Venture Business Association to Announce 'Gyeonggi Business Survey Index' on 30th

This Year's Q4 Decreases by 3.4p Compared to Previous Quarter

The Venture Business Sentiment Index (BSI) for the first quarter of next year recorded an all-time low of 88.9.

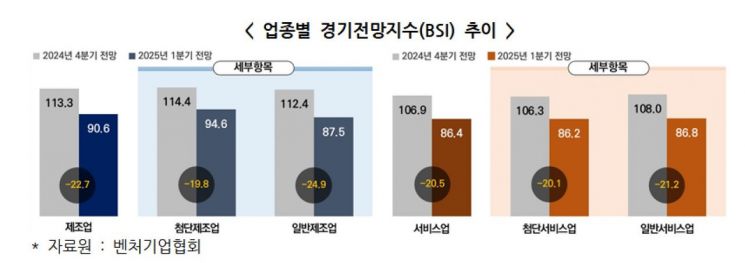

Trend of Business Survey Index (BSI) by Industry for Venture Companies. Provided by the Korea Venture Business Association

Trend of Business Survey Index (BSI) by Industry for Venture Companies. Provided by the Korea Venture Business Association

The Korea Venture Business Association announced on the 30th the "2024 Q4 Venture Business Current Situation Index," based on 1,000 corporate venture-certified companies as of the end of December last year. The venture business BSI is an indicator reflecting the performance and outlook of the venture industry economy. With 100 as the baseline, a value above 100 indicates an improvement in the economy compared to the previous quarter, while below 100 indicates a downturn.

The venture business BSI for Q4 this year was 85.0, down 3.4 points from the previous quarter (88.4), marking a decline for two consecutive quarters. Among the responding companies, 85.2% cited "sluggish domestic sales" as the key factor worsening the economy. This was followed by difficulties in financing (43.4%) and rising labor costs (14.2%) as major aggravating factors.

On the other hand, factors improving the economy were domestic sales improvement (71.9%), smooth financing (27.3%), and export improvement (23.5%) in that order. Notably, the proportion of companies reporting improved exports increased by 7.7 percentage points compared to the previous quarter (15.8%).

Both manufacturing and service industry performance indices fell below the baseline. The manufacturing BSI was 83.5, down 5.8 points from the previous quarter (89.3), and general manufacturing plunged sharply by 10.9 points to 80.0 compared to the previous quarter.

By survey item, management performance (81.8), financial situation (81.9), workforce situation (94.4), and cost expenditure (86.4) all fell short of the baseline. Management performance notably declined by 7.4 points from the previous quarter due to decreases in "domestic sales (83.2)" and "productivity (89.1)."

The venture business BSI for the first quarter of next year dropped 21.8 points from the previous quarter (110.7) to 88.9, marking the lowest level ever recorded. This figure suggests a significant contraction in the venture industry economy in the first quarter of next year.

By industry, both manufacturing and service sectors recorded large decreases of around 20 points compared to the previous quarter, indicating an overall sluggish industry economy. The decline was more pronounced in manufacturing than in services, and more evident in general industries than in advanced sectors.

Looking at the four survey items, management performance (87.4), financial situation (88.2), workforce situation (96.0), and cost expenditure (86.7) all fell below the baseline (100). Management performance saw the largest drop, decreasing by 22.4 points from the previous quarter (109.8). Workforce situation and cost expenditure showed slight recoveries, increasing by 0.8 points and 9.4 points respectively compared to the previous quarter.

The annual venture business BSI for this year was 83.7, reflecting an overall sluggish venture industry economy this year.

Sang-yeop Seong, Chairman of the Korea Venture Business Association, said, "As seen from the sharp drop in the venture business BSI, our economy is expected to face a difficult period next year due to expanding domestic and international uncertainties and worsening macroeconomic conditions." He added, "The government and the National Assembly should ease unnecessary regulations that stifle corporate management to overcome the upcoming challenging business environment and prepare stronger policy support measures to revitalize the domestic market and improve financing conditions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![A Woman Who Jumps Holding a Stolen Dior Bag... The Mind-Shaking, Bizarre Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)