Narasallim Research Institute Analysis Report

4.1 Trillion KRW Budget Cuts and 1.7 Trillion KRW Raised Due to Inheritance Tax Rejection

Additional Budget Cuts Inevitable Amid Economic Downturn

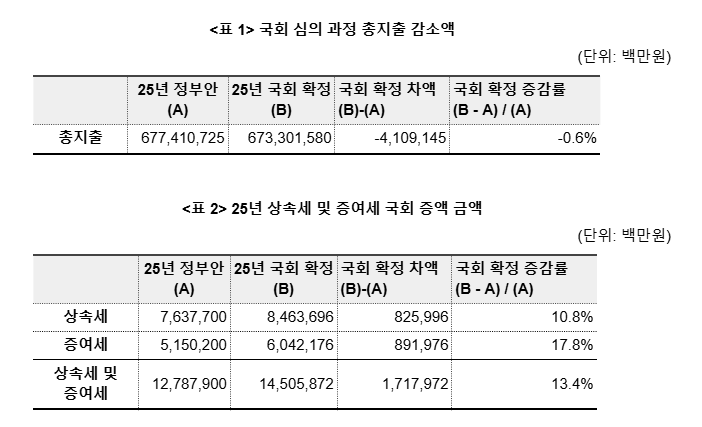

In a situation where risks such as rising political uncertainty and declining economic growth rates are increasing, an analysis has emerged that this year's supplementary budget of 5.8 trillion won will not burden the finances when viewed against this year's budget. This is because last year's budget review was composed only of cuts, and the inheritance and gift tax amendment bill, which had the nature of tax cuts, was 'rejected,' securing at least the minimum supplementary budget resources.

On the 8th, the Nara Salrim Research Institute proposed the necessity of supplementary budget formulation and suggested plans for major projects in a report titled "Proposal on the Scale and Content of the 2025 Supplementary Budget."

The 5.8 Trillion Won Supplementary Budget Resources Have Already Been Secured Without Financial Burden

First, regarding the supplementary budget, the institute explained, "During the National Assembly's budget review process, 4.1 trillion won was cut based on the government's proposal, and 1.7 trillion won in tax revenue was secured due to the rejection of the inheritance and gift tax law." Lee Sang-min, the senior research fellow at the Nara Salrim Research Institute who authored the report, stated, "The National Assembly and the government used a trick to arbitrarily reduce 1.7 trillion won from national tax revenue to maintain the total national tax revenue, equivalent to the 1.7 trillion won increase in inheritance and gift taxes." He argued that "the 2025 national tax revenue amount was arbitrarily adjusted without basis and needs to be readjusted." The government can increase the supplementary budget by at least 5.8 trillion won without damaging the fiscal capacity of the original government proposal submitted to the National Assembly last year.

Furthermore, considering the worsening economic conditions, there was also an opinion that more active supplementary budget formulation could be considered based on broader public consensus. The institute said, "In a situation where domestic demand is deteriorating, if the government increases spending while enduring a short-term fiscal deficit, domestic demand will recover and future growth potential will increase, thereby enhancing the medium- to long-term fiscal sustainability." It added, "When considering fiscal policies such as supplementary budgets, it is necessary to seek fiscal strategies that take into account medium- to long-term fiscal sustainability."

Supplementary Budget Cuts Also Needed Due to Economic Downturn

There was also a claim that support measures for local finances are necessary due to worsening economic conditions. Since a large-scale national tax revenue shortfall is expected again this year due to the economic downturn, a supplementary budget cut on revenue should be made. However, in this case, it was pointed out that fiscal support measures should be prepared through the supplementary budget for local allocation tax (19.24%) granted to local governments and education finance grants (20.79%) granted to education offices in response to the reduction in domestic taxes.

There was also an argument that early supplementary budget formulation is not a choice but a necessity.

Senior Research Fellow Lee said, "The reason for preparing a budget is to predefine government spending activities and disclose them to increase the predictability of government expenditures." He added, "The public and market participants expect a supplementary budget to be made within 2025, so the current main budget is considered incomplete and not finalized, and the information main budget does not serve as a basis for public behavior." He further stated, "The 2025 main budget, which lacks normal negotiations between the ruling and opposition parties and excludes National Assembly increases, is not a properly finalized budget." He emphasized, "It is necessary to increase predictability by finalizing the 2025 government expenditures through early supplementary budget formulation as a process to complete the 2025 main budget."

Meanwhile, the institute identified local government resource compensation measures, emergency welfare, support measures for low-income and socially vulnerable groups such as rental housing, climate crisis response budgets, future technology response budgets such as artificial intelligence (AI), and domestic demand recovery and small business support measures as projects for supplementary budget increases.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.