Domestic Stock Market Continues Upward Trend Since Early Year... KOSPI Recovers 2500 Level

Despite Market Rise, Individuals Most Bought 'Gopbus' This Year

Institutions Bet on Further Gains by Buying Leverage ETFs

As the domestic stock market has shown a favorable trend this year and the KOSPI has recovered the 2500 level, perspectives on the future market differ among buying entities. While individual investors have been buying inverse exchange-traded funds (ETFs) this month, betting on a decline in the index, institutions have been purchasing leveraged ETFs, anticipating further gains.

According to the Korea Exchange on the 9th, the KOSPI closed at 2521.05, up 28.95 points (1.16%) from the previous day, regaining the 2500 level. This is the first time the KOSPI has closed above 2500 since the December 3 emergency martial law incident. Except for one day this month, the KOSPI has recorded gains every day, continuing a favorable trend in contrast to the end of last year. The KOSDAQ has also risen for six consecutive trading days recently, attempting to stabilize above the 720 level.

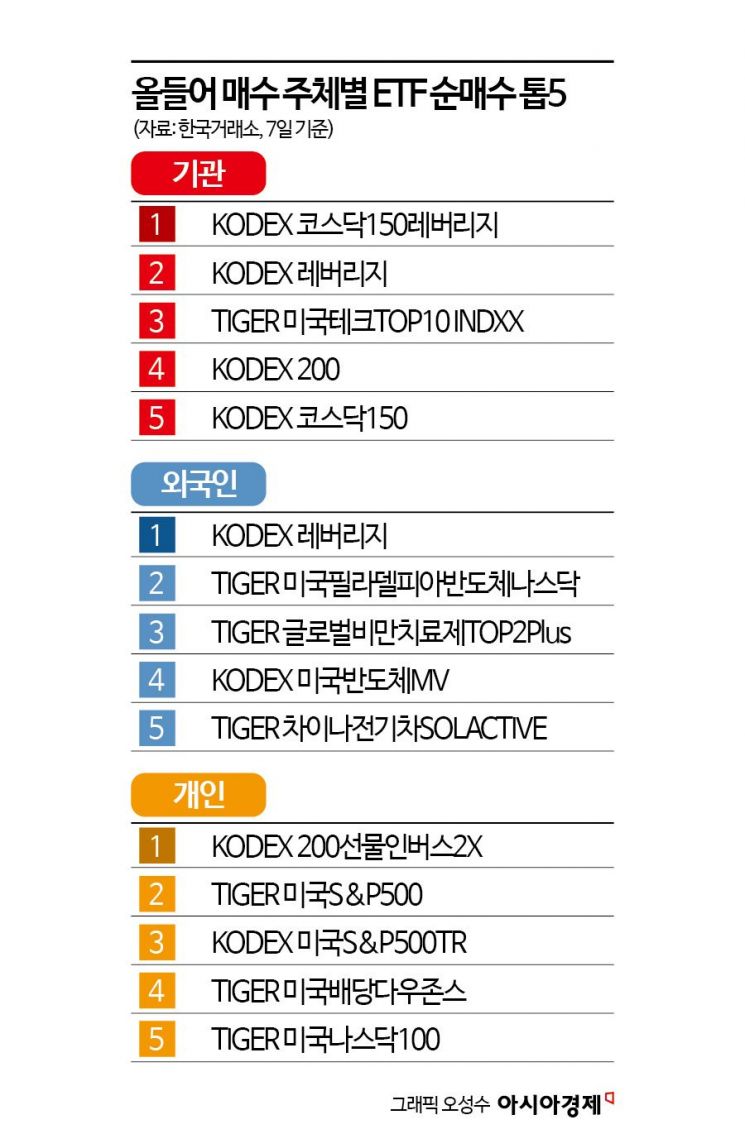

Despite the strong market trend, individual investors are betting on a decline in the index. This month, individuals have net purchased KODEX 200 Futures Inverse 2X, known as "Gopbus" (a combination of "multiply" and "inverse"), amounting to 122 billion KRW, making it the most purchased ETF overall. This product inversely tracks the KOSPI 200 futures index at twice the rate, allowing investors to earn double profits when the KOSPI 200 index falls. Additionally, individuals have also bought KODEX Inverse (23.4 billion KRW) and KODEX KOSDAQ 150 Futures Inverse (22.5 billion KRW), focusing on inverse ETFs that bet on index declines.

On the other hand, institutions have taken the opposite approach by buying leveraged ETFs that profit from index rises. Since the beginning of the year, institutions have net purchased KODEX KOSDAQ 150 Leverage the most, followed by KODEX Leverage. Leveraged ETFs can yield double the returns when the underlying index rises. Other ETFs among the top net purchases by institutions include KODEX 200, KODEX KOSDAQ 150, and TIGER 200, indicating their expectation that the domestic stock market's strength will continue.

Unlike the clearly contrasting behaviors of institutions and individuals, foreign investors have purchased both leveraged and inverse ETFs evenly. Foreigners have net bought KODEX Leverage the most, with 12.1 billion KRW, along with KODEX KOSDAQ 150 Futures Inverse (5.2 billion KRW), KODEX 200 Futures Inverse 2X (3.1 billion KRW), KODEX Inverse (3.0 billion KRW), TIGER Leverage (1.9 billion KRW), and TIGER KOSDAQ 150 Leverage (1.4 billion KRW) among their top net purchases.

Although the index has been on an upward trend recently, some opinions suggest it is too early to consider it a full rebound. Kim Dae-jun, a researcher at Korea Investment & Securities, stated, "The KOSPI has been sluggish due to various negative factors and has undergone a long period of adjustment. As a result, the 12-month forward price-to-earnings ratio (PER) is significantly below the 10-year average, making it very cheap from a price perspective. Moreover, the KOSPI has shown strong resilience below the 2400 level despite bearish pressures, solidifying its bottom during the process of absorbing unfavorable variables." He added, "While it may be premature to expect a full rebound, from a mid- to long-term perspective, it is time to consider increasing exposure with an eye on index gains."

Na Jeong-hwan, a researcher at NH Investment & Securities, commented, "Although the KOSPI has shown a strong upward trend since the beginning of the year, short-term risk factors still exist. Considering future risks, the Korean stock market remains in a volatile phase, and while the stock price level is still low, downside risks are not significant. However, a strategy of buying after risk factors are resolved would be more effective."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)