Operating Loss of 225.5 Billion KRW in Q4 Last Year

LG Energy Solution recorded a quarterly loss for the first time in three years since the third quarter of 2021.

On the 9th, LG Energy Solution announced that its sales for the fourth quarter of last year were 6.4512 trillion KRW, with an operating loss of 225.5 billion KRW. Compared to the same period last year, sales decreased by 19.4%, and operating profit turned into a loss. Compared to the previous quarter, sales also decreased by 6.2%, and operating profit turned into a loss.

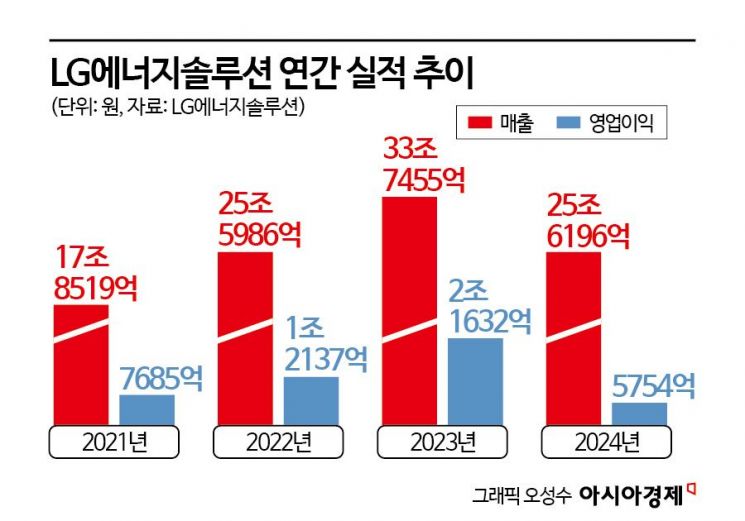

The scale of the Advanced Manufacturing Production Tax Credit (AMPC) under the U.S. Inflation Reduction Act (IRA) was 377.3 billion KRW, and excluding this, the operating profit was -602.8 billion KRW. The annual sales for last year were 256.196 trillion KRW, with an operating profit of 575.4 billion KRW. Compared to 2023, sales decreased by 24.1%, and operating profit decreased by 73.4%.

LG Energy Solution’s quarterly loss is the first loss since the third quarter of 2021. LG Energy Solution had previously recorded a loss in the third quarter of 2021 due to setting aside a provision of 620 billion KRW related to the recall of General Motors (GM)’s 'Bolt EV.' Aside from that period with the provision issue, there have been fluctuations but no losses. On the contrary, annual operating profits steadily increased, showing 768.5 billion KRW in 2021, 1.2137 trillion KRW in 2022, and 2.1632 trillion KRW in 2023. Sales doubled from 17.8519 trillion KRW in 2021 to 33.7455 trillion KRW in 2023.

The cause of the loss after three years is attributed to decreased demand in major markets. In the U.S., the operating rate of the North American plant declined due to reduced electric vehicle sales by major customer GM. The amount of AMPC received, which depends on production scale, also decreased. The growth momentum of the electric vehicle market in Europe also slowed down. Additionally, it is analyzed that seasonal factors such as year-end inventory adjustments by customers and the impact of price reductions due to falling metal prices affected the results.

In December last year, LG Energy Solution launched a company-wide crisis management system. This was to quickly overcome short-term crises such as the chasm (temporary stagnation in growth industries) and changes in eco-friendly and energy policies in various countries, and to secure market competitiveness during the expected recovery period after 2026. President Kim Dong-myung emphasized in this year’s New Year’s address, "We must improve investment efficiency according to market changes and drastically improve organizational structure and cost structure," adding, "This year, meaningful profit generation will be very difficult, so short-term cost reduction activities are also essential."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.