Survey by the Korea Chamber of Commerce and Industry

Recently, the rapid rise in the KRW-USD exchange rate due to increasing domestic and international uncertainties has led to higher raw material procurement costs and overseas investment burdens for companies.

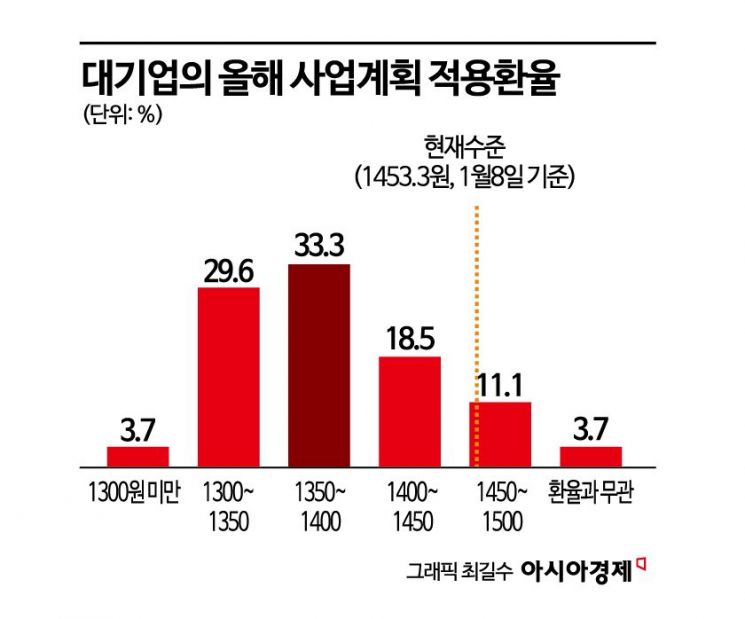

The Korea Chamber of Commerce and Industry (KCCI) announced on the 9th that only 11.1% of companies applied the current exchange rate range of 1450?1500 KRW when establishing their 2025 business plans, according to a recent survey on the 'Exchange Rate Impact on Major Large Corporations' conducted among the top 50 domestic companies.

The most common exchange rate range reflected in business plans was 1350?1400 KRW (33.3%), followed by 1300?1350 KRW (29.6%) and 1400?1450 KRW (18.5%). KCCI stated, "From the companies' perspective, the gap between exchange rate forecasts and actual levels forces them to revise business plans and prepare countermeasures."

Increased Procurement Costs and Investment Burdens

The KRW-USD exchange rate rose to the 1430 KRW level in early December last year amid a state of emergency. On December 18, when the U.S. Federal Reserve (Fed) announced adjustments to the number of rate cuts in 2025, the rate surpassed 1450 KRW. Subsequently, following the impeachment vote of the acting president on the 27th, it exceeded 1470 KRW and has since remained around the 1450 KRW level.

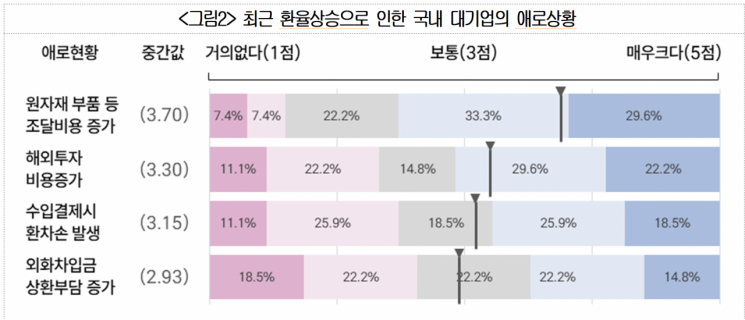

Companies participating in the survey identified 'increased raw material and component procurement costs' (3.7 out of 5 points) as the most challenging management issue related to the exchange rate. This was followed by 'increased overseas investment costs' (3.30 points), 'exchange losses during import payments' (3.15 points), and 'increased burden of foreign currency loan repayments' (2.93 points).

KCCI noted, "Traditionally, exchange rate appreciation has had a favorable effect on export-led economies by lowering export prices. However, with the recent increase in local production overseas and the expansion of exchange rate hedging payments, this effect has become limited. In particular, large corporations are negatively impacted in operating profits due to rising costs of importing high-quality raw materials amid fierce competition in technology and quality."

Companies pointed to 'continued domestic political instability' (85.2%) and 'full-scale initiation of trade policies by the Trump administration' (74.1%) as the main potential factors that could further exacerbate exchange rate instability. Other risk factors included 'delays and reductions in U.S. interest rate cuts' (44.4%), 'imbalances in domestic foreign exchange management' (22.2%), and 'downgrades in South Korea’s sovereign credit rating' (22.2%).

Recent difficulties faced by domestic large corporations due to the recent exchange rate increase. Provided by the Korea Chamber of Commerce and Industry

Recent difficulties faced by domestic large corporations due to the recent exchange rate increase. Provided by the Korea Chamber of Commerce and Industry

Companies Call for Foreign Exchange Market Stabilization Measures and Liquidity Support

As policies to respond to exchange rate instability, companies most frequently requested 'expansion of foreign exchange liquidity support' (63.0%, multiple responses allowed) and 'implementation of emergency foreign exchange market stabilization measures' (63.0%). Other needs included 'strengthening financial support for export-import companies' (37.0%), 'support for joint procurement of raw materials' (33.3%), 'tax benefits for damages caused by exchange rate fluctuations' (25.9%), 'enhanced R&D support for substituting domestic parts and raw materials' (22.2%), and 'support projects for converting overseas investment destinations back to domestic' (3.7%).

For their own responses, companies most commonly cited 'cost reduction through productivity improvement' (74.1%). This was followed by 'diversification of import sources' (37.0%), 'expansion of exchange rate hedging' (33.3%), 'promotion of localization' (22.2%), 'diversification of transaction currencies beyond the dollar' (18.5%), 'adjustment and postponement of overseas investment plans' (14.8%), 'improving profitability through product price increases' (14.8%), and 'expanding dollar holdings by reducing hedge ratios' (3.7%).

Kang Seok-gu, head of the KCCI survey division, said, "When South Korea faced the 1997 foreign exchange crisis and the 2009 global financial crisis, the KRW-USD exchange rate surpassed 1500 KRW, causing significant shocks, but the aftershocks were relatively short-lived. However, this recent exchange rate rise is occurring amid overlapping economic recession and domestic and international risks, so its impact is expected to be greater."

He added, "To prevent unstable exchange rate increases, such as capital outflows and declines in external credibility, from expanding like a so-called Snowball Effect, bold structural reforms and efforts for structural transformation of our economy must be pursued simultaneously."

The survey was conducted via email using a structured questionnaire from December 27 last year to the 6th of this month, targeting the top 50 companies. Thirty-one companies responded, with 63% from manufacturing and 37% from service and construction sectors.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.