Stock Market and Tech Rally Push Wealth of the Rich Near 1,400 Trillion Won

'Great Wealth Migration' Expected by 2048

Severe Wealth Concentration in US... Only 2% of Population Benefits

It is predicted that the total value of inheritance that Generation Z in the United States will receive from this year until 2048 will amount to a staggering $100 trillion (approximately 14 quadrillion won), drawing significant attention.

U.S. economic media outlets such as CNBC recently cited a report published by the asset management firm Cerulli, stating, "The estimated value of inheritance assets to be transferred to Generation Z by 2048 is about $124 trillion (approximately 18 quadrillion won)." Due to the overall strength of the U.S. stock market and the emergence of wealthy individuals in the tech sector, upper-class assets have grown to unprecedented levels, leading to forecasts that the U.S. may experience the "largest wealth transfer in history."

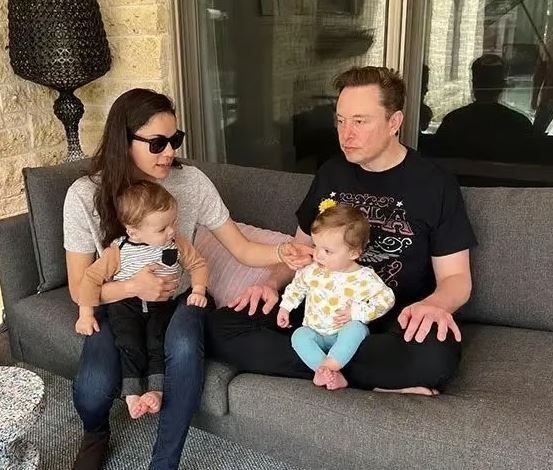

Elon Musk, CEO of Tesla, and twins under Neuralink executive Shivon Zilis. CEO Musk is known as the emerging billionaire with the most complex child inheritance issues. Walter Isaacson Old X Capture

Elon Musk, CEO of Tesla, and twins under Neuralink executive Shivon Zilis. CEO Musk is known as the emerging billionaire with the most complex child inheritance issues. Walter Isaacson Old X Capture

However, it is unlikely that this enormous amount will all remain as the share of Generation Z sons and daughters. The current highest inheritance and gift tax rate in the U.S. is 40%, with tax exemption only up to $11.7 million (approximately 1.7 billion won) per parent, totaling $23.4 million (approximately 3.4 billion won). Although this is lower than South Korea's highest inheritance tax rate of 60%, it is still higher than that of neighboring countries, and wealthy U.S. citizens employ various methods to reduce taxes lost during inheritance and gifting processes.

Cerulli expects that out of the total $124 trillion to be transferred from parents to children, $18 trillion (approximately 2,680 trillion won) will be distributed to charitable organizations established under family names, while the remaining $106 trillion (approximately 15 quadrillion won) will be inherited by spouses, children, and successors. In the U.S., donating assets to society instead of inheriting them can provide tax deduction benefits.

For this reason, many wealthy families in the U.S. commonly establish family-named corporations and transfer donations to these corporations to manage them, thereby saving on income taxes.

Bill Gates, a leading tech mogul in the United States, established the Bill and Melinda Gates Foundation with his ex-wife Melinda to carry out philanthropic activities. Photo by Reuters Yonhap News

Bill Gates, a leading tech mogul in the United States, established the Bill and Melinda Gates Foundation with his ex-wife Melinda to carry out philanthropic activities. Photo by Reuters Yonhap News

Summarizing all this, it is expected that $3 trillion (approximately 4,363 trillion won) will be transferred annually from this year until 2030, increasing to $4 trillion (approximately 5,818 trillion won) annually by 2036, and then growing to $5 trillion (approximately 7,272 trillion won). This amount of wealth transfer each year is about three times South Korea's national gross domestic product (GDP).

Meanwhile, Cerulli estimates that about half of the total inheritance assets, $54 trillion (approximately 7,800 trillion won), are likely to go to spouses rather than children. Additionally, the vast majority of beneficiaries are expected to be women, and considering that Generation Z in the U.S. currently has more females than males, it is anticipated that the gender of the "wealthy class" in the U.S. may tilt toward women in the future.

Furthermore, with the increase in demand for managing vast inherited assets, the demand for family corporation, trust, foundation lawyers, and asset management firms is expected to surge, potentially causing a significant shift in the "conglomerate-related industries."

However, this "wealth shift" is likely to be irrelevant to the majority of Americans. Wealth in the U.S. is concentrated among the top wealthy class, and this trend has intensified especially after COVID-19. Those who will benefit from the massive wealth flow of $3 to $5 trillion annually are estimated to be only about 2% of the total U.S. population.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.