Sanil Electric to List on KOSPI in July

100% Increase Compared to IPO Price

"Gradual Strengthening of Order Momentum Expected Next Year"

Amid the continued sluggishness of newly listed stocks, Sanil Electric is drawing attention with its high stock price increase. This is interpreted as reflecting expectations that the demand for transformers will continue to rise due to the construction of data centers necessary for artificial intelligence (AI).

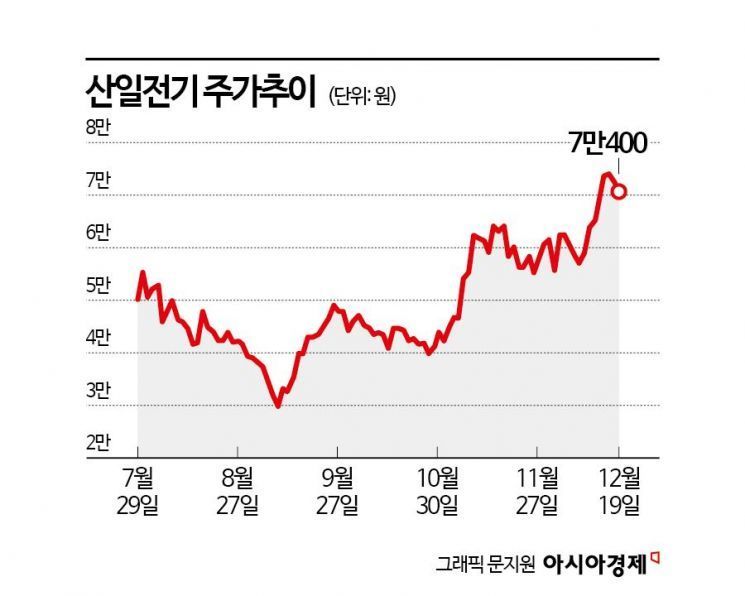

According to the Korea Exchange on the 20th, Sanil Electric closed at 70,400 won on the 19th. This represents a 101.14% increase compared to the public offering price of 35,000 won, and a 137.44% rise compared to the lowest price after listing, 29,650 won on September 6.

While newly listed stocks are experiencing sluggishness, Sanil Electric's stock price shows a steady trend. There are a total of six companies that went public on the stock market this year (excluding REITs and SPACs). Shift Up and Sanil Electric are listed on the KOSPI, while Innospace, Haas, and four others are on the KOSDAQ. Among them, only Shift Up and Sanil Electric are trading above their public offering prices. Shift Up's closing price the previous day was 61,600 won, which is only a 2.67% increase compared to its public offering price of 60,000 won.

Sanil Electric's upward trend is interpreted as reflecting the expected benefits from the advent of the AI era. Data centers are considered essential in the AI implementation process because they are necessary for storing and managing large-scale data. As a result, demand for electricity has increased, drawing attention to related companies.

Sanil Electric was established in 1987. It manufactures and sells power equipment such as special transformers and reactors. The products produced by the company are used in transmission and distribution power grids, renewable energy power plants, energy storage systems (ESS), electric vehicle (EV) charging stations, and data centers.

Its performance also supports this trend. As of the cumulative third quarter this year, Sanil Electric recorded sales of 225.6 billion won and operating profit of 75.5 billion won, marking increases of 38.78% and 80.66% respectively compared to the same period last year. The leverage effect from sales growth improved the margin rate. Additionally, transformer exports remained strong, driven by demand for power grid replacement centered on the U.S. and Europe, as well as expanded investments related to renewable energy and data centers.

Heecheol Park, a researcher at Heungkuk Securities, emphasized, "From this month, when the second factory begins full-scale operation, faster growth is expected," adding, "Sanil Electric is a company proving growth at a pace exceeding the market."

Future performance is also expected to improve. Heungkuk Securities forecasts that in the fourth quarter, Sanil Electric will record sales of 98.2 billion won and operating profit of 31.6 billion won, representing increases of 87.9% and 559.3% respectively compared to the same period last year. The sales and operating profit forecasts for next year are 480 billion won and 175.4 billion won, up 48.3% and 63.7% year-on-year respectively. Rapid growth is expected as the second factory begins full-scale operation.

Yeonju Jo, a researcher at Mirae Asset Securities, explained, "There are many volumes for which contract negotiations have been made after the new factory started operation, so the order momentum is expected to gradually strengthen next year," adding, "With an overwhelming export value chain and proportion toward the U.S., valuation differentiation is likely to continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.