Three Internet Banks Target Personal Business Loans as a "New Growth Engine"

Loan Balances Surge... But Delinquency Rates Rise and Loan Quality Deteriorates

Internet banks are competing to target the personal business loan (corporate loan) market. With financial authorities expected to continue strengthening regulations on household loans this year, internet banks have turned their attention to the personal business loan market as a "new growth opportunity." However, unlike household loans, the personal business loan market has a high delinquency rate, raising warning signs for soundness management.

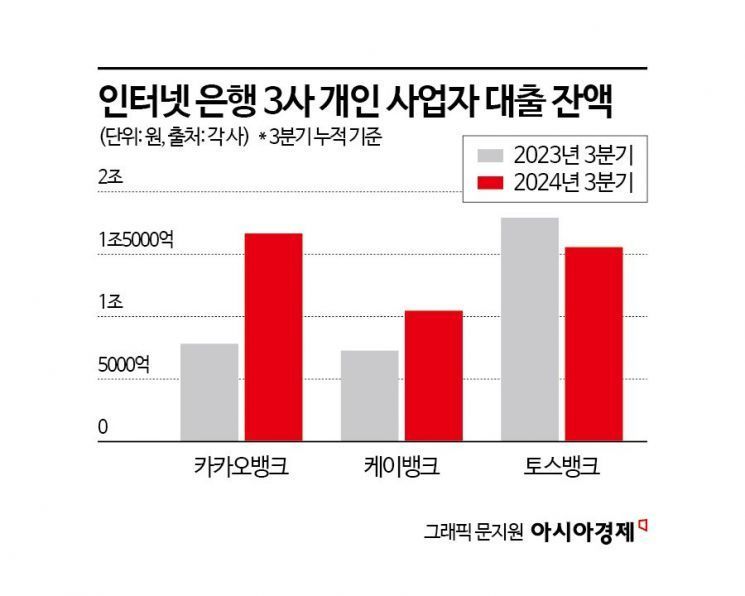

According to the financial sector on the 13th, as of the third quarter of 2024, the total outstanding personal business loans of the three internet banks (Kakao, K Bank, and Toss Bank) amounted to 4.2704 trillion KRW. This represents a 29.30% increase compared to the third quarter of 2023 (3.3024 trillion KRW). By bank, the outstanding personal business loans in the third quarter of 2024 were 1.666 trillion KRW for Kakao Bank, 1.0474 trillion KRW for K Bank, and 1.557 trillion KRW for Toss Bank. In particular, Kakao Bank recorded significant growth, nearly doubling from 783.3 billion KRW in the third quarter of 2023.

Riding this growth momentum, the three internet banks plan to continue targeting the personal business loan market this year. On the 7th, Kakao Bank launched the "VAT Box," which helps personal business customers save in advance for value-added tax incurred during business operations. Kakao Bank has also announced plans to launch "personal business credit loans exceeding 100 million KRW" and "personal business real estate secured loans" this year. Previously, Kakao Bank introduced specialized services for personal business owners, including personal business check cards, issuance of business certificates, and management of business credit information. K Bank, the only internet bank to have launched personal business real estate secured loans, is reportedly preparing services to assist self-employed individuals with tax payments. Toss Bank, which was the first among the three internet banks to start personal business loans, also plans to increase its loan balance this year.

The reason internet banks are rushing to expand the personal business loan market is the expectation that the authorities will continue their household debt management policy this year. In particular, as financial authorities have pointed to internet banks as the main culprit behind the rapid increase in household debt, internet banks have no choice but to shift their focus from household loans to corporate loans to maintain their growth momentum.

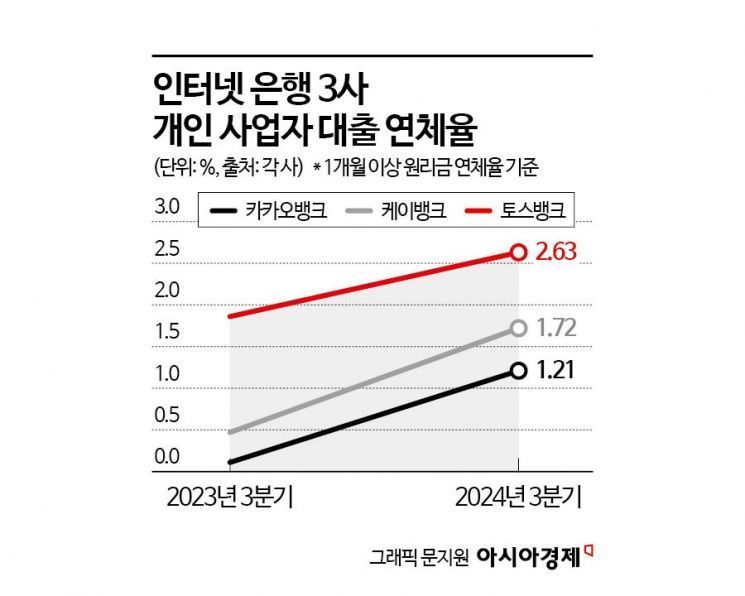

However, managing delinquency rates in personal business loans is challenging, raising warning signs for soundness management. In fact, the delinquency rates (principal and interest overdue by more than one month) of corporate loans at the three internet banks have increased significantly. Kakao Bank's delinquency rate rose sharply from 0.11% in the third quarter of 2023 to 1.21% in the third quarter of 2024. During the same period, K Bank's rate increased from 0.47% to 1.72%, and Toss Bank's from 1.86% to 2.63%.

The quality of loans has also deteriorated. The ratio of non-performing loans, known as the fixed-below loan ratio, has increased significantly. Fixed-below loans are a key indicator of bank soundness and refer to loans overdue for more than three months. Financial institutions classify loans into five categories based on asset soundness: normal, precautionary, fixed, doubtful, and estimated loss. Among these, fixed, doubtful, and estimated loss are collectively called fixed-below loans. Kakao Bank's fixed-below loan ratio for corporate loans rose significantly from 0.14% in the third quarter of 2023 to 0.58% in the third quarter of 2024. K Bank's ratio increased from 0.17% to 0.85%, and Toss Bank's from 1.76% to 2.97% during the same period.

The amount of non-performing loans that generate no income, known as "zombie loans," has also increased. Kakao Bank's zombie loans rose from 0.14% in the third quarter of 2023 to 0.58% in the third quarter of 2024. During the same period, K Bank's increased from 0.55% to 1.07%, and Toss Bank's from 1.75% to 2.36%.

An official from a financial institution said, "Due to the nature of internet banks focusing on retail and the ongoing household loan regulations, the areas where they can expand their market share are limited. To maintain soundness, they are expanding loans with solid collateral, such as personal business real estate secured loans, and are working on advancing personal credit evaluation models."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)