At the end of last year, the number of internal information technology (IT) personnel in domestic financial companies increased by 8% compared to the previous year, while the number of external IT personnel outsourced, such as through subcontracting, increased by only 3%. The proportion of internal personnel among the total IT workforce reached 48.3%, approaching 50%.

The Financial Informatization Promotion Council published the "2022-2023 Financial Informatization Promotion Status" on the 29th, containing these findings. The booklet surveyed a total of 145 financial companies, including 20 domestic banks, 78 financial investment firms, 39 insurance companies, and 8 credit card companies, compiling statistical data related to domestic financial informatization such as IT operation status.

At the end of last year, the average number of internal IT personnel in the 145 domestic financial companies was 93.7, increasing by 8% from the previous year due to growing IT personnel demand. The proportion of internal IT personnel among all employees steadily rose from 4.5% in 2020 to 6.3% last year.

On the other hand, the average number of external IT personnel outsourced was 100.3, with a growth rate of 3%, which was lower than the 8% increase in internal IT personnel. Consequently, the share of internal personnel among total IT staff has continuously expanded, accounting for 48.3% last year. This reflects that financial companies recognize securing excellent internal IT personnel as a key factor in enhancing competitiveness.

Last year, the average IT budget of domestic financial companies was 65.1 billion KRW, marking a 5.7% increase from the previous year. The proportion of IT budgets within the total budgets of financial companies reached 10.7% at the end of last year. The operational budget share expanded mainly due to the increase in IT personnel, while the capital budget share, such as investment in computer equipment, decreased.

Internet Trading Transactions Increased by 15.1%, Transaction Amount by 11.2%

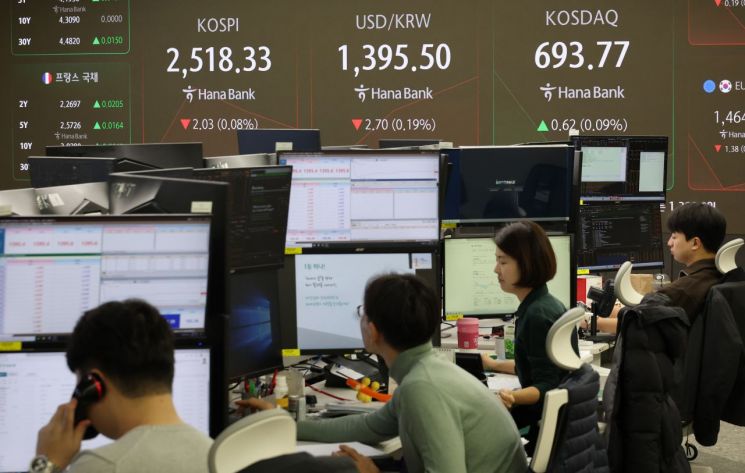

The usage scale of major customer-facing electronic financial services such as internet banking and trading showed an upward trend. The number of internet banking service transactions and transaction amounts at domestic banks and postal financial institutions increased by 14.9% (22.65 million transactions per day) and 7.4% (82.0056 trillion KRW), respectively, compared to the previous year.

In particular, the number of internet trading transactions and transaction amounts at financial investment companies, including stock trading and fund transfers, increased by 15.1% (31.36 million transactions per day) and 11.2% (60.7162 trillion KRW), respectively, compared to the previous year.

The proportion of usage through mobile devices continues to rise steadily. Last year, mobile banking accounted for 87.6% of transaction counts and 18.5% of transaction amounts. The relatively lower proportion of transaction amounts compared to transaction counts is because mobile banking is mainly used for relatively small fund transfers.

Meanwhile, according to a survey conducted among IT personnel of financial companies and related financial institutions, the key issues in the financial IT sector were most frequently cited as "Activation of cloud environment usage in the financial sector" (77.7%), "Increased utilization of big data in financial services" (68.4%), and "Launch of AI-based financial services such as robo-advisors and chatbots" (66.0%).

The technology fields expected to grow the fastest over the next three years were identified as "AI technologies such as robo-advisors and chatbots" (72.8%), "Cloud environment utilization technologies" (66.0%), and "Big data processing technologies" (51.0%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.