KCCI Announces Results of '2025 Distribution Industry Outlook Survey' Targeting 300 Retailers Nationwide

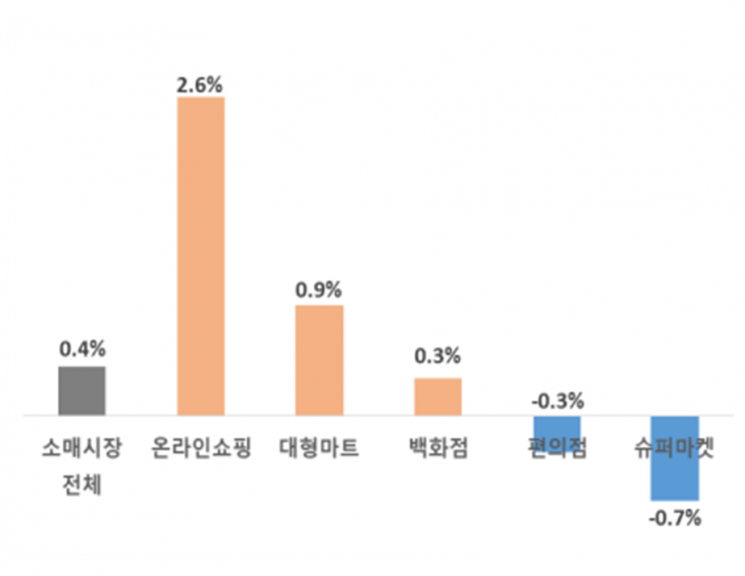

There is a forecast that the domestic retail distribution market will grow by only 0.4% next year. This is the lowest growth rate since the COVID-19 pandemic in 2020.

The Korea Chamber of Commerce and Industry announced on the 26th that this result came from the '2025 Distribution Industry Outlook Survey (multiple responses)' conducted from the 7th to the 15th of last month targeting 300 retail distribution companies nationwide.

66.3% of the responding companies evaluated that the distribution market next year will be more negative than this year. The main reasons cited were ▲contraction of consumer sentiment (63.8%) ▲continued high inflation (47.7%) ▲increased household debt burden due to sustained high interest rates (38.2%) ▲intensified market competition (34.2%) ▲income and wage instability (24.2%).

Professor Lee Dong-il of Sejong University and president of the Korea Distribution Science Association diagnosed, "Concerns over tariff increases by the second Trump administration and high exchange rates have recently increased uncertainties and risks for the domestic economy and companies," adding, "The sense of anxiety felt by the domestic retail distribution industry has risen accordingly."

By business type, online shopping is expected to record the highest growth rate at 2.6%. However, 64.6% of the responding companies evaluated it negatively, citing intensified competition (78.7%), rising costs (63.8%), and the entry of China commerce into the domestic market (51.1%) as the main reasons.

The large discount store industry forecasted a market growth rate of 0.9% next year. Two out of three large discount store companies (64.2%) viewed the market negatively. The main causes of the negative outlook were intensified competition with online channels (94.1%), consumption slowdown due to high inflation and high interest rates (55.9%), and profitability deterioration due to discount competition (50.0%).

The department store industry projected a market growth rate of 0.3% for next year. 68.4% of companies viewed the market negatively, citing contraction of consumer sentiment due to economic recession (53.8%) and the spread of rational consumption tendencies due to high inflation and high interest rates (15.4%) as reasons.

Convenience stores (-0.3%) and supermarkets (-0.7%) are expected to experience negative growth respectively. The convenience store industry cited consumption contraction due to high inflation and high interest rates (86.8%) and rising costs such as labor expenses (85.3%) as major causes. Supermarkets were negatively affected by deteriorating consumer sentiment (33.3%) and intensified online competition (29.6%).

In the 'Top 10 Issues in the Distribution Industry in 2024' survey, the distribution industry selected 'Frozen consumer sentiment due to high inflation and high interest rates (60.7%)' as the number one issue. Following were ▲the invasion of China commerce (54.3%) ▲delays in settlement by TMON and WEMAKEPRICE (21.7%) ▲increase in convenience store shopping groups (19.7%) ▲buying cosmetics at Daiso (18.0%).

Additionally, ▲strengthening marketing based on social networking services (SNS) (15.0%) ▲spread of new technology utilization such as AI (11.3%) ▲sale/closure of inefficient businesses (11.3%) ▲expansion of weekday mandatory closure days for large discount stores (10.3%) ▲seeking survival through store renewal (10.9%) followed.

Jang Geun-mu, director of the Korea Chamber of Commerce and Industry's Distribution and Logistics Promotion Institute, said, "Concerns such as America First policies and tariff increases have emerged as powerful keywords that will determine the domestic and international economy in 2025," adding, "Our distribution companies must prepare various scenarios and countermeasures in advance and respond to risks through accurate analysis."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)