81.8% Coverage Rate for Four Major Severe Diseases

Flu Shots and Respiratory Tests Identified as Causes

Government Calls for "Non-Covered Services and Real-Expense Insurance Reform"

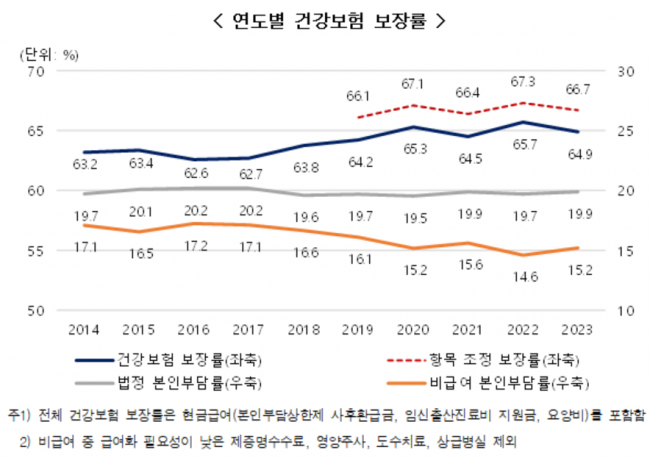

The health insurance coverage rate in 2023 was 64.9%, down 0.8 percentage points from the previous year. Although the overall coverage rate slightly declined due to an increase in non-reimbursable treatments such as flu treatment injections, the coverage rate for severe and high-cost medical conditions, including the four major severe diseases, rose compared to the previous year.

According to the "2023 Health Insurance Patient Medical Expense Survey" released by the National Health Insurance Service on the 7th, the total medical expenses for health insurance patients, including non-reimbursable costs, amounted to approximately 133 trillion won, a 10.3% increase from 120.6 trillion won in 2022. Of this, the insurer's burden was estimated at 86.3 trillion won, statutory out-of-pocket payments at 26.5 trillion won, and non-reimbursable medical expenses at 20.2 trillion won.

The health insurance coverage rate refers to the proportion of medical expenses covered by the National Health Insurance Service among total medical costs, excluding over-the-counter drugs, cosmetic and prosthetic costs for aesthetic purposes, and herbal medicine costs for health promotion. In 2023, the statutory out-of-pocket rate rose from 19.7% to 19.9%, and the non-reimbursable burden rate increased from 14.6% to 15.2%, up by 0.2 and 0.6 percentage points respectively.

Excluding administrative costs such as certification fees and items with low necessity for coverage like nutritional injections, manual therapy, and premium hospital room charges, the health insurance coverage rate was 66.7%.

Coverage Rate for Severe and High-Cost Medical Conditions Slightly Increased

By type of medical institution, coverage rates decreased in tertiary general hospitals, general hospitals, hospitals, and clinics, while coverage rates increased in long-term care hospitals. The coverage rate for medical institutions at the general hospital level or higher was 68.6%, down 1.0 percentage point from the previous year. This was analyzed to be due to an increase in the proportion of non-reimbursable examination fees from 10.4% in 2022 to 11.7% in 2023 at tertiary general hospitals, and an increase in the proportion of non-reimbursable treatment and surgery fees from 13.2% to 16.5% at general hospitals.

For hospitals, the health insurance coverage rate decreased by 1.2 percentage points from the previous year to 50.2%, due to new non-reimbursable items such as bone marrow aspiration concentrate intra-articular injections and an increase in non-reimbursable treatment materials. Clinics saw a sharp drop in coverage rate by 3.4 percentage points to 57.3%, as non-reimbursable flu treatment injections and respiratory disease tests surged. In long-term care hospitals, the coverage rate increased by 1.0 percentage point to 68.8%, as the use of non-reimbursable immune enhancers decreased.

The coverage rate for severe and high-cost medical conditions slightly increased compared to the previous year. The coverage rate for the four major severe diseases was 81.8%, up 0.3 percentage points from the previous year. By disease, cancer coverage was 76.3%, and rare and severe intractable diseases were 89.0%, increasing by 0.6 and 0.3 percentage points respectively. Cerebrovascular diseases were at 88.2%, and heart diseases at 90.0%, decreasing by 1.5 and 0.1 percentage points respectively.

The coverage rate for the top 30 severe and high-cost medical conditions per capita, including leukemia, pancreatic cancer, and lymphoma, was 80.9%, up 0.4 percentage points from the previous year. The coverage rate for the top 50 diseases, including dementia and respiratory tuberculosis, was 79.0%.

Coverage Rates for Children and Elderly Both Slightly Declined

For children aged 0 to 5, the health insurance coverage rate decreased by 0.6 percentage points to 67.4%, due to an increase in respiratory diseases and higher use of pharmacies with high statutory out-of-pocket rates. For the elderly aged 65 and over, the coverage rate also declined by 0.5 percentage points to 69.9%, as the use of non-reimbursable musculoskeletal treatment materials and injection fees increased.

By income level, coverage rates tended to be higher in lower income brackets than in higher income brackets. The effect of the out-of-pocket maximum payment system was also significant. For workplace subscribers, the coverage rate for the lowest income bracket (reflecting the out-of-pocket maximum payment system) was 65.0%, while for the highest income bracket it was 60.3%. For regional subscribers, it was 78.2% for the lowest income bracket and 60.5% for the highest.

The government views management of non-reimbursable costs as necessary to alleviate the national medical expense burden and plans to reduce the proportion of non-reimbursable expenses going forward. Additionally, it plans to develop reform measures for indemnity insurance that cause unnecessary excessive medical use through discussions with experts including the medical community.

Furthermore, according to the "2nd Comprehensive National Health Insurance Plan" established in February last year, the government aims to provide essential medical services timely for national health promotion by continuously strengthening coverage focused on essential medical fields such as severe and rare intractable diseases, rather than uniform coverage expansion. To this end, approximately 1.45 trillion won of health insurance funds were invested as of December last year to alleviate medical blind spots, including ▲strengthening drug coverage to reduce the burden of high-cost drugs ▲enhancing coverage for vulnerable groups such as children and disabled persons ▲expanding diseases eligible for special calculation exceptions.

Kwon Byung-gi, Director of Essential Medical Support at the Ministry of Health and Welfare, said, "The non-reimbursable management plan and indemnity insurance reform plan will be finalized after public forums to gather diverse opinions from various sectors and will be included in the 2nd medical reform implementation plan. We will also continue efforts to strengthen health insurance coverage in essential medical fields."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.