Announcement of Financial Support Measures for Small Business Owners in the Banking Sector

Programs Including Customized Debt Adjustment, Support for Closed Businesses, Win-Win Guarantees and Loans Activated

Customized Debt Adjustment to Begin as Early as March Next Year

Main Banks to Provide Commercial Area Analysis and Financial and Management Consulting

Financial Authorities Accelerate by Revising Supervisory Regulations and Issuing Interpretations and Non-Action Opinions

The government and 20 banks will begin full-scale implementation of a financial support plan for small business owners, with a maximum scale of 700 billion KRW, as early as March next year. The plan aims to reduce the financial burden on small business owners by adjusting debts through installment repayments and interest reductions, and by providing funds only for essential needs, ensuring sustainable support tailored to each borrower's situation. The government plans to promptly improve related systems to ensure the effective operation of this plan.

On the 23rd, Cho Yong-byeong, Chairman of the Korea Federation of Banks, and the heads of 20 member banks held a meeting with Kim Byung-hwan, Chairman of the Financial Services Commission, Oh Young-joo, Minister of SMEs and Startups, and Lee Bok-hyun, Governor of the Financial Supervisory Service, to announce the banking sector's financial support plan for small business owners. The heads of 20 banks including Industrial Bank of Korea, NongHyup, Shinhan, Woori, SC First Bank, Hana, IBK, Kookmin, Korea Citibank, Export-Import Bank, Suhyup, IM Bank, Busan, Gwangju, Jeju, Jeonbuk, Gyeongnam, K Bank, Kakao Bank, and Toss Bank attended.

The plan focuses on ▲ customized debt adjustment for borrowers before delinquency ▲ low-interest, long-term installment repayment programs for closed businesses ▲ win-win guarantees and loans ▲ introduction of consulting programs by the banking sector. The banking sector analyzed that customized debt adjustment will reduce interest burdens by 121 billion KRW annually for 100,000 borrowers and 5 trillion KRW in loan amounts, averaging 1.21 million KRW per borrower per year. The low-interest, long-term installment repayment program for closed businesses is expected to reduce interest burdens by 315 billion KRW (1.03 million KRW per borrower annually) for 100,000 borrowers and 7 trillion KRW in loans annually. Additionally, about 20 billion KRW will be contributed through win-win guarantees and loans.

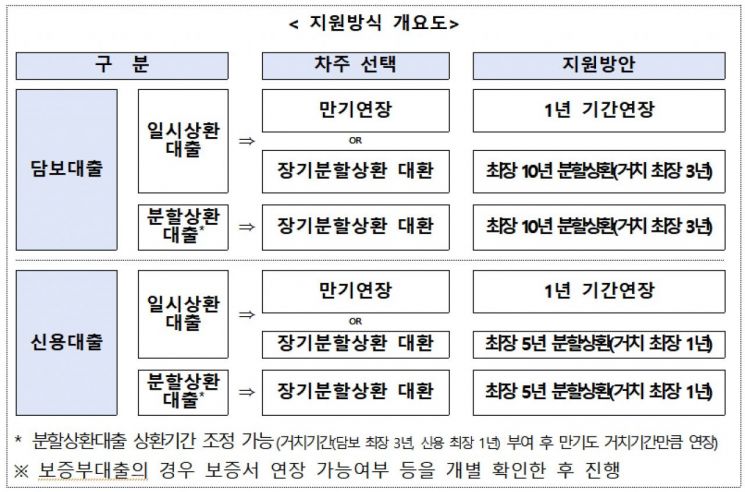

The banking sector will first support small business owners who are expected to have repayment difficulties even if they are currently normal borrowers, through long-term installment repayments and interest reductions tailored to small business owners. The existing 'Individual Business Loan 119' program, which was independently implemented by banks and targeted only individual business owners, will be strengthened and expanded to include corporate small business owners. The program name has been changed to '119PLUS' (tentative).

The support targets borrowers at risk of delinquency, those in financial difficulties such as business suspension, and those with continuous delinquency periods of less than 90 days. In particular, the criteria for borrowers at risk of delinquency will be quantified and subdivided, and if the requirements are met, the screening process will be simplified to provide support.

A Korea Federation of Banks official explained, "We plan to actively support not only maturity extensions but also long-term installment refinancing and interest burden relief to reduce the possibility of defaults and ease repayment burdens." He added, "Existing business loans will be refinanced into long-term installment products with maturities of up to 10 years, and interest reduction measures will be implemented concurrently during refinancing and maturity extension processes."

Reducing loan burdens after business closure... Introduction of refinancing loans with interest rates in the 3% range and long-term installment repayments up to 30 years

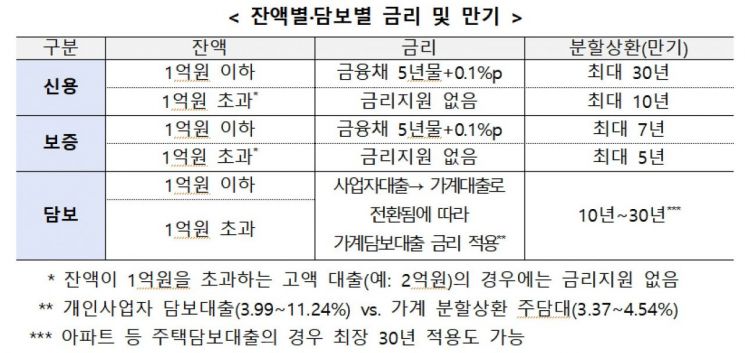

A 'low-interest, long-term installment repayment program for closed businesses' will also be introduced to allow small business owners who can no longer continue their business to settle their business without heavy burdens and repay remaining loans slowly. The core is to support refinancing of individual business loans currently being repaid normally at about 3%, which is half the average interest rate of individual business credit loans (about 6%), for up to 30 years.

Detailed support includes repayment deferral (up to 1 year) or grace periods (up to 2 years), and loans with balances up to 100 million KRW will be supported at low interest rates around 3%. Early repayment fees due to refinancing will be waived.

A financial authority official stated, "If a borrower receiving support under the program takes out a new business loan, the support will be discontinued," and added, "After revising the Korea Federation of Banks' model regulations and completing system work, the program is scheduled to be implemented between March and April next year."

Small business owners with a willingness to restart their business, such as those who have repaid faithfully or have potential to enhance competitiveness, can receive additional business funds through the small business owner win-win guarantee and loan programs named 'Hae-sal-loan 119' and 'Small Business Growth up (up)'.

'Hae-sal-loan 119' targets micro individual business owners with annual sales of 300 million KRW or less who have been complying with the banking sector's '119PLUS' program for more than six months, and will be implemented from April next year. To encourage principal repayment, borrowers with long-term installment repayments or conditional maturity extensions who have complied for more than three months are also included. The interest rate is about 6-7% per annum, with a maximum repayment period of 5 years and a maximum limit of 20 million KRW. Borrowers can receive the 119PLUS program, guarantee screening, and loans all at once from a specific bank to use new funds.

Additionally, the 'Small Business Growth up' program will be implemented from July next year to provide additional guaranteed loans for equipment and working capital to small business owners capable of strengthening competitiveness. Eligible businesses must already be operating and demonstrate plans to enhance competitiveness such as profitability and sales growth. The program applies a lower interest rate than unsecured loans (guarantee fee rate 0.8%) with up to 10 years of installment repayment (including up to 3 grace periods). The limit is 50 million KRW for individual business owners and 100 million KRW for corporate small business owners.

Main banks to provide consulting including commercial area analysis and financial/management support... System improvements underway

Main banks will also engage in consulting services such as commercial area analysis and financial and management support. For start-ups, they will provide start-up support consulting including commercial area analysis and preferential interest rates during consulting. For existing business operators, they will support management advice, financial, tax, accounting, and legal consultations. For closed businesses, customized consulting will be provided, including management support for closure procedures and guidance on cost reduction services.

A banking sector official said, "We will prioritize support for start-ups and debt-adjusted borrowers and gradually expand the target group," adding, "After each bank conducts initial consulting, a task force (TF) led by the Korea Federation of Banks will be formed to prepare detailed consulting plans in the first quarter of next year."

The Financial Services Commission, Ministry of SMEs and Startups, and Financial Supervisory Service plan to promptly take necessary measures to support the banking sector's financial support plan for small business owners. They will support active debt adjustment by the banking sector through improvements in management condition evaluations and exemption of related employees from liability, and will also promote extension of guarantees by regional credit guarantee foundations to supply funds.

Furthermore, to activate the supply of management burden support services such as platforms and brokerage services for win-win cooperation between banks and small and medium enterprises, institutional improvements such as utilizing the financial sandbox and allowing ancillary businesses will be pursued.

A financial authority official explained, "To systematically manage the banking sector's financial support plan for small business owners, the Korea Inclusive Finance Agency will comprehensively manage support performance with cooperation from related organizations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.