LFP Market Once Considered China-Centric

"LG Chem and Other Korean Battery Research Show Outstanding Competitiveness"

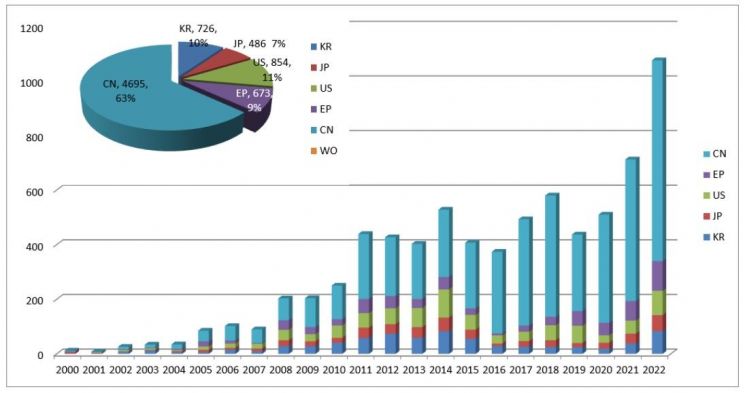

Number of LFP Patents by Country. Source=SNE Research 'Core Patents, Technologies, and Market Trends of LFP Batteries' Report, CN=China, KR=Korea, JP=Japan, etc.

Number of LFP Patents by Country. Source=SNE Research 'Core Patents, Technologies, and Market Trends of LFP Batteries' Report, CN=China, KR=Korea, JP=Japan, etc.

Analysis has emerged showing that Korean companies possess outstanding research competitiveness in the LFP (Lithium Iron Phosphate) battery sector, which was previously considered to be led by China.

According to the 'LFP Patent Report' by energy market research firm SNE Research on the 2nd, LG Chem was found to be the global leader with 16 core patents as of 2022, based on the number of patent citations and patent family counts. This result indicates that LG Chem holds numerous high-quality patents that significantly influence technological advancement beyond mere quantitative patent competition. A patent family refers to a group of patents based on the same invention, representing the international scope and extensibility of the patent.

LFP batteries have lower energy density compared to NCM (Nickel Cobalt Manganese) batteries but offer high stability and cost competitiveness. With the growth of the electric vehicle market, LFP batteries are increasingly adopted mainly in mid- to low-priced models. It is widely agreed that due to their significantly lower fire risk and stable operation, LFP batteries will also be broadly used for ESS (Energy Storage Systems).

SNE Research explained, "While China holds an overwhelming lead in LFP battery-related patent applications, Korea is laying the groundwork for a technological leap through qualitative patent competitiveness and new research directions."

According to the report, China filed 4,695 patents related to LFP, accounting for 63% of the total patent applications. The United States (11%), Europe (9%), and Korea (approximately 10%, with 726 patents) follow behind.

Korea maintained steady growth in LFP battery research from the 2000s through the early 2010s. However, as attention shifted to NCM high-nickel cathode technology capable of long-distance driving in the mid-2010s, domestic research focus changed to NCM-centered development. Consequently, LFP-related research experienced a stagnation period, according to industry consensus. Recently, however, LFP battery research has been revitalized due to advancements in Cell-to-Pack (CTP) technology. CTP technology connects battery cells directly at the pack level without modularization, compensating for the low energy density of LFP batteries while also contributing to manufacturing cost reduction.

Domestic battery companies are accelerating mass production of LFP batteries. LG Energy Solution began LFP battery production in China at the end of 2023, and Samsung SDI started developing ESS LFP batteries aiming for mass production by 2026. SK On was the first among the three battery companies to unveil an electric vehicle LFP battery prototype in March 2023 and is preparing for mass production targeted between 2026 and 2027.

SNE Research evaluated, "Korean companies like LG Chem have a high likelihood of changing the market landscape based on highly cited patents and core technologies," adding, "Regarding LFP batteries that combine stability and economic efficiency, Korea can secure a technological advantage in the global market based on its core patent competitiveness."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.