Second Lowest Shipment Volume Since 33.9 Million Tons in 1990, Prolonged Construction Market Recession Concerns

"Ultra-Tight Fiscal Policy Inevitable, Survival at Stake... Facing a Long, Dark Tunnel of Recession"

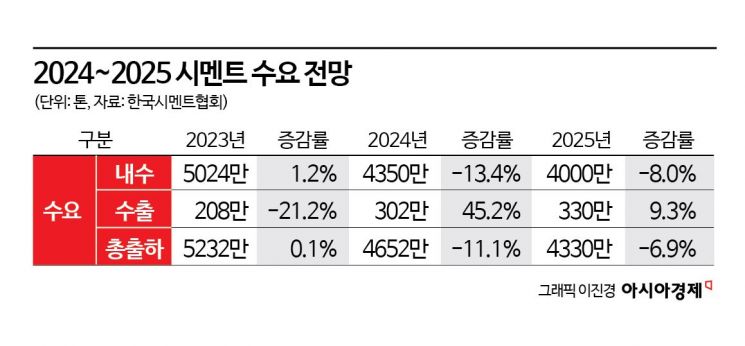

The domestic cement shipment forecast for next year has been downgraded to 40 million tons, and this year's domestic shipment, initially expected to be 44 million tons, has also been revised to 43.5 million tons. As the recession in the construction industry, a key upstream sector, continues, the cement industry is heading toward its worst downturn ever.

According to the Korea Cement Association on the 19th, the association compiled the expected cement shipment volumes for this year and next by surveying major cement companies earlier this month. The total shipment volume for this year was 46.52 million tons, including 43.5 million tons domestically and 3.02 million tons for export. Domestic shipments decreased by about 0.5 million tons from the 44 million tons forecast in September and fell 13.4% compared to last year's 50.24 million tons.

The forecast for next year is a total of 43.3 million tons, with 40 million tons domestically and 3.3 million tons for export. This represents a decrease of about 2 million tons from the 42 million tons domestic shipment forecast at the end of September and about an 8% drop compared to this year's 43.5 million tons.

The domestic cement shipment volume falling to 40 million tons marks the second-lowest record in 35 years since 1990, when it was 33.9 million tons. Moreover, both this year and next year’s shipment volumes are lower than the 44.62 million tons recorded during the 1998 International Monetary Fund (IMF) foreign exchange crisis. This indicates the worst recession in 26 years since the IMF crisis. Due to the nature of the construction materials industry, it is rare to revise shipment forecasts just a quarter after they are made, but the severe downturn in the market made it inevitable to adjust the shipment estimates.

What is even more serious is the difficulty in predicting the recovery timing of the recent construction market slump. The timing of this shipment re-estimation was before the presidential impeachment motion was proposed, and considering the negative impact of political instability on various economic sectors, the situation is analyzed to have worsened.

The Cement Association attributes this year’s shipment decline to decreases in construction orders by 2.0%, construction performance by 0.9%, and housing construction permits by 22.6% compared to the same period last year (as of the end of September).

The outlook for next year is even more negative. The cement industry expects that the risk factors in the business environment will expand due to a decrease in construction sites caused by liquidity crises among construction companies, and that the construction market slump will prolong due to delayed recovery in the real estate market and reduced construction investment. The social overhead capital (SOC) project budget for next year is expected to be 25.4 trillion won, about 1 trillion won less than this year’s 26.4 trillion won, which is also expected to have an impact.

A representative from the Cement Association said, "This year already saw a double-digit decrease (13.4%), and the outlook for the construction market entering a full-fledged downturn next year is even more uncertain," adding, "If this situation continues and worsens, the domestic shipment volume for next year could fall below the forecasted 40 million tons. The cement industry may regress to the level of the 1980s."

An industry insider said, "In a situation where ultra-tight fiscal policies are inevitable to secure funds for environmental investments, the situation is worsening to the point where even survival is a concern," and added, "It is daunting to figure out how to navigate through this long tunnel of recession."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)