Credit Recovery Committee Implements Four Types of 'Customized Support'

Special Cases for Rapid Debt Adjustment and Pre-Debt Adjustment Extended for One Year Until the End of Next Year

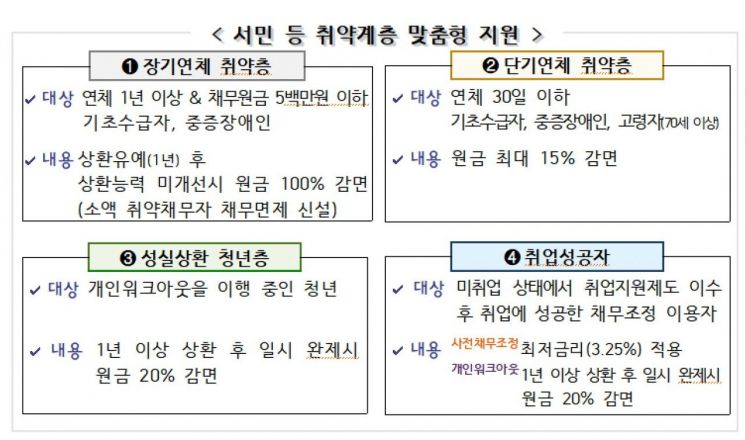

From the 30th, the Credit Recovery Committee will strengthen tailored debt adjustment support based on debtor characteristics such as vulnerable groups, youth, and the unemployed. For vulnerable debtors with principal debts of 5 million KRW or less (overdue for more than one year), the debt will be deferred for one year, and if repayment ability does not improve, the principal will be 100% forgiven. For vulnerable groups with short-term arrears of 30 days or less, the principal will be reduced by up to 15%.

On the 29th, the Financial Services Commission announced that this tailored debt adjustment support plan will be implemented from the 30th. The support plan consists of four parts: ▲bold support for vulnerable groups with small debts (principal 5 million KRW or less) who are long-term overdue (over one year) including debt forgiveness ▲proactive support for vulnerable groups with short-term arrears (30 days or less) ▲strengthening debt adjustment incentives for youth who faithfully carry out debt adjustments ▲strengthening debt adjustment incentives for those who succeed in employment.

First, more aggressive debt adjustments will be supported for basic livelihood security recipients and persons with severe disabilities who have small debts overdue for more than one year. For basic livelihood security recipients and persons with severe disabilities holding small debts with a principal of 5 million KRW or less and overdue for more than one year, a one-year repayment deferral will be provided, and if repayment ability does not improve, the principal will be 100% forgiven. The scope of repayment burden reduction has been expanded to provide a swift opportunity for recovery to vulnerable groups who have suffered from long-term collection efforts.

Additionally, proactive support will be strengthened for basic livelihood security recipients, persons with severe disabilities, and elderly persons aged 70 or older who are short-term overdue for 30 days or less. Previously, support for arrears of 30 days or less focused on interest rate reductions, but to enable vulnerable groups with significantly low repayment ability to recover quickly, principal reductions of up to 15% will be provided.

Incentives for faithful repayment will also be strengthened to encourage youth to take the initiative in recovery and faithfully repay their debts. For youth aged 34 or younger who have been overdue for more than 90 days and are using the Credit Recovery Committee’s personal workout program, if they faithfully repay for more than one year and then make a lump-sum payment, the debt reduction rate will be expanded from a maximum of 15% to 20%.

Furthermore, to encourage voluntary improvement of repayment ability among unemployed persons using the Credit Recovery Committee’s debt adjustment program, debt adjustment incentives will be provided to debtors who succeed in employment after completing employment support programs. Those using pre-debt adjustment with principal and interest installment repayment conditions will be applied the lowest interest rate (annual 3.25%), and those using personal workout with principal installment repayment conditions will have their debt reduction rate expanded from a maximum of 15% to 20% if they faithfully repay for more than one year and then make a lump-sum payment.

Moreover, considering the difficult economic situation such as delayed domestic demand recovery and proactive debt adjustment demand, the special cases for rapid debt adjustment and pre-debt adjustment, which are temporarily operated until the end of this year, will be extended until the end of December next year. The rapid debt adjustment special case expands the target of overdue risk persons to the bottom 20% of credit scores (previously: bottom 10%) and reduces the agreed interest rate by 30-50% (previously: no interest rate reduction). The pre-debt adjustment special case supports basic livelihood security recipients, persons with severe disabilities, and elderly persons aged 70 or older with principal reductions of up to 30% (previously: only interest rate reductions up to 70% without principal reduction). Through this, debt burdens will be reduced before overdue conditions worsen, enabling rapid economic stability.

Applications and submissions for Credit Recovery Committee debt adjustments can be made by visiting one of the 50 integrated financial support centers nationwide, accessing the Credit Recovery Committee’s cyber counseling department, or through the dedicated app. Inquiries to the Credit Recovery Committee call center will provide detailed system guidance, including non-face-to-face (online) application methods and consultation reservations for visiting on-site counters (integrated financial support centers). Going forward, the Financial Services Commission plans to continuously pursue system improvements to reduce debt burdens for vulnerable groups such as low-income households and to support full economic independence.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)