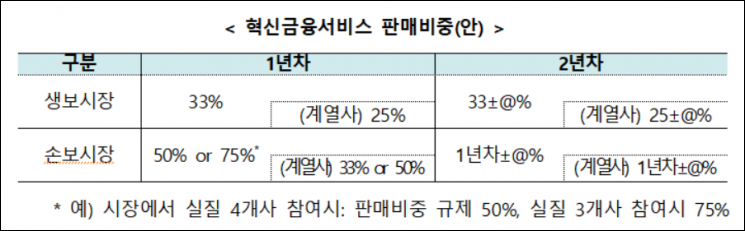

Improvement to 33% for Life Insurers, 50% and 75% for Non-life Insurers

Further Expansion Planned... Measures to Prevent Favoritism for Affiliates

Preferential Interest Rate Option Introduced for Insurance Policy Loans

The 'Bancassurance 25% rule,' which limits the sales proportion of specific insurance company products by financial institution insurance agencies such as banks, will be revised for the first time in about 20 years. Additionally, a preferential interest rate item for the elderly will be introduced in insurance policy loans.

On the 21st, the Financial Services Commission held the 6th Insurance Reform Meeting and discussed insurance industry issues containing these contents. The main agenda items at this meeting included ▲ insurance industry issues ▲ measures to strengthen accountability in insurance sales channels ▲ inducement plans for long-term and stable management of insurance companies such as performance system reform ▲ and proposals for future-oriented tasks.

Since the introduction of financial institution insurance agencies in 2003, banks, card companies, agricultural and fisheries cooperatives, and securities companies have been able to sell insurance products as insurance agencies. The financial institution insurance agency channel is regulated in terms of recruitment products, personnel, and methods, considering the impact on existing insurance sales channels. They have generally focused on selling savings-type insurance products as they are not allowed to sell automobile insurance and whole life insurance. In 2005, financial authorities strengthened product proportion regulations, limiting the sales proportion of a specific insurance company by financial institution insurance agencies to no more than 25%, and this has been operated without significant changes for 20 years.

In the field, there have often been cases where consumer choice was restricted because products desired by consumers could not be sold due to the sales proportion regulation. When an insurance company's product reached 25% of sales volume early, bank counters had no choice but to recommend products from other insurance companies with fewer benefits to comply with the 25% rule. Moreover, since Samsung Fire & Marine Insurance withdrew from the bancassurance market in April last year, compliance with the sales proportion regulation has become even more difficult. This is because only four non-life insurance companies?Hyundai Marine & Fire Insurance, DB Insurance, KB Insurance, and NH Nonghyup Insurance?participate in bancassurance.

The financial authorities plan to gradually ease the 25% rule through innovative financial services. In the first year of innovative financial services, this year, the sales proportion regulation will be increased to 33% for life insurance companies and 50% or 75% for non-life insurance companies. However, for affiliated company products, the 25% rule will still apply to life insurance companies, while it will be eased to 33% or 50% for non-life insurance companies. At the end of the first year, the sales proportion for the second year (whether to increase, maintain, or decrease) will be decided considering the effects of deregulation and the financial impact on insurance companies. Subsequently, institutionalization will be pursued considering the operation results of innovative financial services and market conditions.

Insurance companies without bank affiliates oppose the revision of the 25% rule because it could lead to more preferential treatment of affiliated company products. In response, the authorities plan to require financial institution insurance agencies to disclose monthly sales proportions by affiliated insurance companies to prevent preferential treatment. Conditions will also be imposed to prohibit unjustified refusal or discrimination against insurance company product affiliation requests. To enhance consumer choice and enable small and medium-sized insurance companies to compete fairly with competitive products, the obligation for financial institution insurance agencies to compare and explain similar or identical products will be strengthened. When recruiting insurance, financial institution insurance agencies will provide a list of all affiliated insurance companies, and the products from the insurance companies desired by consumers among the affiliated products must be included. When an agent recommends a specific product, they will be required to explain the reasons for the recommendation and separately provide information on sales commissions for each product.

Preferential Interest Rates for the Elderly Introduced in Insurance Policy Loans

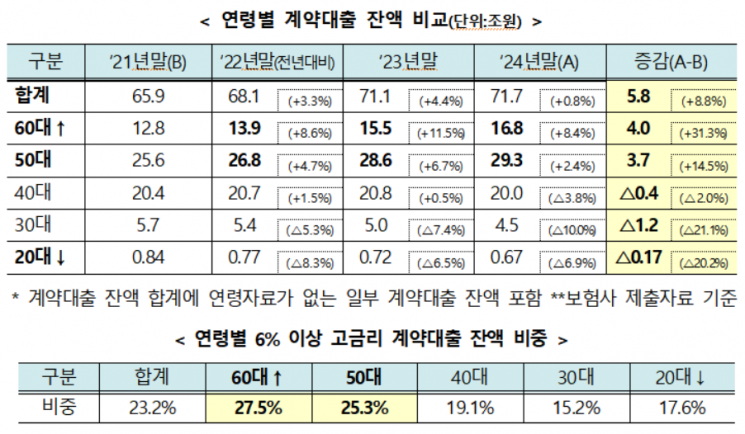

The authorities have also prepared improvement measures for insurance policy loans. Insurance policy loans are loans used when urgent funds are needed. They are advances on insurance benefits executed according to insurance contracts and are granted immediately upon application without loan screening. The outstanding balance of insurance policy loans has steadily increased from 65.9 trillion won in 2021 to 71.7 trillion won at the end of last year.

Loan interest is charged as compensation for the cost of raising reserves and the reduction in future investment returns from operating these reserves, so the insurance product's guaranteed interest rate becomes the basic loan interest rate. Additional interest rates are added to calculate the loan interest. In the past, for high-interest contract products (6-8%), the product's interest rate was set as the basic interest rate for insurance policy loans, resulting in high interest rates. There have been many criticisms that consumers bear a heavy burden when taking insurance policy loans on past high-interest contracts. The authorities plan to ease the interest burden on insurance policy loans by introducing a preferential interest rate item and restructuring the loan interest rate system.

Going forward, preferential interest rates will be provided when policyholders of high-interest insurance products exceeding certain standards set by insurance companies take out loans. Preferential interest rates will also be provided for the elderly, who are likely to need urgent loans and have difficulty accessing other preferential interest rate items such as online channels, as a consumer protection measure. Additionally, preferential interest rates will be offered to users of non-face-to-face online channels with low major operating costs, sound borrowers who have no overdue loan interest for a certain period, and automatic loan executions to maintain insurance contracts in case of premium non-payment. These items can be combined.

Status of Insurance Policy Loans by Age Group and Proportion of High-Interest Policy Loan Balances. Provided by the Financial Services Commission

Status of Insurance Policy Loans by Age Group and Proportion of High-Interest Policy Loan Balances. Provided by the Financial Services Commission

The authorities expect that the preferential interest rate system will result in an annual interest reduction effect of 33.16 billion won. After revising the association's model regulations and preparing detailed operational standards for each insurance company, the preferential interest rate measures are expected to be implemented as early as the second half of this year.

Kim So-young, Vice Chairman of the Financial Services Commission, said, "As with the characteristics of insurance products with a long-term perspective, I ask the insurance industry to internalize long-term growth and sustainability, and I hope today's discussion will serve as the foundation for that. Since the two pillars of the Insurance Reform Meeting are trust and innovation, the next meeting should thoroughly prepare future-oriented tasks so that the insurance industry can shed old habits and take a step forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)