Plan to Strengthen Accountability of Insurance Sales Channels Discussed at 6th Insurance Reform Meeting

Insurance Companies Must Accumulate Additional Capital if Negligent in GA Management

GAs Required to Manage Branch Commissions and Incomplete Sales

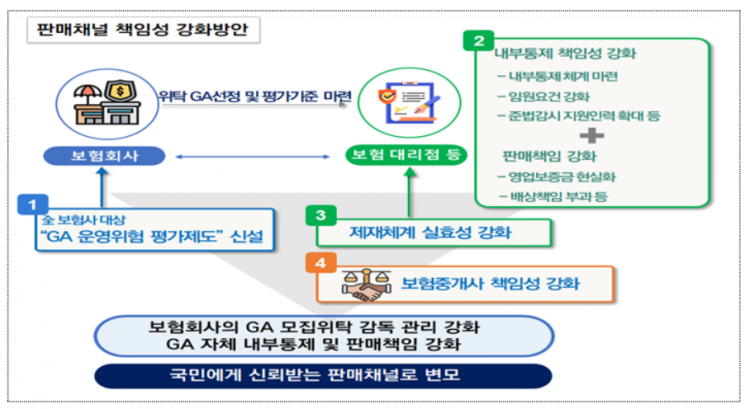

Going forward, insurance companies must establish their own evaluation criteria for corporate insurance agencies (GA) that sell their products and are required to report the evaluation results to the board of directors. If an insurance company neglects GA management, a penalty requiring additional capital accumulation will be imposed. GAs must also establish internal control mechanisms to manage branch commissions and unhealthy sales practices.

The Financial Services Commission announced on the 22nd that it discussed these measures as part of the "Strengthening Accountability of Insurance Sales Channels" at the 6th Insurance Reform Meeting.

Kim So-young, Vice Chairman of the Financial Services Commission, attended the 6th Insurance Reform Meeting held on the 20th to discuss the 'Measures to Strengthen Accountability of Insurance Sales Channels.' Photo by Financial Services Commission

Kim So-young, Vice Chairman of the Financial Services Commission, attended the 6th Insurance Reform Meeting held on the 20th to discuss the 'Measures to Strengthen Accountability of Insurance Sales Channels.' Photo by Financial Services Commission

Insurance sales channels largely consist of face-to-face channels where planners meet consumers directly. Recently, the phenomenon of "separation of manufacturing and sales," where insurance companies focus on product manufacturing and asset management while GAs handle product sales, has accelerated, causing GAs to rapidly grow as a major sales channel. The number of planners affiliated with GAs surged from 244,000 in 2021 to 285,000 last year.

The rapid growth of GAs has had a positive effect by expanding consumer choice through comparison and provision of various insurance products. However, despite this external growth, there have been consistent criticisms regarding insufficient internal controls and persistent issues of incomplete sales. Insurance companies, which are supposed to select and manage excellent GAs, often concluded consignment contracts based solely on GA sales performance to expand short-term results, rather than considering consumer protection aspects such as contract retention rates or incomplete sales rates. In response, financial authorities have been discussing improvement measures through the sales channel division of the Insurance Reform Meeting, which includes participation from the GA Association, Life and Non-life Insurance Associations, and insurance companies.

Measures to Strengthen Accountability of Sales Channels Discussed at the 6th Insurance Reform Meeting. Provided by the Financial Services Commission

Measures to Strengthen Accountability of Sales Channels Discussed at the 6th Insurance Reform Meeting. Provided by the Financial Services Commission

Insurance companies must recognize the risk of GA sales consignment as a major management risk and strengthen GA sales consignment management. They must establish their own GA selection and evaluation criteria that comply with international standards such as those of the International Association of Insurance Supervisors (IAIS) and select consigned GAs accordingly. Insurance companies must annually inspect and evaluate GA consignment tasks based on these criteria and develop risk management plans for GAs with low evaluation grades. The results of consignment risk inspections must be mandatorily reported to the board of directors.

The financial authorities plan to introduce a "GA Operational Risk Evaluation System" to assess whether insurance companies have properly managed risks related to GAs. This system will comprehensively evaluate the contract retention rate, incomplete sales rate, and insurance company commission policies of consigned GAs and classify them into grades from 1 to 5. Insurance companies with low evaluation results will be required to accumulate additional capital, such as through the solvency capital requirement (K-ICS). Linked with existing GA evaluation systems, such as internal control evaluations of large GAs, incentives will be provided for consignment contracts with GAs rated as excellent or good. This aims to encourage consignment contracts with GAs of excellent or good grades.

Internal control and sales responsibility mechanisms for GAs have also been established. GA headquarters must establish internal control systems to manage branch commissions and unhealthy sales practices. Compliance with internal controls will be regularly inspected, and measures will be prepared in case of violations.

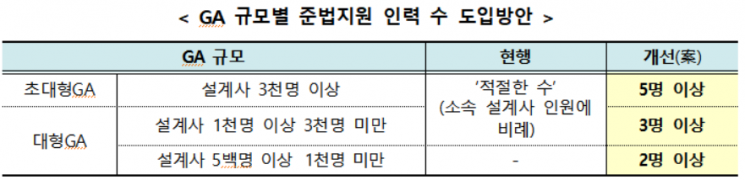

To enable efficient internal control operations, a minimum number of compliance monitoring support personnel will be introduced according to the size of the GA. Currently, the compliance monitoring support organization is formed in proportion to the number of affiliated planners. Going forward, a minimum number of 2 to 5 personnel will be stipulated.

Introduction of Compliance Support Personnel by Size of Corporate Insurance Agencies (GA). Provided by the Financial Services Commission

Introduction of Compliance Support Personnel by Size of Corporate Insurance Agencies (GA). Provided by the Financial Services Commission

To enhance compensation liability capabilities, a minimum limit for GA business deposits, which previously lacked a minimum and thus had low effectiveness, will be newly established. The current maximum limit of 300 million KRW will be raised to 500 million KRW. Compensation liability for GAs will also be significantly strengthened, including reinforcing insurance companies' subrogation rights against GAs in cases of consumer damage caused by incomplete sales.

The GA sanction system will also be restructured to prevent harm to diligent planners and improve sanction effectiveness. To avoid threatening the livelihoods of planners who did not commit illegal acts during GA business suspension, a substitute fine system will be introduced to impose fines instead of business suspension.

It will be fundamentally prohibited for sanctioned GAs to transfer insurance contracts to other GAs and continue operations to evade sanctions such as registration cancellation or business suspension. To prevent GA executives and employees from abusing multiple registrations as a means of sanction evasion, restrictions on multiple registrations will be imposed in certain cases. To promote sound sales channels, reasons for registration cancellation of insurance agencies will be expanded to include violations of financial-related laws such as the Act on the Regulation of Conducting Fund-Raising Business without Permission, in addition to the Insurance Business Act.

For insurance brokers, which have recently grown mainly in the non-life insurance sector, accountability strengthening measures equivalent to those for GAs will be pursued under the principle of same function, same regulation. Large corporate insurance brokers (with annual brokerage commissions of 20 billion KRW or more) will be required to establish internal control standards. The Financial Supervisory Service plans to establish a regular reporting system on management status to build a continuous monitoring system. To strengthen market discipline, disclosures previously conducted individually by each corporate insurance broker will be unified on the Insurance Brokers Association website, and disclosure items will be expanded.

This accountability strengthening plan for insurance sales channels will promptly implement tasks that can be carried out without legal amendments, such as establishing selection and evaluation criteria for consigned GAs. Related legal and supervisory regulation amendments will also be pursued swiftly. Kim So-young, Vice Chairman of the Financial Services Commission, said, "Cancellations due to incomplete sales lead to distrust of the entire insurance industry," adding, "We must establish a sales culture that prioritizes consumers through strengthened responsibility for incomplete sales and the establishment of internal controls."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.