Geonjeongyeon 'Construction Market and Issues Seen Through Indicators'

Instability in Rental Market Due to Conversion from Purchase Demand to Jeonse and Monthly Rent

Construction Industry Slump Continues Amid High Exchange Rates and Impeachment Political Turmoil

Due to the concentration of Jeonse and monthly rent housing in the metropolitan area in the first quarter of this year, there is a forecast that Jeonse and monthly rent prices will rise. This is because the financial authorities' loan regulations in the metropolitan area continue this year following last year, and despite two cuts in the base interest rate, the still high mortgage loan interest rates lead demanders to opt for Jeonse and monthly rent contracts rather than home purchases.

The Korea Institute of Construction Policy (KICP) released the 'Construction Market and Issues Seen through the 4th Quarter 2024 Indicators' on the 2nd, containing this information.

KICP predicted that Jeonse and monthly rent prices will rise as the metropolitan area housing sales market shrinks in the first half of this year. It analyzed that as sales demand remains cautious, instability in the rental market and upward pressure on prices will intensify.

The housing sales market is gradually shrinking due to loan regulations by financial authorities. Although the Bank of Korea cut the base interest rate twice last year, the mortgage loan interest rate remains high, preventing buying sentiment from recovering. According to the Bank of Korea's 'Weighted Average Interest Rate of Financial Institutions,' the average mortgage loan interest rate at deposit banks rose to 4.30% in November last year, up from 3.50% in July last year.

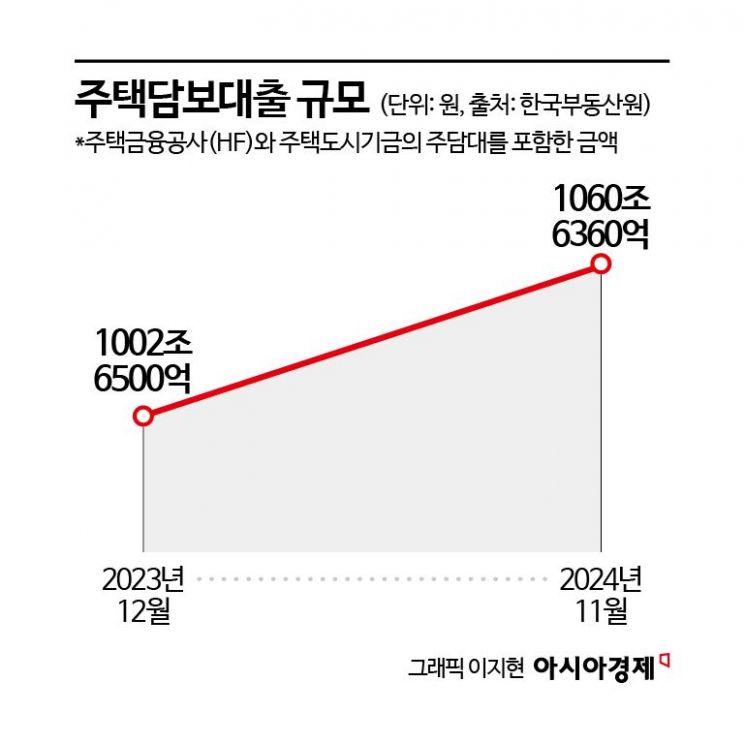

The day before, financial authorities also announced that banks exceeding last year's household loan target limit will have their loan limits reduced this year. Accordingly, loan limits for this year are expected to decrease at Shinhan Bank, Hana Bank, Woori Bank, and others. According to the Korea Real Estate Board, the scale of mortgage loans has steadily increased to 1,060.636 trillion KRW as of November last year.

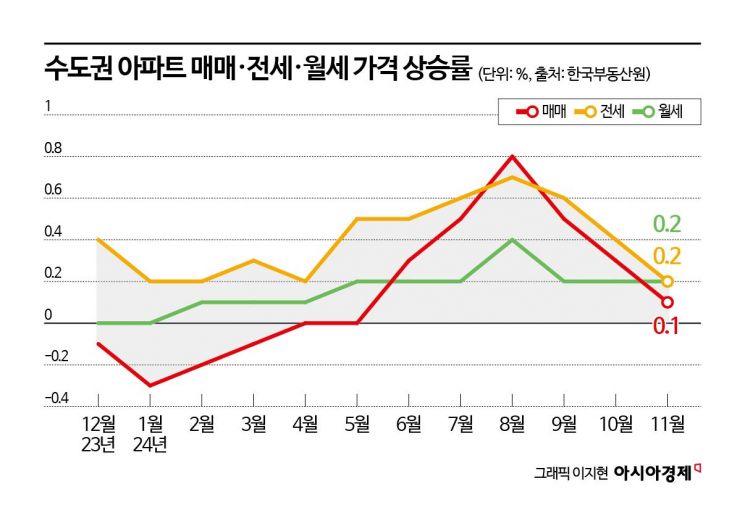

While strengthened loan regulations have reduced the rise in metropolitan area housing prices, monthly rent continues to increase steadily without slowing down. According to the Korea Real Estate Board, metropolitan area housing prices rose only 0.1% month-on-month in November last year. The growth rate has slowed since September last year (0.5%). In contrast, monthly rent increased by 0.2% each month during the same period.

KICP stated, "Last year, due to expectations of mortgage loan interest rate cuts, cautious buying amid strengthened loan regulations, and avoidance of Jeonse in non-apartment housing due to Jeonse fraud, monthly rent demand was more prominent than sales demand," adding, "In the first quarter of this year, rental market instability and price pressure will intensify due to cautious sales demand."

Meanwhile, KICP also forecasted that the construction industry downturn will continue into the first quarter of this year, following last year.

In particular, it predicted that the slump will continue mainly in the private construction sector. Concerns about a contraction in private sector orders due to political uncertainty are growing, and negative ripple effects such as worsening construction company sentiment are causing the economy to shrink. On the other hand, the public and civil engineering sectors are expected to rebound due to early fiscal execution and other factors.

Construction investment this year is expected to decline repeatedly, decreasing by 1.2% compared to last year's performance and falling below 300 trillion KRW. Public investment and civil engineering investment are expected to remain flat, while private investment and building investment are expected to be sluggish.

Concerns about a construction industry downturn due to exchange rate increases were also raised. Recently, the KRW/USD exchange rate has approached 1,470 won amid domestic and international uncertainties such as concerns over the inauguration of the Trump administration's second term and impeachment politics. If the exchange rate surges, raw material costs rise, leading to increased construction costs. According to KICP, as the exchange rate rose in November last year, the import material price increase rate was 6%, which was higher than the 0.2% increase in domestic materials.

It also pointed out that the impact of exchange rate increases is greater on small and medium-sized construction companies than on large construction companies. Large construction companies contract materials on an annual or semi-annual basis, so the immediate impact of high exchange rates is limited. Small and medium-sized construction companies import materials according to exchange rates, so they inevitably suffer more losses compared to large construction companies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.