10-Year U.S. Treasury Yield Rises, S&P 500 Falls

Concerns Grow Over Further Stock Declines if Rates Keep Rising

"Temporary Volatility from High Rates Could Be a Buying Opportunity"

Recently, as U.S. Treasury yields have risen sharply, the U.S. stock market is undergoing a correction. While the securities industry warns that further increases in interest rates could expand downside volatility in the stock market, it also expects the medium- to long-term upward trend to resume if corporate earnings continue to improve.

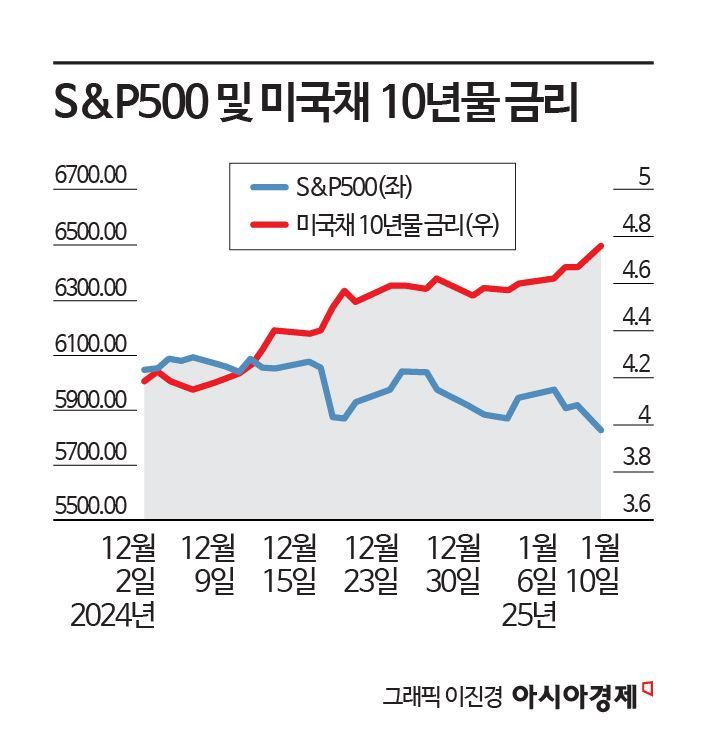

According to the financial investment industry on the 14th, over the past five weeks ending on the 10th (local time), the 10-year U.S. Treasury yield rose by 14.9%, while the S&P 500 index, representing the U.S. stock market, fell by 4.3%. The stronger-than-expected U.S. economy has diminished expectations for rate cuts, and with yields rallying, stock prices are taking a breather.

In the securities industry, concerns have emerged that if interest rates rise further due to an increase in expected inflation, the initially anticipated earnings forecasts could be impaired. Lee Jaeman, a researcher at Hana Securities, explained, "If the U.S. 10-year Treasury yield rises by 10 basis points (1bp = 0.01 percentage points) above 4.5%, the S&P 500 index falls by 2%. The most negative scenario for further rate increases is influenced by rising expected inflation. In this case, it is difficult to expect the currently forecasted S&P 500 earnings growth rate."

If the high interest rate environment continues for the time being, downside volatility in the stock market is expected to increase. Kim Hwan, a researcher at NH Investment & Securities, said, "The sensitivity of stock prices to recent interest rates has increased. This means that when interest rates rise, stock prices fall. Until the timing of additional rate cuts by the U.S. Federal Reserve (Fed) becomes visible, the lower bound of interest rates is likely to be supported. This will stimulate valuation pressure on stock prices."

Kim also mentioned that in a situation where interest rates remain at a high level, the stock performance of large growth stocks is expected to be relatively favorable. He observed, "The stock prices of the Magnificent 7 (M7) are relatively resilient in a high interest rate environment because they have low debt ratios and strong cash flows. Even if market volatility expands due to continued high interest rates and a strong dollar, large growth stocks with solid fundamentals will show stability."

There is also an analysis that this volatility caused by high interest rates presents an opportunity to actively increase stock allocations. Kim Seonghwan, a researcher at Shinhan Investment Corp., pointed out, "What is noteworthy in past cases where preventive rate cuts were implemented is that even if the base rate remained frozen for a long time or was slightly increased, (if the economy and earnings improved), stock prices ultimately rose in a trending manner."

He added, "Reevaluation of the base rate cut path and rising market interest rates are likely to slow the pace of stock price increases in the first quarter of this year, but after digesting this, the stock price movement for the remaining period could be smooth. Interest rate-driven volatility is a buying opportunity."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)