Warning signs have been raised regarding the corporate loan default risk at the five major banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup). This is because 70% of non-performing loans, commonly referred to as 'bad debts,' are corporate loans. Non-performing loans that generate no interest income, known as 'zero-yield loans,' also surged by about 19% compared to the same period last year, with 72% of these zero-yield loans identified as corporate loans. In particular, concerns are growing that the recent exchange rate approaching the 1,500 won mark will increase foreign exchange losses for companies, further hindering their loan repayment capacity.

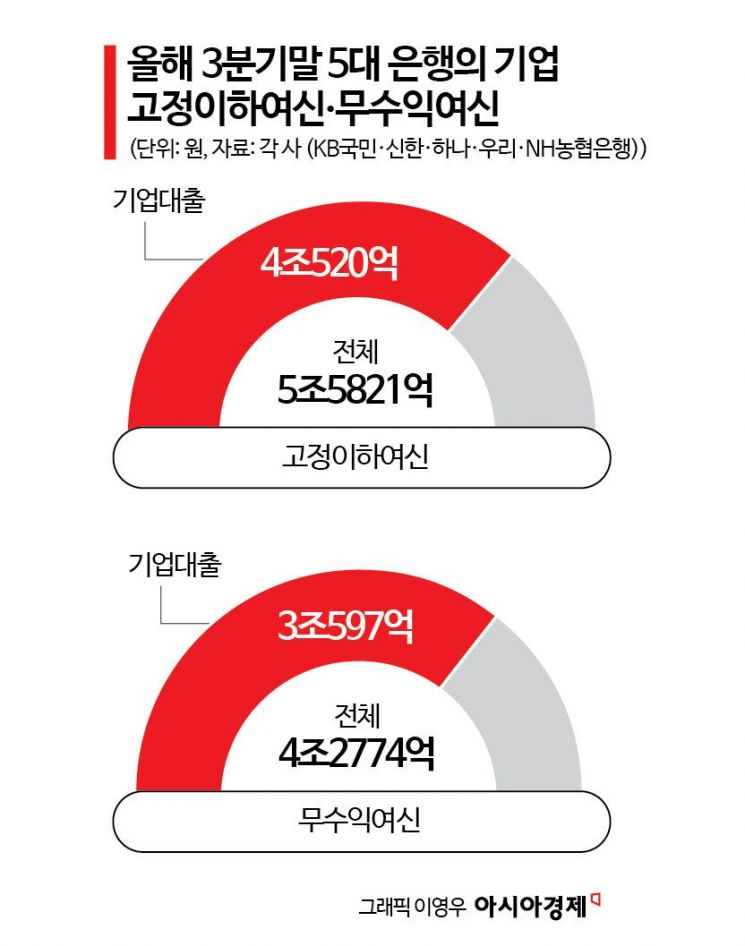

According to the financial sector on the 24th, the five major banks' non-performing loans as of the third quarter amounted to 5.5821 trillion won. This represents an approximately 29% increase compared to the same period last year (4.342 trillion won). Non-performing loans are a representative indicator of bank soundness and refer to loans overdue for more than three months. Financial institutions classify asset soundness into five stages: ▲Normal ▲Precautionary ▲Substandard ▲Doubtful ▲Estimated Loss, with ▲Substandard ▲Doubtful ▲Estimated Loss collectively referred to as non-performing loans.

Notably, 73% of non-performing loans were corporate loans. Corporate non-performing loans at the five major banks totaled 4.052 trillion won, accounting for about 73% of the total. This is interpreted as a result of aggressively increasing corporate loans after loan growth was restricted due to strengthened household debt management by financial authorities.

By bank, KB Kookmin Bank's corporate non-performing loans increased by 500.6 billion won from the previous year to 1.1836 trillion won, the largest amount. NH Nonghyup Bank followed with 1.047 trillion won (+356.3 billion won). Hana Bank recorded 610.6 billion won (+105.1 billion won), and Woori Bank had 536.5 billion won (+74.5 billion won). Shinhan Bank's corporate non-performing loans were 674.3 billion won (-4.6 billion won), the only one among the five major banks to see a decrease compared to the previous year.

Zero-yield loans, so-called 'empty-can loans' where interest is not received despite lending, also increased significantly. Zero-yield loans refer to loans overdue for more than three months or those with no interest income due to legal management. As of the third quarter this year, zero-yield loans at the five major banks amounted to 4.2773 trillion won, a 19.6% increase compared to the same period last year. This is a notable rise compared to the 7.8% increase in total loans at the five major banks during the same period.

Among zero-yield loans at the five major banks, 3.0597 trillion won, or 72%, were corporate loans. NH Nonghyup Bank's increase was particularly remarkable, with corporate loans accounting for 846.9 billion won out of its 1.1005 trillion won in zero-yield loans, a 62.3% (360.2 billion won) surge compared to the same period last year.

Moreover, concerns are mounting that with the exchange rate soaring close to 1,500 won, it will be difficult for companies to improve their repayment capacity in the future. When the exchange rate rises, companies incur greater foreign exchange losses, reducing operating profits. Although export companies are generally thought to benefit from a rising exchange rate, most raw materials are imported, so the sales increase effect is minimal or even negative. The Korea Institute for Industrial Economics & Trade reported that a 10% increase in the exchange rate lowers large companies' operating profit margins by 0.29 percentage points. For small and medium-sized enterprises (SMEs), the situation is more severe. According to the Small and Medium Business Venture Research Institute, a 1% increase in the exchange rate raises losses for domestic SMEs by 0.36%.

A banking sector official said, "Due to the prolonged high interest rates and sluggish domestic demand, many defaults have occurred. Now, with political instability followed by soaring exchange rates, even if interest rates begin to fall, the deterioration in the quality of corporate loans is expected to be inevitable for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)