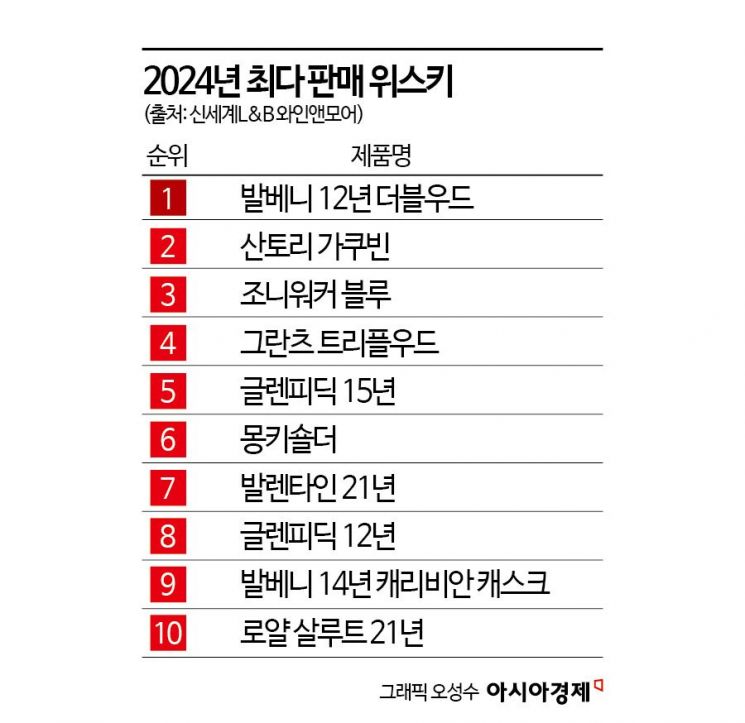

Wine & More's Best-Selling Whiskey

'Balvenie 12 Year DoubleWood'

Consumer Contraction... Choosing a Quality-Assured Steady Seller

Last year, the domestic whiskey market, which faced the combined challenges of an economic recession and an impeachment crisis, showed a trend of selecting and focusing on products with verified quality.

According to Shinsegae L&B on the 3rd, the best-selling whiskey at nationwide Wine & More stores last year was William Grant & Sons' 'Balvenie 12 Year DoubleWood.' The Balvenie 12 Year DoubleWood, a Scotch single malt whiskey, is a representative product of Balvenie, characterized by aging for 12 years in bourbon casks and finishing with an additional 6 months of maturation in sherry casks before release.

The Balvenie 12 Year DoubleWood was a steady seller that ranked second in Wine & More sales in 2023 and is also famous as the whiskey most sought after by beginners. Wine & More explained, "The easier procurement of this product's stock compared to the previous year seems to have influenced the increase in sales."

Following closely was the Japanese blended whiskey 'Suntory Kakubin.' Kakubin is known for its distinctive square bottle shaped like a turtle shell and is credited as a key driver of the domestic highball craze. Kakubin is recognized as a whiskey specialized for highballs and has become widely popular due to its easy availability in restaurants, large supermarkets, and convenience stores. Additionally, its relatively affordable price of around 30,000 KRW for a 700ml bottle contributed to the sales increase. Notably, its sales volume rose by 65% compared to the previous year, making it the fastest-growing single product.

The third place was taken by the Scotch blended whiskey 'Johnnie Walker Blue Label.' Johnnie Walker Blue is the top-tier product of the Johnnie Walker brand, with every bottle bearing a serial number. As the most expensive regular Johnnie Walker product, priced around 300,000 KRW per bottle, it is highly demanded as a gift. Other products in the top five included the Scotch blended whiskey 'Grant's Triple Wood,' known for its affordable price in the high teens of thousands of KRW for a 1-liter bottle, and the Scotch single malt whiskey 'Glenfiddich 15 Year.'

All these whiskeys are traditional popular products with high brand recognition.

This contrasts with the previous year when inexpensive highball products dominated the upper ranks. Last year, the domestic whiskey market expanded, leading to brand diversification and offering consumers a wider range of choices than ever before. However, due to the economic downturn and other factors, consumer sentiment contracted, resulting in a shift in consumption patterns toward seeking popular products with guaranteed quality rather than experimenting with various products. Instead of consuming a variety of products out of curiosity or low price, consumers concentrated their spending on certain products, even if they were somewhat more expensive.

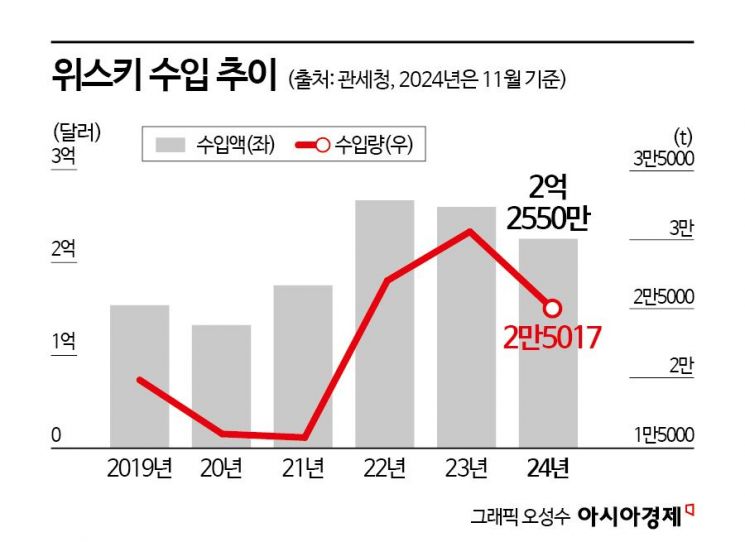

The domestic whiskey market, which had been on an upward trend for several years, took a breather last year. The whiskey market grew significantly during the COVID-19 pandemic, fueled by the popularity of home drinking culture and highballs, but the prolonged economic recession and the year-end internal turmoil last year dampened consumer sentiment, causing a slowdown. According to the Korea Customs Service, domestic whiskey imports as of November last year were 25,017 tons, down 11.7% from 28,391 tons in the same period the previous year. Import value also decreased by 4.9%, from 237.19 million USD to 225.5 million USD during the same period.

Sales at Wine & More also declined across most alcoholic beverage categories, with whiskey down 8%, wine down 8%, and beer down 9%. A Wine & More official explained, "In 2023, popular whiskeys sold well regardless of price when simply displayed, but now it is difficult to sell without promotions accompanied by price discounts." However, despite the sluggish liquor market, Japanese alcoholic beverages, led by Kakubin whiskey, as well as beer and sake, all showed sales growth and made significant advances.

With the ongoing impact of a high exchange rate, consumer sentiment is expected to be slow to recover this year, making profit margin preservation the top priority for all companies. An industry insider said, "As overseas travel has become more active, the number of consumers purchasing at duty-free shops or overseas where whiskey is relatively cheaper has increased significantly," and added, "This year, price increases for flagship products and reductions in promotions are expected to improve profit margins."

However, some voices suggest this is a short-term adjustment following rapid market growth. The unprecedented growth in recent years has raised industry expectations, but it is difficult to say that the gradual growth trend has been broken. Another industry insider said, "There is certainly pressure on the domestic consumption market due to the recession, but it is also clear that the domestic whiskey consumer base is strengthening," and predicted, "Although there will be differences among companies, demand for reasonably priced products and the growth of standard whiskeys are expected to continue this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)