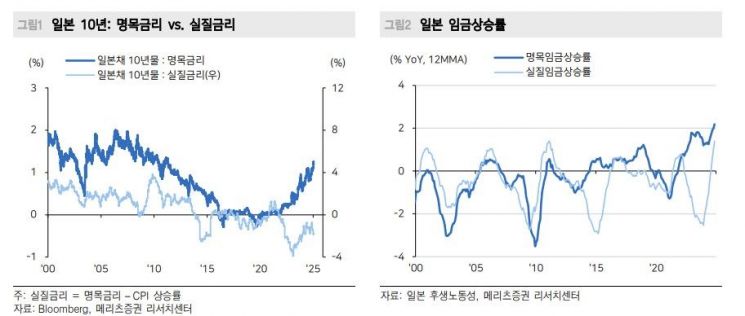

He noted that, looking solely at Japan's economic situation, conditions were already favorable for a rate hike in December last year, citing reasons such as ▲ accommodative financial conditions ▲ virtuous cycle between wages and prices ▲ sustained economic growth above potential growth rate. Despite two rate hikes last year, real interest rates remain negative according to economic indicators. Wage growth has been steadily rising since December 2023. Future economic growth is also expected to be positive.

Economist Park emphasized, "Above all, it is encouraging that Japan's domestic conditions point to an escape from structural deflation," forecasting that the spring wage increase rate, which was 5.1% last year, will remain at a similar level this year. The January Sakura Report (Japan Regional Economic Report) also noted improvements in employment and wage conditions across all regions. Additionally, the discontinuation of the Japanese government's energy subsidy payments implemented since 2023 is also considered a future inflationary factor.

He stressed, "With inflation becoming entrenched and economic outlook optimistic, there is virtually no reason for BOJ to delay rate hikes," adding, "Rather, since external conditions could change rapidly, a preemptive hike is necessary to enable future accommodative monetary policy." As specific grounds for the January hike forecast, he cited policy directions announced by U.S. President Donald Trump in his inauguration speech and local media reports on statements by BOJ officials including Deputy Governor Ry?zo Himino.

However, due to BOJ's low credibility, Economist Park emphasized that the yen is in the realm of reaction. He explained, "It would be reasonable to buy yen after confirming BOJ's policy decisions," adding, "Of course, since the U.S. Federal Reserve (Fed) has entered a rate cut cycle, the narrowing of the interest rate differential with Japan will be a factor for yen appreciation. However, given the uncertainty of BOJ's policy decisions, it will be difficult for the yen to sustain appreciation solely due to BOJ hikes." He added, "However, considering the yen's valuation attractiveness, during periods of a weak dollar, the yen's appreciation against other currencies will be greater."

Economist Park predicted, citing factors such as a slight reduction in external uncertainties following President Trump's inauguration in the second half of the year, the Japanese House of Councillors election scheduled for July, and the release of a new revised economic outlook in July, "the next BOJ rate hike is expected in July," while also noting that "uncertainty remains high."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.