CU, 30,000 Basic Skincare Products Sold at 3,000 Won Uniform Price

GS25 Also Sees 70% Increase in Skincare Product Sales

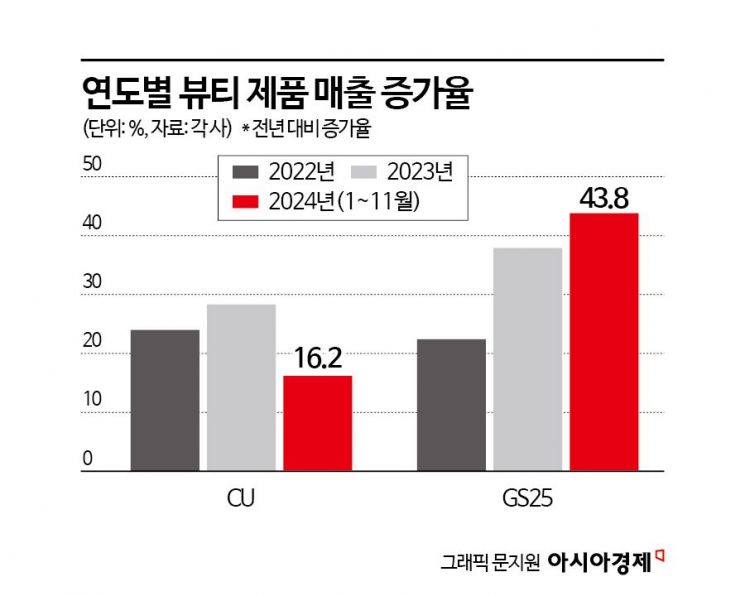

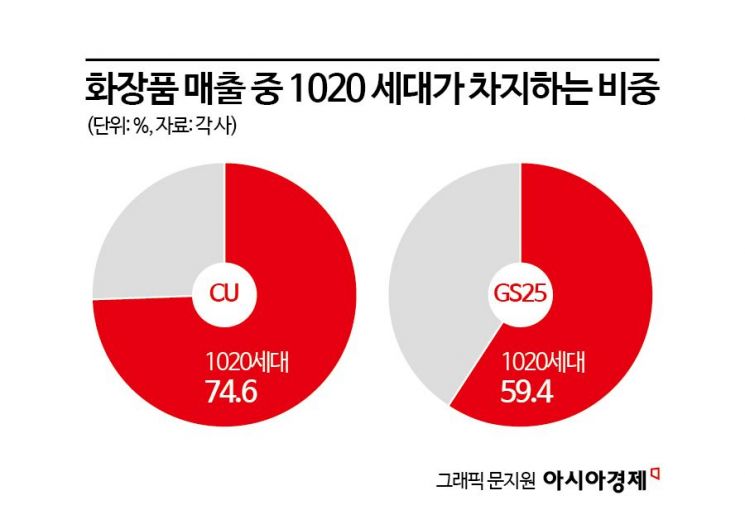

Sales Proportion of 1020 Generation Approaches 70%

Low-priced cosmetics under 10,000 won are selling like hotcakes, mainly at lifestyle specialty stores and convenience stores. In the era of high inflation, products emphasizing cost-effectiveness have gained popularity, making convenience stores and lifestyle specialty stores a rapidly emerging channel for cosmetics purchases among the 10s and 20s age group.

According to the distribution industry on the 21st, CU, a convenience store operated by BGF Retail, recorded cumulative sales of 30,000 units by the 17th of this month for three small-sized basic cosmetics (serum, water glow pack, moisturizing cream) launched in collaboration with the cosmetics brand Angeluca. These products were released at CU last September and ranked first to third in sales within CU's cosmetics category. All these products are priced uniformly at 3,000 won.

The model is examining a cost-effective cosmetic product priced at 3,000 won released by GS25. Provided by GS Retail

The model is examining a cost-effective cosmetic product priced at 3,000 won released by GS25. Provided by GS Retail

GS25, a convenience store operated by GS Retail, has also been consecutively launching skincare products such as creams, serums, and mask packs since May. The products introduced this year include two from Mediheal, four from Dewytree, and one from Acnes, with a combined sales volume of about 100,000 units as of this month. Prices are set at 700 won for mask packs, 5,000 won for toners, 7,000 won for serums, and 9,900 won for all-in-one lotions. The sales growth rate is also steep, with a 68.2% increase in sales last month compared to September for these products.

Emart24 also partnered with the cosmetics brand Plu to launch three cosmetics, including micro-needle essence, last September. Sales from October 1 to 18 increased by 32% compared to the initial launch period (October 1?18).

Not only convenience stores but also lifestyle specialty store Daiso has gained a reputation as a "cost-effective cosmetics hotspot." While small and medium-sized cosmetics companies have been stocked, major cosmetics companies such as Amorepacific, LG Household & Health Care, and Aekyung have also launched new exclusive brands for Daiso and are selling them. Due to the nature of the uniform price lifestyle specialty store, all beauty products are priced under 5,000 won.

Beauty brands stocked at Daiso are also experiencing sold-out streaks. LG Household & Health Care's "Spot Calming Gel," launched at Daiso last September, surpassed cumulative sales of 100,000 units by the end of last month. This product was released as "CNP Bye od-td," a second brand of CNP owned by LG Household & Health Care and an exclusive brand for Daiso.

Aekyung Industrial introduced its A Solution brand products to Daiso, and the "Houttuynia Cordata Calamine Soothing Spot," launched in August, sold out immediately after supply. Thanks to this, A Solution's sales at Daiso in the third quarter of this year surged eightfold compared to the same period last year. This achievement surpasses A Solution's total Daiso sales for the entire previous year.

The reason convenience stores and lifestyle specialty stores have rapidly emerged as new channels for cosmetics purchases is their superior accessibility compared to Health & Beauty (H&B) stores or cosmetics road shops. Additionally, the popularity of cost-effective beauty products sold at convenience stores and Daiso, especially among young consumers, plays a significant role. In fact, when looking at CU's cosmetics sales by age group, teenagers account for 42.3%, and people in their 20s account for 32.3%. The so-called "Jalpa generation" accounts for over 70% of sales. At GS25, the 10s and 20s age group accounted for 59.4% of cosmetics category sales from January to November this year.

A GS25 official stated, "In 2025, we plan to continue expanding cost-effective beauty items, including basic skincare and color cosmetics." On the 11th, GS25 newly launched a set of six basic cosmetics?sunscreen, serum, moisturizing cream, etc.?individually packaged based on a single-use amount (2 ml), priced at 3,000 won per set of six.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)