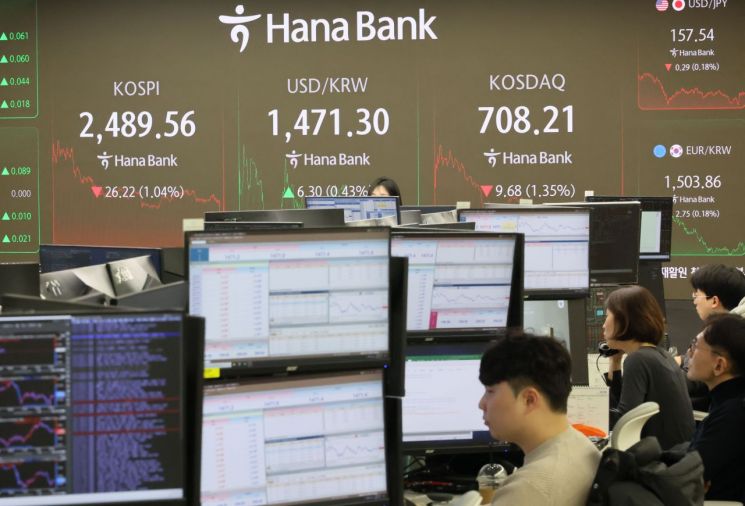

First Close Below 2500 Since January 6

Heavy Net Selling by Foreign Investors, Net Buying by Institutions and Individuals

KOSPI Impacted by Last Week's Sharp Decline in U.S. Markets

The KOSPI 2500 level finally broke down amid nearly 900 billion won worth of foreign selling pressure. This marks the second consecutive day of decline following the last trading day of last week, and it is the first time in four trading days that the 2500 level has been breached based on the closing price.

On the 13th, the KOSPI closed at 2489.56, down 26.22 points (1.04%) from the previous trading day. The KOSPI opened at 2508.15, down 7.63 points (0.30%) from the previous day, reached a high of 2513.93 early in the session, but the 2500 level collapsed during the morning. The KOSPI fell to the 2400 level and did not surpass 2500 even once in the afternoon. This is the first time since January 6 that the KOSPI has closed below the 2500 level.

By investor type, foreigners were net sellers of 875.7 billion won. This was the largest net selling by foreigners since the beginning of the year. In contrast, individuals and institutions were net buyers of 746.1 billion won and 25.8 billion won, respectively. The individual net buying was also the largest since 2025.

By sector, Paper & Wood rose 2.11%, Textiles & Apparel 0.97%, Telecommunications 0.51%, Pharmaceuticals 0.28%, Finance 0.12%, and Insurance 0.10%. All other sectors declined. In particular, five sectors?Medical Precision (-2.81%), Electrical & Electronics (-2.28%), Metals (-2.12%), Construction (-1.56%), and Manufacturing (-1.48%)?experienced larger declines than the KOSPI index.

There were 262 stocks that rose, 640 that fell, and 42 that closed unchanged. Among the top 10 stocks by market capitalization, all declined except Samsung Biologics (1.20%), KB Financial Group (1.71%), and NAVER (0.99%). The market leader Samsung Electronics (-2.17%), along with SK Hynix (-4.52%) and Hyundai Motor (-2.65%), recorded declines exceeding 2%.

Lee Jaewon and Cho Mingyu, researchers at Shinhan Investment Corp., said, "High market interest rates are threatening the stock market, and not only Korea but Asian stock markets also widened their losses today." They added, "Foreigners were net sellers of both spot and futures for two consecutive trading days, and the won-dollar exchange rate rebounded again due to the dollar's strength." The two researchers also noted, "Domestic semiconductors were weak following news of additional U.S. semiconductor regulations against China."

The KOSDAQ index closed at 708.21, down 9.68 points (1.35%) from the previous session.

By investor type, individuals were the sole net buyers with 99.4 billion won, while foreigners and institutions were net sellers of 37.6 billion won and 50.3 billion won, respectively.

There were 367 stocks that rose, 1,265 that fell, and 70 that closed unchanged. The top 10 stocks by market capitalization showed mixed trends. Leading KOSDAQ biotech stocks such as Alteogen (-3.39%), HLB (-2.62%), and Rigacombio (-2.97%) all declined. Meanwhile, Hugel, a specialized biopharmaceutical company, performed well with a 2.88% gain. Rainbow Robotics (3.91%), recently acquired as a subsidiary of Samsung Electronics, was the strongest among the top stocks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)