GP Qualification Returned by Kona Venture Partners

Six VCs, Including Logan Ventures and Krit Ventures, Make Another Attempt

Final GP Selection to Be Announced in March

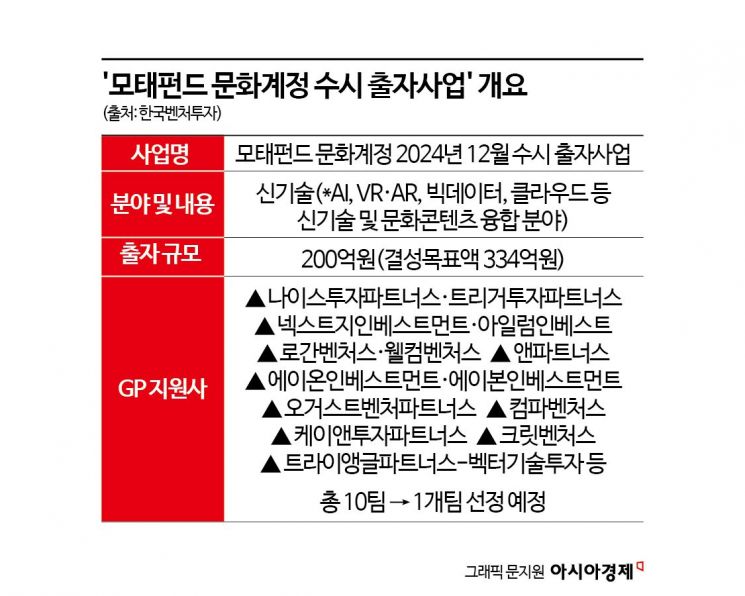

Ten general partners (GPs) competed in the 'New Technology Fund' occasional investment project under the Cultural Account of the Korea Venture Investment Corp. (KVIC)-managed Korea Fund of Funds, recording a competition rate of 10 to 1. This investment project is being conducted after Kona Venture Partners, selected as a GP in the regular investment project last April, voluntarily returned its management qualification due to failure to secure private matching funds.

According to the venture capital (VC) industry on the 21st, Korea Venture Investment announced that a total of 10 teams submitted GP applications for the 'Korea Fund of Funds Cultural Account December 2024 Occasional Investment Project,' including ▲Nice Investment Partners & Trigger Investment Partners ▲Next G Investment & Aillum Investment ▲Logan Ventures & Welcome Ventures ▲AN Partners ▲Aon Investment & Avon Investment ▲August Venture Partners ▲Compa Ventures ▲K& Investment Partners ▲Krit Ventures ▲Triangle Partners & Vector Technology Investment. Each team was composed of single VCs or consortiums.

Notably, among the challengers in this investment project, six VCs?▲Logan Ventures ▲Krit Ventures ▲August Venture Partners ▲Triangle Partners ▲Trigger Investment Partners ▲Welcome Ventures?were also listed as applicant GPs in last year’s regular investment project.

Logan Ventures, which early on selected 'convergent content' as a key investment area, is recognized for its expertise in the metaverse and VR·AR fields. Krit Ventures invested approximately KRW 25 billion last year across K-content sectors such as games, music, and media, as well as new technology-based fields including platforms, commerce, artificial intelligence (AI), and blockchain. August Venture Partners, established in 2022, is a VC that secured its first GP qualification in the following year’s occasional investment project (promoting Korean film releases). Trigger Investment Partners has demonstrated strengths in AI and data analytics technologies.

The total investment scale of this project is KRW 20 billion, focusing on new technologies. The investment areas include artificial intelligence (AI), 3D printing, cloud Internet of Things (IoT), virtual reality (VR)·augmented realityAR), visual effects, and other fields converging new technologies with cultural content.

The selected GPs must raise a fund of at least KRW 33.4 billion and invest more than 60% of the target fund size in small and venture companies and projects combining the cultural industry and new technologies. The remaining 40% can be autonomously invested in related industrial sectors. The total investment period is four years. The fund formation deadline for this project is within three months, with possible extensions within three months in unavoidable cases.

Korea Venture Investment plans to select the final GPs by the end of March. Face-to-face evaluations will be conducted next month for VCs that pass the first document screening. The main evaluation criteria include the GP’s investment capability, appropriateness of investment strategy, and fund formation ability. A VC industry insider said, “The ability to attract private funds will be critically examined during the evaluation process,” adding, “Kona Venture Partners extended the fund formation deadline twice last year and eventually returned the GP qualification because it failed to secure private sector funds.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)