Samsung Asset Management announced on the 2nd that it has selected the investment keyword for Exchange-Traded Fund (ETF) investments that investors should pay attention to in 2025, the Year of the Blue Snake (Eulsa Year), as ‘B.A.A.M (Baem)’.

This year, it is expected that the stock market led by the United States will continue, supported by a robust U.S. economy. The promising investment destination for 2025 is selected as the ‘United States,’ and four investment strategy keywords under ‘B.A.A.M’ along with a total of 12 recommended KODEX ETFs across each sector were presented.

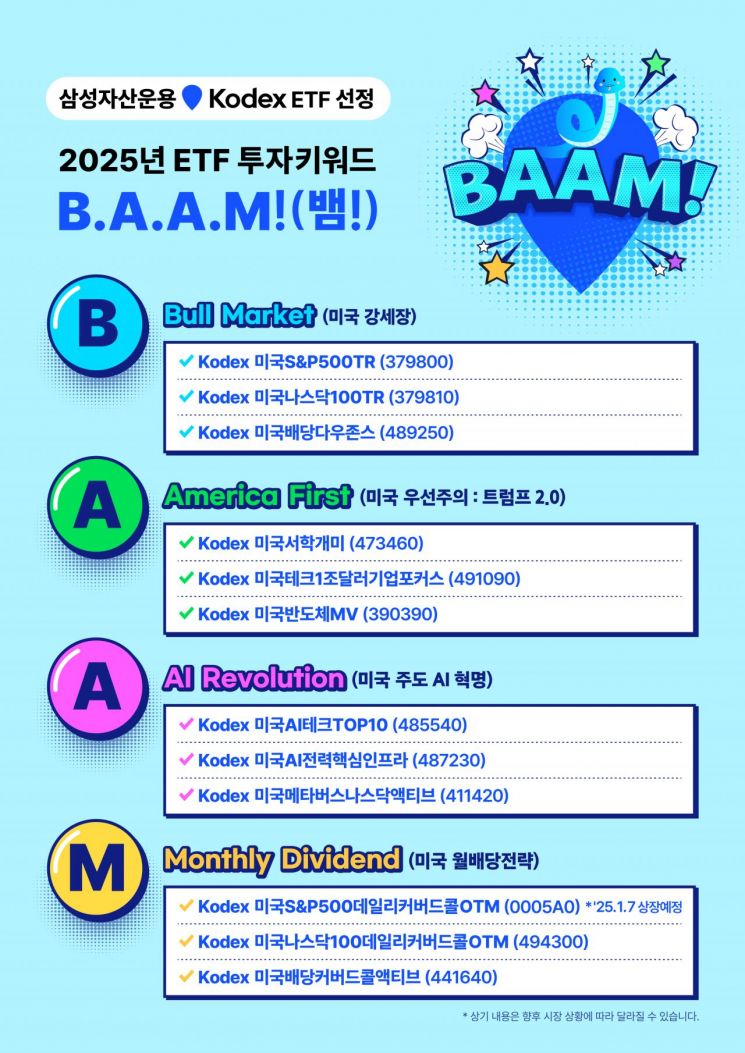

The investment keyword ‘B.A.A.M’ stands for ‘Bull Market’ in the U.S., ‘America First: Trump 2.0,’ ‘AI Revolution led by the U.S.,’ and ‘Monthly Dividend Strategy in the U.S.’

The first keyword is ‘U.S. Bull Market,’ which forecasts that the strong U.S. economic growth will sustain a bullish U.S. stock market in 2025. Accordingly, investments in major U.S. indices and high-quality dividend growth stocks are expected to remain valid. Related ETFs include ▲KODEX U.S. S&P 500 TR ▲KODEX U.S. Nasdaq 100 TR ▲KODEX U.S. Dividend Dow Jones ETF.

‘America First: Trump 2.0’ is also expected to be one of the most important investment destinations this year. In particular, selective approaches and continuous attention are needed for key industries and companies expected to benefit from policies following the inauguration of the Trump 2nd administration. Notable related ETFs include ▲KODEX U.S. Seohak Gaemi ▲KODEX U.S. Tech 1 Trillion Dollar Company Focus ▲KODEX U.S. Semiconductor MV ETF.

In 2025, the full-scale ‘U.S.-led AI Revolution’ is expected to bring explosive growth to related industries and companies. With continued AI investments by major U.S. big tech companies, AI technological innovation led by the U.S. is projected to continue in 2025. Related products include ▲KODEX U.S. AI Tech TOP10 ▲KODEX U.S. AI Power Core Infrastructure ▲KODEX U.S. Metaverse Nasdaq Active ETF.

Lastly, the ‘Monthly Dividend Strategy in the U.S.,’ which saw strong investment enthusiasm in 2024, is expected to remain effective in the new year. Market volatility due to macroeconomic uncertainties will continue to stir investors’ anxieties, and demand from investors seeking to manage risk and secure income is expected to expand.

Related ETFs that participate partially in market gains while securing stable cash flow through monthly dividends include ▲KODEX U.S. Nasdaq 100 Daily Covered Call OTM and ▲KODEX U.S. Dividend Covered Call Active, both of which have been listed. Additionally, ▲KODEX U.S. S&P 500 Daily Covered Call OTM is scheduled to be listed on the 7th of this month.

Kim Dohyung, Head of ETF Consulting at Samsung Asset Management, emphasized, “In 2025, alongside existing macro issues such as U.S. economic indicators and monetary policy, the inauguration of the Trump 2nd administration adds a significant variable, making increased stock market uncertainty inevitable. Selective portfolio construction will determine differentiated returns this year, and it is important to build a robust portfolio centered on the U.S. along with the B.A.A.M strategy.”

Meanwhile, Samsung Asset Management plans to hold a YouTube live webinar titled ‘2025 Investment Keyword B.A.A.M’ at 7 p.m. on the 9th of this month for investors considering ETF portfolios to include this year.

Accessing Samsung Asset Management’s YouTube channel will allow real-time participation. Various prizes will also be offered through a raffle, including two Shilla Hotel Parkview dining vouchers (for 2 people), 50 sets of BBQ Golden Olive Chicken and 1.25ℓ Cola, 50 Burger King Monster Whopper sets, and 300 Starbucks Americano (HOT) drinks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)