Imports Worth 19 Trillion Won Until November Last Year

Price Competitiveness Rises Due to FTA Agreement

Imports Expected to Increase Further Under Trump’s Second Term

Last year, South Korea's imports of U.S. crude oil reached an all-time high. With President-elect Donald Trump, who is set to take office on the 20th, pledging to expand domestic oil drilling and increase oil production, imports of U.S. crude oil are expected to rise further.

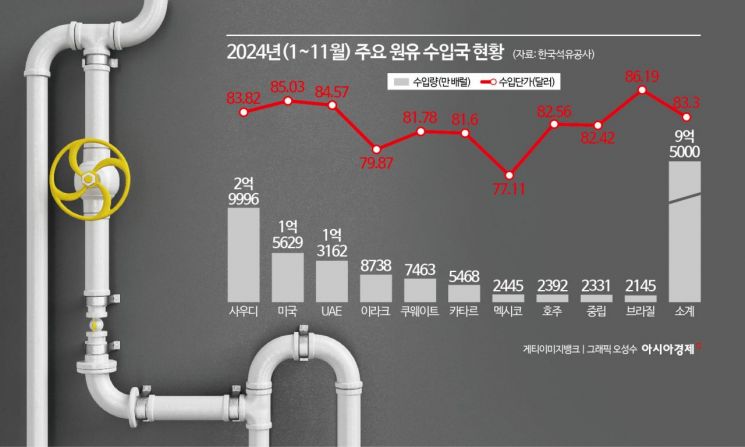

According to the Korea National Oil Corporation on the 6th, from January to November last year, crude oil imported from the U.S. totaled 156.29 million barrels, far surpassing the previous record import volume of 142.37 million barrels set the year before. The import value reached $13.32623 billion, approximately 19.6 trillion Korean won. The U.S. ranked second, following Saudi Arabia, the undisputed largest crude oil supplier, which exported 299.96 million barrels.

Following the U.S. were the United Arab Emirates (131.62 million barrels), Iraq (87.38 million barrels), Kuwait (74.63 million barrels), and Qatar (54.68 million barrels). Among the top 10 major import countries, non-Middle Eastern countries included the U.S., Mexico (24.45 million barrels), Australia (23.92 million barrels), and Brazil (21.45 million barrels).

U.S. crude oil is more expensive compared to Middle Eastern oil. Looking at the import prices by country, U.S. crude oil averaged $85.03 per barrel, which is $1 to $5 higher per barrel than Saudi Arabia ($83.82), the United Arab Emirates ($84.57), and Iraq ($79.87). It is also more expensive than Mexico ($77.11) and Australia ($82.56).

The reason domestic refiners imported relatively more expensive U.S. crude oil is due to its "duty-free" status. Under the Korea-U.S. Free Trade Agreement (FTA), a 3% tariff on U.S. crude oil is waived. This makes U.S. crude oil cheaper compared to Middle Eastern crude oil, which is subject to full tariffs, making it the preferred choice for refiners.

Moreover, since 2018, the U.S. has emerged as the world's largest crude oil exporter through active shale gas development. According to the U.S. Energy Information Administration (EIA), as of 2022, the U.S. accounted for 14.7% of global crude oil production, surpassing Saudi Arabia (13.1%) and Russia (12.7%) to become the world's largest crude oil producer.

Riding this trend, South Korea has actively increased its imports of U.S. crude oil, and since the U.S. overtook Kuwait to become the second-largest supplier in 2021, it has maintained this ranking for four consecutive years. Imports have surged by an impressive 19.9% over the past three years since 2021.

With the inauguration of President Trump's second term government, which has pledged to expand oil drilling, imports of U.S. energy are expected to increase further. Last year, South Korea's trade surplus with the U.S. reached a record high of $55.69 billion, and the government is actively considering increasing imports of U.S. energy to improve the unbalanced trade balance. However, it is anticipated that the target will be LNG, which is entirely imported by the public enterprise Korea Gas Corporation, rather than crude oil imported by refiners.

An official from the refining industry said, "If U.S. crude oil is cheaper in terms of price considering tariffs, we have increased imports of U.S. crude oil even without government requests," adding, "At this point, mandating an increase in imports from a specific country could be seen as excessive government intervention."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)