6 Years Later, the 서민금융협의회 Meeting Held

Supply Plan Increases by 365 Billion KRW Compared to Last Year

Comprehensive Support for Users in Finance, Employment, Welfare, and Housing

The government plans to supply 11 trillion won worth of policy-based financial services for low-income earners this year, focusing on concentrated disbursement in the first half to counter sluggish domestic demand. It will also provide heavy debt adjustment support, including full principal forgiveness for vulnerable groups who have been delinquent on small debts of 5 million won or less for over a year.

On the 9th, the Financial Services Commission (FSC) announced this at the Low-Income Financial Council meeting held in the main conference room of the Korea Inclusive Finance Agency, chaired by Vice Chairman Kim So-young. Vice Chairman Kim said, "It is necessary to enhance financial inclusiveness," adding, "To supplement the sluggish domestic economy, we will operate funds flexibly, including early execution of major policy-based financial products for low-income earners." The Low-Income Financial Council, which had been suspended since the COVID-19 pandemic after 2019, was reconvened after six years.

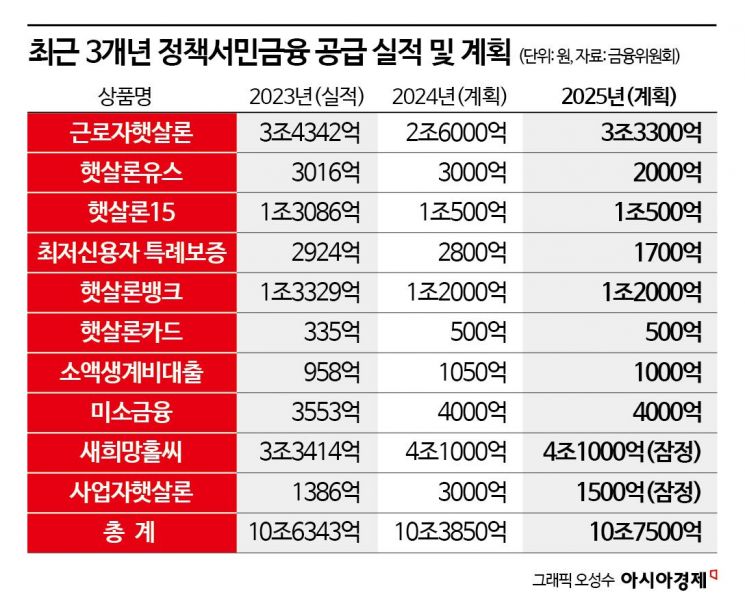

According to the FSC, the scale of policy-based financial supply increased from an annual average of 6.8 trillion won before COVID-19 (2016?2019) to 9.5 trillion won after COVID-19 (2020?2023), and it will expand further this year. The supply plan for policy-based financial products, which was about 10.385 trillion won last year, has increased to 10.75 trillion won this year, with some products considering additional expansion depending on disbursement trends.

Looking at recent supply performance and plans, the Worker’s Sunshine Loan (Geunroja Haetsallon) was adjusted from 3.8285 trillion won in 2022 to 2.6 trillion won last year, then expanded again to 3.33 trillion won this year. Haetsallon 15 and Haetsallon Bank will maintain levels similar to last year at 1.05 trillion won and 1.2 trillion won, respectively. For Haetsallon Youth, the supply plan was set at 200 billion won, 100 billion won less than last year, but authorities plan to consider an additional 100 billion won expansion depending on disbursement trends. The special guarantee for lowest credit borrowers was adjusted from 280 billion won last year to 170 billion won this year, while the Haetsallon Card will maintain a scale of 50 billion won. The Sae Hope Holssi (New Hope Loan) supply target will be decided this year considering bank-specific handling performance and operating profits, with a tentative forecast of about 4.1 trillion won.

In addition, the FSC will strengthen support for vulnerable debtors. It will implement a small debt forgiveness system for basic livelihood security recipients and severely disabled persons who have debts of 5 million won or less and have been delinquent for over a year, and expand debt adjustment for youth and employed persons. It also plans to support the field settlement of the Personal Debtor Protection Act, enacted in October last year, to activate financial companies’ own debt adjustment efforts.

Dr. Kim Young-il of NICE Credit Information pointed out, "An analysis of recent loan trends by private financial companies suggests that funding may not be smooth, especially for low-income and vulnerable borrowers." Accordingly, the council decided to activate private low-income financial services while supplementing the potential contraction of private finance with policy-based financial services.

Beyond financial support and debt adjustment, the FSC will strengthen policy support functions by providing integrated support programs linking finance, employment, welfare, and housing for low-income financial users in cooperation with related ministries such as the Ministry of Employment and Labor. The inflow routes for support targets will also be expanded not only to the public sector but also to the private sector, such as financial companies.

The financial authorities will also strengthen a government-wide response to eradicate illegal private loans. They plan to establish subordinate regulations for the amended Loan Business Act, passed by the National Assembly on December 27 last year, to promote early settlement of new systems such as invalidation of antisocial illegal loan contracts and restriction of criminal proceeds of illegal private lenders.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.