Kim Hyun-jung, Democratic Party Lawmaker

Introduces Amendment Bill to Revise Disqualification Clauses in 17 Financial Sector Laws Regarding Bankruptcy Declarations

Concerns Over Potential Increase in Bankruptcy Abuse Cases... "Supplementary Measures Needed"

A bill is being promoted that would allow bankrupt financial professionals such as insurance planners, card solicitors, and executives of lending companies to be re-employed in their respective industries. The purpose is to help them reintegrate into society without discrimination due to bankruptcy, but concerns have been raised that moral hazard and other side effects could increase.

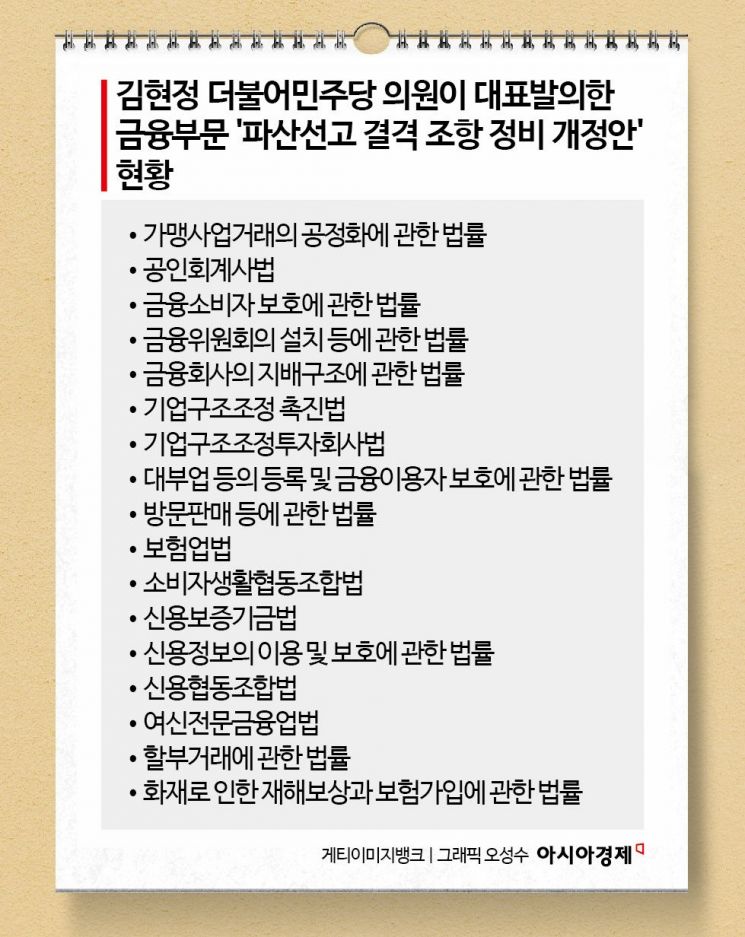

According to the National Assembly Legislative Information System on the 6th, Kim Hyun-jung, a member of the National Assembly's Political Affairs Committee from the Democratic Party of Korea, officially proposed an amendment on the 30th of last month to remove disqualification clauses related to bankruptcy declarations from 17 financial sector laws, including the Insurance Business Act, Specialized Credit Finance Business Act, and the Act on Registration of Credit Business and Protection of Financial Consumers.

The "Act on Debtor Sacrifice and Bankruptcy," enacted in 2006, stipulates that debtors should not be subject to disadvantages such as employment restrictions due to bankruptcy. However, despite the intent of this law, many current laws still define non-revoked bankruptcy declarations as grounds for employment disqualification, which has been criticized as problematic. Currently, bankrupt individuals face 287 qualification restrictions under 245 laws. To address this, during the 21st National Assembly, Park Joo-min of the Democratic Party of Korea pushed for legal amendments, but since related bills were scattered across standing committees, legislative progress was limited. Consequently, in the 22nd National Assembly, members of the Democratic Party's Euljiro Committee recently decided to each propose bills to revise employment disqualification clauses for bankrupt individuals by standing committee, thereby reinitiating the legislative process.

Currently, insurance planners who have been declared bankrupt cannot be re-employed as planners or establish corporations to operate unless they have been reinstated through discharge or other means. This is because the Insurance Business Act prohibits registration of planners who have been declared bankrupt and not reinstated (discharged, etc.). The same provisions apply to card solicitors and representatives or executives of lending companies. The amendment bill to the 17 financial sector laws, proposed by Representative Kim, mainly aims to delete these provisions. Kim said, "This amendment is the first step to remove structural barriers that make it difficult for bankrupt individuals to economically recover and socially reintegrate due to excessive qualification restrictions," adding, "We will strive to provide opportunities to rise again, not to define personal failure, in line with the original intent of the insolvency system."

However, there are opinions that such blanket legislative measures for bankrupt financial professionals could exacerbate problems. There is a concern that financial professionals who closely interact with consumers might exploit bankruptcy, causing harm to consumers. For example, card solicitors receive commissions of 100,000 to 200,000 KRW from card companies based on performance when attracting card subscribers. According to the Specialized Credit Finance Business Act, card solicitors provide customers with support funds amounting to 100% of the annual fee if recruited online, or 10% if offline, using these commissions. However, there are cases where customers fail to receive support funds due to the card solicitor disappearing. A card industry official said, "Cases where solicitors maximize commissions and then file for bankruptcy without providing support funds increased during the COVID-19 pandemic," adding, "If such individuals can easily be re-employed in the future, abuse cases may increase."

According to the Monthly Court Statistics Report, from January to November this year, 1,745 corporate bankruptcy cases were filed nationwide, surpassing last year's total of 1,657, which was the highest ever. Corporate bankruptcy declarations also increased by about 16.3% to 1,514 cases compared to last year's 1,302, marking a record high. While bankruptcies among self-employed individuals have increased due to the economic downturn, some cases involved intentional bankruptcy for the purpose of "eat-and-run loans." Eat-and-run loans refer to borrowing far more than one's credit limit through illicit means and then filing for bankruptcy. In July last year, a law firm was caught encouraging clients to engage in such acts to collect fees.

A financial industry official said, "If a bankrupt person is reinstated by faithfully repaying debts, there is no problem in working again as an insurance planner or similar," adding, "It is questionable whether legislation that effectively nullifies the bankruptcy reinstatement process is appropriate." A representative from Kim Hyun-jung's office said, "(Side effects) are a concern," but added, "Since the proposed laws cover various professions, detailed reviews will be conducted separately by profession when the bills are examined in the legislative subcommittee."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.