Competitive Edge in Battery, PCS, EMS, etc.

Recent Consecutive Trillion-Won Battery Orders Centered in North America

South Korea's energy storage system (ESS) industry is expected to ride the surge in power demand driven by artificial intelligence (AI) by securing its value chain.

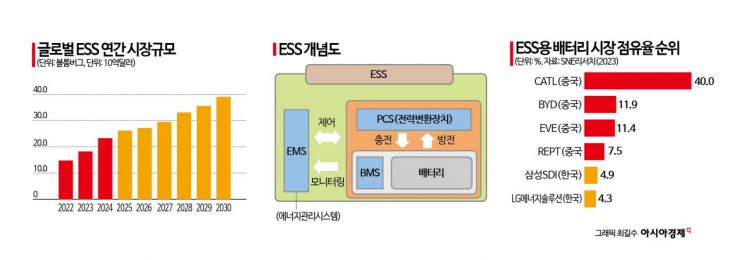

According to the industry on the 2nd, Korean battery and power equipment companies possess global manufacturing competitiveness in the three main components of ESS?batteries, power conversion systems (PCS), and energy management systems (EMS)?and are targeting the market accordingly.

Battery companies are finding relief by supplying ESS batteries worth trillions of won even during the electric vehicle demand chasm period. LG Energy Solution signed large-scale ESS supply contracts in North America for two consecutive months in November and December last year. Both contracts involve supplying ESS batteries for renewable energy projects, totaling 15.5 GWh. Considering that the price of ESS battery containers is $170?200 per kWh, these contracts exceed 4 trillion won. Samsung SDI also signed a contract in July last year to supply ESS batteries worth over 1 trillion won to NextEra Energy, the largest power company in the U.S. SK On has yet to secure large-scale ESS contracts worth trillions of won but plans to provide AI-driven power supply optimization solutions by combining SK Innovation E&S’s energy portfolio. Battery companies are also establishing the LFP (lithium iron phosphate) value chain, known for relatively lower energy density but excellent safety suitable for ESS batteries, mainly in North America.

ESS stores electricity when production is active and supplies it when demand surges. It not only improves power efficiency but also stores renewable energy such as wind and solar power to supply when electricity demand is high. This is why companies committed to RE100 (100% renewable energy usage) are conducting private projects combining renewable energy and ESS. ESS demand is expected to increase with the surge in AI-driven power demand.

Korean industry can create synergy by combining battery manufacturing competitiveness with PCS as well as various power equipment value chains such as transformers and circuit breakers. ESS products exported by power equipment companies like Hyosung Heavy Industries are equipped with Korean batteries. In the EMS sector, LG Energy Solution strengthened its competitiveness by acquiring EMS company NEC Energy Solutions in 2022. Rebranded as ‘LG Energy Solution Vertik,’ the company is evaluated to have maintenance and repair capabilities based on its self-developed EMS software and over 10 years of global operational data.

So far, ESS has not shown a steep upward trend due to slow activation of large-scale renewable energy projects. However, recently, large-scale projects have started operating mainly in North America, leading to a series of orders. With the increase in renewable energy share and policy drives from various countries, the ESS market is expected to grow rapidly. According to BloombergNEF’s forecast (2023), the ESS installation capacity (excluding pumped storage) is expected to increase more than tenfold from 91.5 GWh in 2022 to 1,432 GWh in 2030. The global annual ESS market size is projected to grow from $15.2 billion (about 22.37 trillion won) in 2022 to $39.5 billion (about 58.14 trillion won) in 2030. By region, the U.S. and China are expected to account for more than half of the global ESS deployment, with continued growth anticipated in other major advanced countries as well.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.