The three internet-only banks (KakaoBank, K Bank, and Toss Bank) recorded strong profit growth this year. Their productivity per employee also far exceeded that of commercial banks by more than double, significantly widening the profitability gap with commercial banks. This is due to the relatively small number of employees at internet banks combined with rapid profit growth. However, there are concerns that the growth rate may have reached its limit, making it uncertain whether this growth trend will continue in the future.

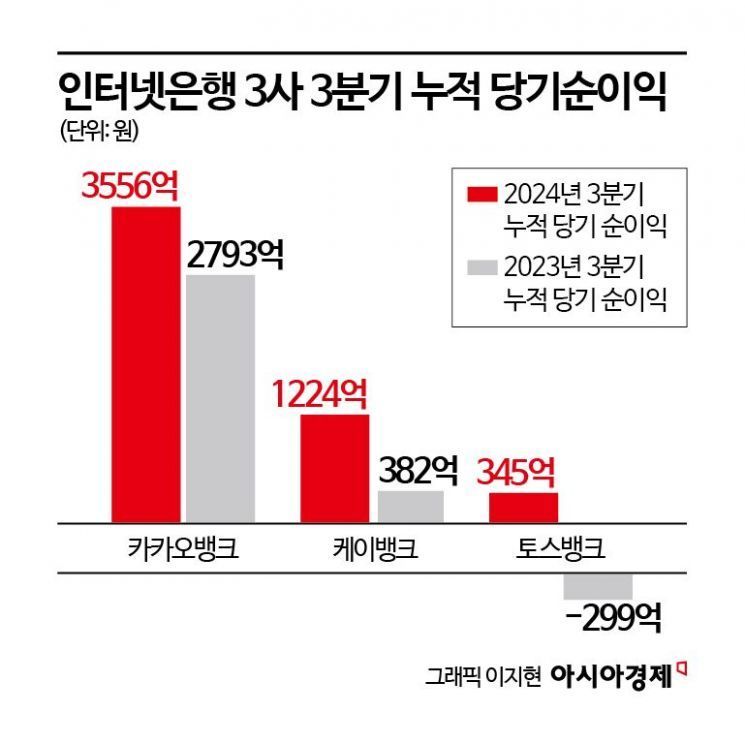

According to the Q3 management disclosures on the 19th, KakaoBank posted a cumulative net profit of 355.6 billion KRW for the first three quarters of this year. This represents a 27.3% increase compared to the same period last year (279.3 billion KRW). The growth rate has slowed compared to the previous year (37.9%). K Bank also achieved a net profit of 122.4 billion KRW during the same period, surging to about three times the amount from the previous year (38.2 billion KRW). Toss Bank turned profitable this year after a loss of 29.9 billion KRW in Q3 last year, recording a cumulative net profit of 34.5 billion KRW for the first three quarters.

The average profit per employee, a key productivity indicator, was also significantly higher for internet banks compared to commercial banks. The pre-provision profit per employee at the three internet banks averaged 562 million KRW, up 27.4% from 441 million KRW in the same period last year. In contrast, the average profit per employee at the five major domestic commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) was 255 million KRW. Among the banks, Toss Bank showed the highest productivity as of Q3. Toss Bank, with 564 employees, recorded a profit per employee of 764 million KRW, about a 60% increase from 477 million KRW in the previous year. K Bank (577 employees) posted 500 million KRW per employee (450 million KRW last year), and KakaoBank (1,568 employees) recorded 423 million KRW (396 million KRW last year).

However, it remains uncertain whether the three internet banks will maintain this growth trend going forward. Taejun Jung, a researcher at Mirae Asset Securities, said, "KakaoBank announced a value-up plan last month, aiming for an average annual operating profit growth of over 15%, a return on equity (ROE) of 15%, and a 50% dividend payout ratio by 2026, targeting 2030." He added, "However, assuming an average annual growth of 15% and maintaining a 50% dividend payout ratio after 2026, the ROE in 2030 would only be 11.1% based on the growth rate shown so far." Jung further pointed out, "To exceed an ROE of 15%, an average annual growth rate of at least 21% is required, but KakaoBank's operating profit growth rate has been declining every year, so managing growth rate is essential."

For K Bank, which failed its second listing this year, additional growth will be difficult unless it succeeds in a third listing or secures capital through other means. Jung said, "Currently, K Bank's total loans are close to the loan limit of 12.5 times its total capital," adding, "If the third listing attempt also fails, the loan growth capacity will sharply decrease." He also noted, "Additionally, unlike the loan loss cost ratio, the expense ratio is worsening, which is a cause for concern."

Toss Bank succeeded in turning a profit but has not shown a clear profit growth trend. Toss Bank demonstrated strong profit growth with simultaneous increases in interest and non-interest income, but loan loss costs have also risen rapidly. Jung explained, "In the past, Toss Bank's higher proportion of mid-to-low credit borrowers by more than 15 percentage points compared to KakaoBank or K Bank explained the lower asset quality, but now the difference in the proportion of mid-to-low credit borrowers compared to other banks is minimal, so the high loan loss costs can only be explained by deteriorating asset quality management." He added, "Since a cut in the base interest rate leads to a further decline in net interest margin, how quickly asset quality is restored will be an important variable for profit growth."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)