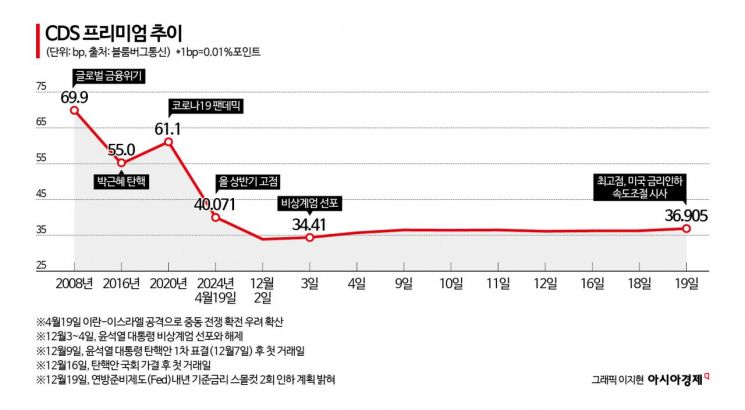

36.905bp as of closing on the 19th... Highest since martial law incident

Lower than during Park's impeachment and Iran airstrikes in early this year

Despite the extreme political turmoil caused by the 12·3 emergency martial law incident and the impeachment of President Yoon Suk-yeol, the credit default swap (CDS) premium reflecting South Korea's credit risk showed little fluctuation. After the emergency martial law incident, the CDS premium rose to 36.506bp (1bp = 0.01 percentage points), which was lower than during the impeachment phase of former President Park Geun-hye and also below the peak earlier this year when Iran launched airstrikes against Israel. This indicates that the international financial market did not significantly reflect the negative impact of the martial law and impeachment political crisis.

However, the mood changed rapidly following news that the U.S. Federal Reserve (Fed) would slow the pace of interest rate cuts. The CDS premium, which had been stabilizing downward, surged beyond the level during the martial law incident as the exchange rate soared to levels comparable to the global financial crisis due to U.S.-originated negative factors. Concerns are growing that with ongoing domestic political instability due to the impeachment crisis and a worsening global economic environment, economic recovery may become even more difficult.

According to Bloomberg and other sources, the Korean CDS premium (based on the 5-year Foreign Exchange Stabilization Fund bond) closed at 36.905bp on the 19th (local time) in the New York market. This was an increase of 0.623bp from the previous session, marking the highest point since the emergency martial law incident. However, it remained below the yearly high of 40.071bp recorded on April 15, when Iran launched airstrikes against Israel.

The CDS premium increased after President Yoon declared martial law on the 3rd of this month (34.41bp), reaching a peak of 36.506bp on the 9th, the first trading day after the first impeachment motion was dismissed. After the impeachment motion was passed, the premium trended downward, giving back much of the earlier gains. However, following remarks by Fed Chair Jerome Powell suggesting a slowdown in the pace of rate cuts, the figure rebounded sharply. A Ministry of Economy and Finance official explained, "The CDS premium is reacting more strongly to the U.S. interest rate cut cycle than to the impeachment," adding, "Even during former President Park's impeachment, the premium was more influenced by interest rate hike variables."

The CDS premium refers to the fee paid by bondholders as insurance against the risk that the issuing country or company may default on repayment. When the credit risk of the country or company increases, the CDS premium rises. South Korea has historically seen sharp increases in CDS premiums during crises such as global economic instability or North Korean nuclear provocations. During the 2008 global financial crisis, the premium soared to 699bp (October 27), and during the peak of the COVID-19 pandemic shock in 2020, it rose to 61.1bp (March 23). When candlelight protests demanding former President Park's resignation erupted amid the Choi Soon-sil political scandal, the premium peaked at 55.0bp (November 14).

However, the fact that the CDS premium is lower than during past economic crises does not mean there is room for complacency. It is currently impossible to predict the impact of the new phase of U.S.-originated interest rate cuts. The won-dollar exchange rate recently surpassed 1,450 won in weekly trading, reaching the highest level since the global financial crisis. On that day, the Seoul foreign exchange market opened at 1,450.0 won and traded around that level. A sharp rise in the exchange rate leads to a chain reaction of increased raw material import prices, negatively affecting corporate investment and employment, thereby harming the overall Korean economy. The timing of the Bank of Korea's preemptive interest rate cuts, considered a tool for economic recovery, may also be delayed.

The economic conditions are also much worse than in the past. Unlike during former President Park's impeachment in 2016, when a tax revenue boom provided ample fiscal capacity to counter domestic demand stagnation, this year is expected to see a tax revenue shortfall of 30 trillion won following last year's 56 trillion won deficit. Although the waves of economic crisis are rising, there is a shortage of fiscal ammunition to thaw the economic chill triggered by the impeachment.

The addition of a major uncertainty amid warnings of declining growth rates is even more concerning. The Korean economy is facing export peak-out due to deteriorating global competitiveness of key export items such as semiconductors and prolonged domestic demand stagnation. As a result, major institutions have recently lowered their economic growth forecasts for South Korea next year to the 1% range. Bank of Korea Governor Lee Chang-yong stated at a price explanation meeting on the 18th, "Economic sentiment indicators have worsened significantly, and downward pressure on the economy is strong," adding, "This year’s economic growth rate is expected to be 0.1 percentage points lower than the previous forecast of 2.2%."

A decline in economic growth is a key factor negatively affecting the credit ratings assigned by international credit rating agencies. Fitch Ratings previously pointed out in a report following the emergency martial law incident that "if this situation prolongs, South Korea's sovereign credit rating will face downward pressure."

Concerns are also growing that investment will rapidly contract as companies shrink in response to heightened trade environment uncertainties with the launch of the second Trump administration next month. In desperation, business circles have appealed to the National Assembly for support. Recently, economic organization heads including Choi Tae-won, Chairman of the Korea Chamber of Commerce and Industry, visited the National Assembly and expressed concerns, saying, "The greatest fear in the economy is uncertainty," and "If uncertain conditions persist for a long time, serious damage to macroeconomic indicators is inevitable."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.