Samyang Foods Stock Price Continues Uptrend, Sets Record Highs

Touched 780,000 Won Intraday on the 19th

News of China Factory Establishment Drives Stock Price Increase

Brokerage Targets Rising... Price Target Reaches 900,000 Won Range

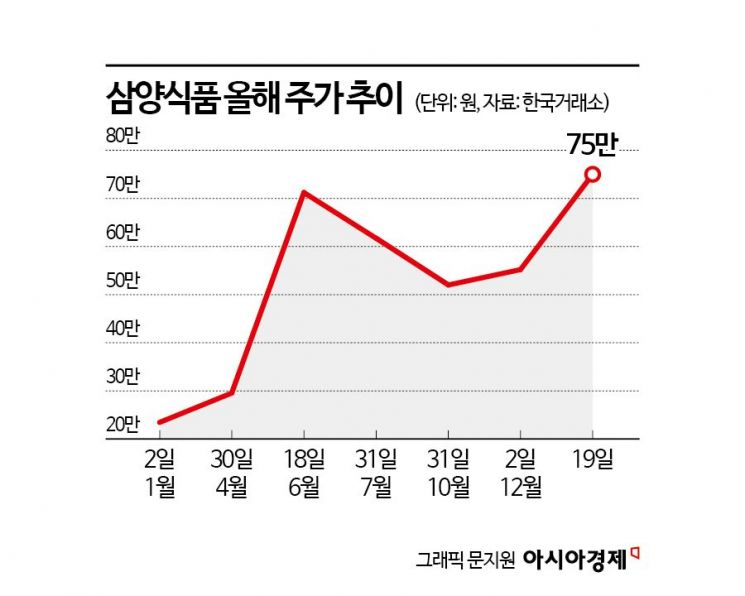

Samyang Foods is soaring again. Its stock price has risen more than 44% this month alone, reaching 750,000 KRW. Market expectations are also being adjusted upward accordingly. The target stock price has surpassed the 900,000 KRW mark.

According to the Korea Exchange on the 20th, Samyang Foods closed at 750,000 KRW, up 6.08% from the previous day. During the session, it rose to 785,000 KRW, setting a new all-time high. Earlier, on the 17th, it also reached an intraday high of 756,000 KRW, continuing its streak of breaking record highs this month.

Starting this year in the 200,000 KRW range, Samyang Foods surged throughout the first half, with its stock price surpassing the 700,000 KRW level for the first time in June. Due to fatigue from the rapid rise in the first half, the stock price fell to the 400,000 KRW range in the second half, showing some correction. The stock price, which had been moving in the 500,000 KRW range, gained momentum this month and climbed back to the 700,000 KRW level. It has risen 247% year-to-date.

The stock price increase of Samyang Foods this month was driven by institutional investors. Since November, institutions have been steadily buying Samyang Foods. From November, institutions have net purchased 113 billion KRW worth of Samyang Foods shares. Foreign investors have also joined the buying this month, purchasing 40.8 billion KRW worth of shares.

In particular, the recent announcement of establishing a local factory in China acted as a driving force for the record high. On the 16th, Samyang Foods disclosed plans to establish a production subsidiary in China and build a local factory to conduct business in the Chinese market. To this end, it plans to establish Samyang Singapore Limited, an overseas business headquarters, with an investment of 64.7 billion KRW, and through this company, set up the Chinese production subsidiary.

Ryu Eun-ae, a researcher at KB Securities, cited the establishment of the Chinese production subsidiary as leading to increased profitability in the Chinese business, improved sales mix due to a higher proportion of exports to Western countries, and the formulation of business strategies tailored to Chinese characteristics. Researcher Ryu explained, "With the construction of the local factory in China, the annual sales in China, currently about 400 billion KRW, are expected to grow. Local production in China is anticipated to reduce labor and transportation costs compared to domestic production. The increase in sales and reduction in cost burdens will directly lead to margin improvement." As of the third quarter cumulative basis this year, sales in China amounted to 306.6 billion KRW, accounting for 24.5% of total sales. With the operation of the local factory in China, the domestic factory will focus on producing export volumes to Western countries such as the United States and Europe, where unit prices are higher, which is expected to have the effect of raising the average selling price (ASP). Researcher Ryu added, "Exports to the United States and Europe are estimated to have unit prices about 20-30% higher than those to existing Asian markets, so an increase in the proportion of exports to Western countries is a direct factor for ASP growth."

Securities firms are also raising their target prices for Samyang Foods one after another, raising market expectations. Kiwoom Securities raised the target price for Samyang Foods from 800,000 KRW to 950,000 KRW. Park Sang-jun, a researcher at Kiwoom Securities, said, "We raised the target price considering the upward revision of earnings estimates due to exchange rate increases and mid- to long-term growth potential. If global sales increase as planned by the company, Samyang Foods' annual sales are expected to expand to about 3.5 trillion KRW and operating profit to 850 billion KRW by 2029. This means sales will more than double and operating profit will increase by about 2.5 times compared to this year."

DS Investment & Securities also raised the target price for Samyang Foods from 720,000 KRW to 850,000 KRW. Jang Ji-hye, a researcher at DS Investment & Securities, said, "The target price increase is due to changing the investment period based on 2025 earnings and raising the target multiple from the previous price-earnings ratio (PER) of 18 times to 20 times. Considering that the average PER of the KOSPI and KOSPI food and beverage index is around 10 times, this is a high level, but we expanded the premium because Samyang Foods' earnings per share (EPS) growth rate is expected to continuously outperform the market average and domestic and international competitors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)