Hana Financial Research Institute Publishes Report on 'Changes in Insurance Product Department Store GAs'

Large GAs with Over 500 Employees Grow at an Average Annual Rate of 4.6%

Insurance Companies Seek to Secure GA Influence through M&A and Equity Investments

With the introduction of the new International Financial Reporting Standard (IFRS17), it is analyzed that General Agencies (GA) for corporate insurance will experience rapid growth. Large insurance companies are expected to intensify competition to secure market share by increasing their control over GAs through mergers and acquisitions (M&A) or equity investments.

According to the report "Changes in the Insurance Product Department Store GA" published by Hana Financial Research Institute on the 23rd, GAs that sell various insurance products from multiple insurers have recently grown rapidly in number and have become a key sales channel for insurers. The number of GAs with more than 500 employees increased from 56 in 2018 to 70 last year, growing at an average annual rate of 4.6%. The share of GA sales in new life insurance contracts rose from 24% in 2018 to 41.3% in 2022. During the same period, the share for non-life insurers increased from 42.9% to 53.6%. The cumulative insurance premiums through GAs in the third quarter of this year reached 768 billion KRW, a 21% increase compared to the same period last year.

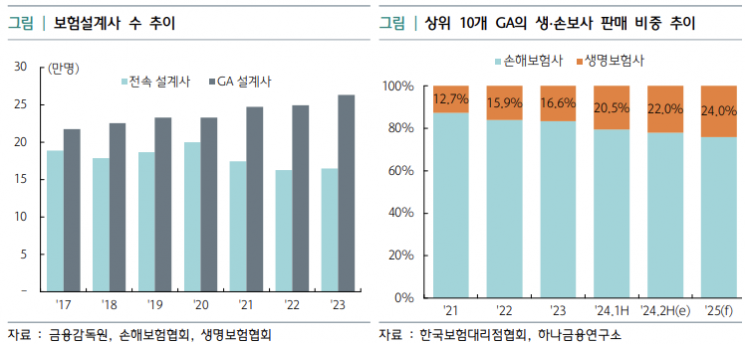

Trends in the number of insurance planners and the sales share of life and non-life insurance companies by corporate insurance agencies (GA). Provided by Hana Financial Research Institute

Trends in the number of insurance planners and the sales share of life and non-life insurance companies by corporate insurance agencies (GA). Provided by Hana Financial Research Institute

The number of planners affiliated with GAs has been rapidly increasing every year due to more favorable commission policies compared to exclusive planners of insurance companies. The number of GA-affiliated planners grew at a compound annual growth rate (CAGR) of 3.2% from 2018 to 2023. In contrast, the number of exclusive planners for insurance companies decreased by 1.5% during the same period.

Recently, profitability has significantly increased, especially among large GAs with over 500 employees. Kosdaq-listed companies Inka Financial Services and GA Korea reported net profits of 29.5 billion KRW and 9.2 billion KRW last year, respectively, marking increases of 41.9% and 53.3% compared to the previous year.

As GAs grow in size, existing insurance companies are responding by increasing their control over GAs. The strategies differ between the life and non-life insurance sectors.

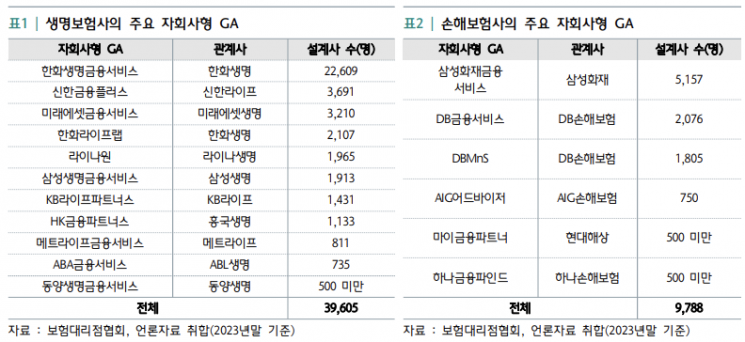

Life insurers such as Hanwha Life and Mirae Asset Life have mainly spun off their exclusive organizations and converted them into subsidiary GAs. The number of planners in life insurers’ subsidiary GAs grew by 6.9% over the recent eight months, from 37,000 in January to 39,000 in September. The conversion to subsidiary GAs has led to a decrease in the number of exclusive planners at life insurers. After spinning off, subsidiary GAs have expanded their influence in the insurance market through M&A. Hanwha Life’s subsidiary, Hanwha Life Financial Services, has grown into the GA with the largest planner organization in the domestic GA market by acquiring Reno Insurance Agency and People Life. Mirae Asset Life’s subsidiary, Mirae Asset Financial Services, has grown into a large GA by absorbing Mirae Asset Life’s exclusive planners.

Non-life insurers are expanding their entry into the GA market more through equity investments or business partnerships rather than converting to subsidiary GAs. Representative examples include Hanwha General Insurance and Meritz Fire & Marine Insurance investing in traditional large GAs such as Inka Financial Services.

Small and medium-sized companies are securing control over GAs by strengthening sales competitiveness through expanding sales convenience or strategic alliances rather than capital-intensive methods like M&A.

Status of Subsidiary-Type Corporate Insurance Agencies (GA) of Domestic Insurance Companies. Provided by Hana Financial Research Institute

Status of Subsidiary-Type Corporate Insurance Agencies (GA) of Domestic Insurance Companies. Provided by Hana Financial Research Institute

Traditional GAs are also growing into large GAs through M&A to respond to insurance companies and are increasing their influence in the GA market. Honors Financial Services, formed by the merger of First Asset and Woori Life, has grown into a large GA with over 5,000 planners. Traditional GA Korea Insurance Finance has expanded its influence in the GA market by growing into a large GA through mergers and acquisitions among GAs such as Leaders, MIC, and Insmoa.

It is expected that the influence of GAs will further increase next year, the third year since the introduction of IFRS17. Under the IFRS17 system, the insurance contract margin (CSM), an insurer’s profitability indicator, has become important, and securing a large amount of CSM requires long-term insurance periods and high-risk premiums, which are characteristics of protection insurance. Protection insurance is the main product of GAs. Lee Ki-hong, a research fellow at Hana Financial Research Institute, said, "Protection insurance accounts for the highest proportion of GA channels for both life and non-life insurers," and predicted, "As protection insurance sales become more important in the future, the influence of GAs will further increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.