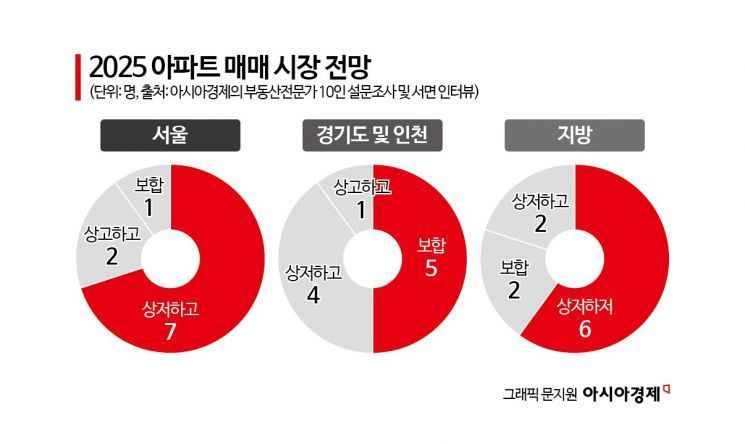

Analysis of '2025 Apartment Market Outlook' by 10 Real Estate Experts

7 out of 10 Expect Seoul Apartment Prices to Show 'High-Low-High' Trend

In the First Half, Prices Likely to Fall Due to Buying Hesitation Amid Impeachment Turmoil

Rising Jeonse Prices and Supply Shortages to Push Prices Up from Second Half

Order of Articles in '2025 Apartment Market Outlook'

▶ ① Sales Market (Seoul, Gyeonggi-do, Incheon, and Provinces)

② Jeonse Market (Seoul, Gyeonggi-do, Incheon, and Provinces)

③ Market Impact and Policies

This is the consensus among 10 domestic real estate experts regarding this year's apartment sales market. According to Asia Economy's '2025 Apartment Market Outlook' on the 6th, 7 out of 10 experts predicted that the Seoul apartment sales market will show a 'low in the first half, high in the second half' trend. Two experts expected a 'high in the first half, higher in the second half' trend, indicating a continuous high-level rally throughout the year. Only one expert forecasted a 'stable' market. This survey was conducted on the 27th of last month through questionnaires and written interviews.

Supply Shortage and Interest Rate Cuts to Impact from Second Half

The seven experts who predicted a 'low in the first half, high in the second half' trend expected prices to fall by 1-2% in the first half and rise by 1-5% in the second half. They recommended buying apartments in Seoul during the first half when prices are likely to decline. In fact, the Seoul apartment market froze solidly at the end of last year and the beginning of this year. According to the 'Weekly Apartment Price Trend for the Fifth Week of December 2024' released by the Korea Real Estate Board on the 2nd, the upward trend in Seoul apartment sales prices that had continued since March last year stopped after 41 weeks.

Kim Je-kyung, Director of Toomi Real Estate Consulting, said, "Until the first half, the country will be engulfed in turmoil due to the impeachment political situation, making it difficult for buyers to actively purchase apartments. However, with a serious supply shortage expected in Seoul from 2026 and interest rates falling, buying sentiment will start moving actively from the second half." He added, "The first half is the opportunity to buy before prices rise."

Kwon Young-sun, Team Leader of Shinhan Bank Real Estate Investment Advisory Center, said, "Currently, sales demand is suppressed due to loan regulations. The adjustment phase is expected to continue until the first half, so it is necessary to look for affordable properties." Yoon Soo-min, Senior Real Estate Specialist at NH Nonghyup, also said, "The earlier you secure a home this year, the better. The second half, when instability in the jeonse and monthly rent market intensifies, will be a turning point for house price increases."

"Apartments Over 900 Million KRW in Seoul, Which Had Been Weak, Will Rise This Year"

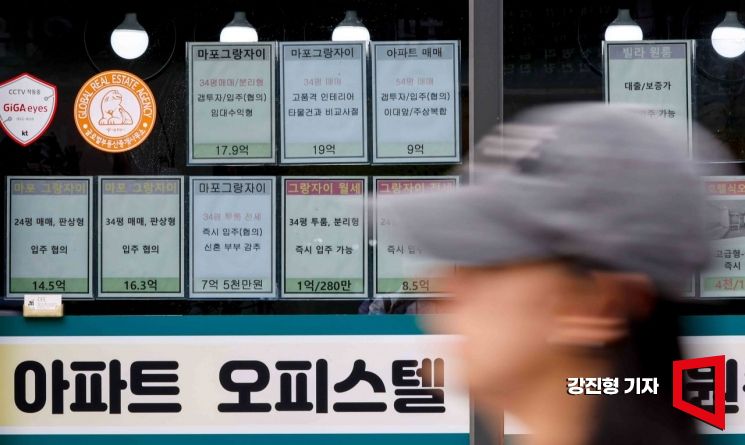

According to the KB Real Estate Weekly KB Apartment Market Trend report, last week Seoul apartment sale prices surged by 0.22% in just one week. On the 5th, apartment sale and jeonse prices were posted in the real estate market of Mapo-gu, Seoul. Photo by Kang Jin-hyung aymsdream@

According to the KB Real Estate Weekly KB Apartment Market Trend report, last week Seoul apartment sale prices surged by 0.22% in just one week. On the 5th, apartment sale and jeonse prices were posted in the real estate market of Mapo-gu, Seoul. Photo by Kang Jin-hyung aymsdream@

The price increase in the second half is likely to start with apartments priced below 900 million KRW. Yoon Ji-hae, Research Team Leader at Real Estate R114, said, "Buyers suppressed by loan regulations will shift to the jeonse and monthly rent market. As rental prices rise, the previously sluggish market for mid-to-low priced apartments below 900 million KRW is expected to begin a solid upward trend." She added, "As the second half approaches, demand sentiment will be stimulated due to concerns over supply shortages, leading to a larger price increase. Prices in Seoul could rise by 2-4% depending on the area."

Kim Gyu-jung, Real Estate Specialist at Korea Investment & Securities, predicted, "If accompanied by interest rate cuts and fiscal expansion for economic stimulus, Seoul apartment sales prices could rise more than 5% in the second half of this year." Professor Lee Chang-moo of Hanyang University’s Urban Engineering Department also said, "When excessive demand regulations such as political instability and loan restrictions reach their limits, the unresolved supply contraction effect will become prominent, causing prices to rise more than 5% in the second half."

Gyeonggi-do and Incheon Expected to be 'Stable'... Varies by Region

Yangji 5 Complex Hanyang Apartment, Sunae-dong, Bundang-gu, Seongnam-si, Gyeonggi Province

Yangji 5 Complex Hanyang Apartment, Sunae-dong, Bundang-gu, Seongnam-si, Gyeonggi Province (Photo by Seungwook Park)

Apartment sales prices in Gyeonggi-do and Incheon have weaker upward momentum compared to Seoul. Opinions were divided between 'stable' (5 experts) and 'low in the first half, high in the second half' (4 experts), with only one expecting a 'high in the first half, higher in the second half' trend. It was analyzed that polarization is clear depending on the region, and buyers waiting to purchase will be affected by strengthened policy loan regulations.

Kim Hyo-sun, Senior Real Estate Specialist at NH Nonghyup, who expects stability, said, "Newly built complexes in areas with development benefits such as first-generation new towns like Bundang or Gwacheon, or areas south of the Han River with excellent accessibility, will see price increases." Areas benefiting from the metropolitan express railway (GTX) such as Indeokwon or Bucheon are also worth long-term attention.

Kim added, "On the other hand, areas where supply has been congested or where real demand is lacking will continue a long-term downward trend." For example, southern Gyeonggi areas like Pyeongtaek, Anseong, Yeoju, and Icheon, as well as Uijeongbu and Yangju, are expected to remain weak due to excessive supply. In Incheon, large-scale supply has been released in Cheongna and Geomdan.

Ham Young-jin, Head of Real Estate Research Lab at Woori Bank, who predicted a 'low in the first half, high in the second half' trend, mentioned strengthened policy loan regulations. Ham said, "While special loans for newborns will continue, the reduction of Didimdol loan limits for apartments in the metropolitan area could cause sales prices to fall about 1% in the first half."

However, Ham added, "The total number of new housing units in Gyeonggi-do will decrease significantly from 99,294 units in 2024 to 58,683 units in 2025. Due to this, jeonse prices will rise in the second half, and in areas with a shortage of new housing, buyers may switch to purchasing."

Provinces with Accumulated Unsold Units to See Decline... Political Turmoil Also a Negative Factor

Apartment sales prices in the provinces are expected to continue a 'low in the first half, low in the second half' trend this year, according to more than half of the experts (6). Two predicted stability, and one expected a 'low in the first half, high in the second half' trend. Experts forecasting price declines estimated drops of 1-5%. They cited the backlog of over 50,000 unsold units and political situations as causes.

Kim Je-kyung, Director of Toomi Real Estate Consulting, said, "Measures to revitalize the provincial apartment market, including solutions for unsold units, are needed, but with the government itself unstable, new support measures are unlikely. If an early presidential election is held and a progressive government takes power, there are strong concerns about stricter regulations on multiple homeowners, which would be negative for the provincial apartment market."

There is also an opinion that metropolitan cities, where the population is relatively maintained, are worth considering for buying. Ko Jong-wan, Director of Korea Asset Management Research Institute, predicted, "In metropolitan cities where the decline in jeonse prices slows due to reduced new housing supply, there will be no further house price declines this year."

Meanwhile, Park Won-gap, Senior Real Estate Specialist at KB Real Estate, advised homebuyers this year on appropriate purchase prices, saying, "I recommend a two-track strategy of 'urgent sale properties' or 'newly launched units cheaper than market price.' For Seoul, selectively buy properties priced 10-15% below the peak, and for the metropolitan area and provinces, focus on properties more than 20% cheaper." He added, "In the provinces, prices are too high, causing many unsold units. Avoid places where prices are too expensive. Be cautious about properties priced more than 10% above surrounding market prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)