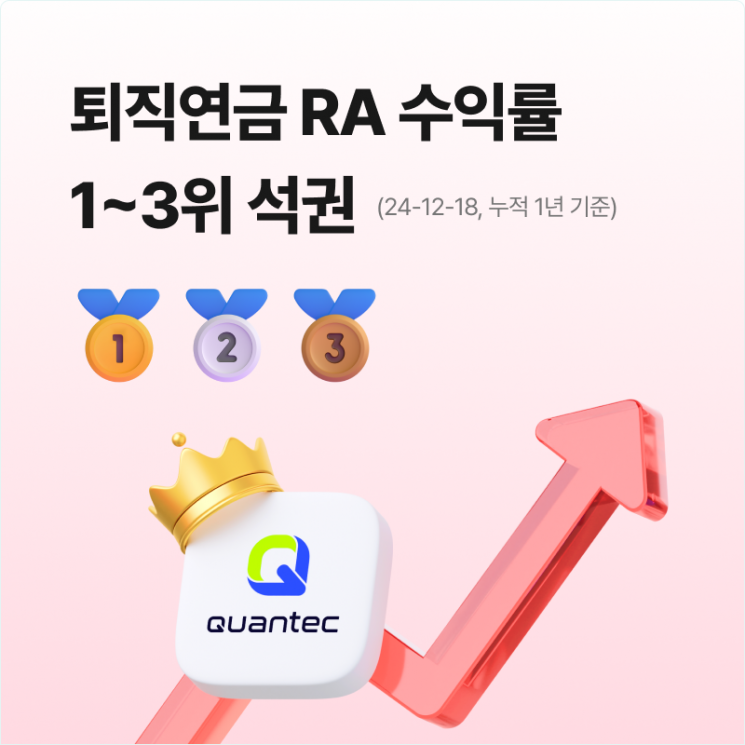

The retirement pension algorithm introduced by AI automatic investment company Quantec ranked among the top in 1-year returns among 143 aggressive investment algorithms disclosed at the Koscom Robo-Advisor Testbed Center.

On the 19th, Quantec announced that ▲Buffett Style Developed Markets ▲Multi-Asset Developed Markets ▲Multi-Asset Balanced recorded 1-year returns of 31.59%, 31.52%, and 31.13%, respectively.

Buffett Style Developed Markets is an asset allocation product reflecting Warren Buffett's trust in the capital market and a long-term investment philosophy, ranking first in both annualized and cumulative returns.

The regulatory sandbox allowing RA (Retirement Account) discretionary investment for retirement pensions is awaiting final approval, and full-scale service is expected to launch next year.

Last year, Quantec partnered with major domestic securities firms such as NH Investment & Securities, Shinhan Investment Corp., and Hana Securities. This year, as it partners with the most commercial banks in the industry, including Shinhan Bank, NH Nonghyup Bank, Woori Bank, and Hana Bank, it plans to lead the market with thorough preparation.

A Quantec discretionary investment official said, "Since RA started in 2016, Quantec's algorithms have shown good performance," adding, "As the government is ambitiously leading this initiative, it will greatly contribute to the guarantee and improvement of retirement benefits."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)