Hankyungyeop, '2025 National Consumer Spending Plan Survey'

Household Consumer Spending Expected to Decrease by 1.6% Next Year

High Inflation Major Factor in Reduced Spending Decisions

75.7% Say Consumer Spending Will Recover Only After 2026

Top Policy Priority Is "Price Stability"

More than half of our citizens have confirmed plans to reduce their consumption expenditures next year. This is interpreted as a result of significantly weakened consumer sentiment due to the ongoing burden of high prices, the rapid increase in household debt, and high interest rates, creating conditions that make it difficult for people to open their wallets.

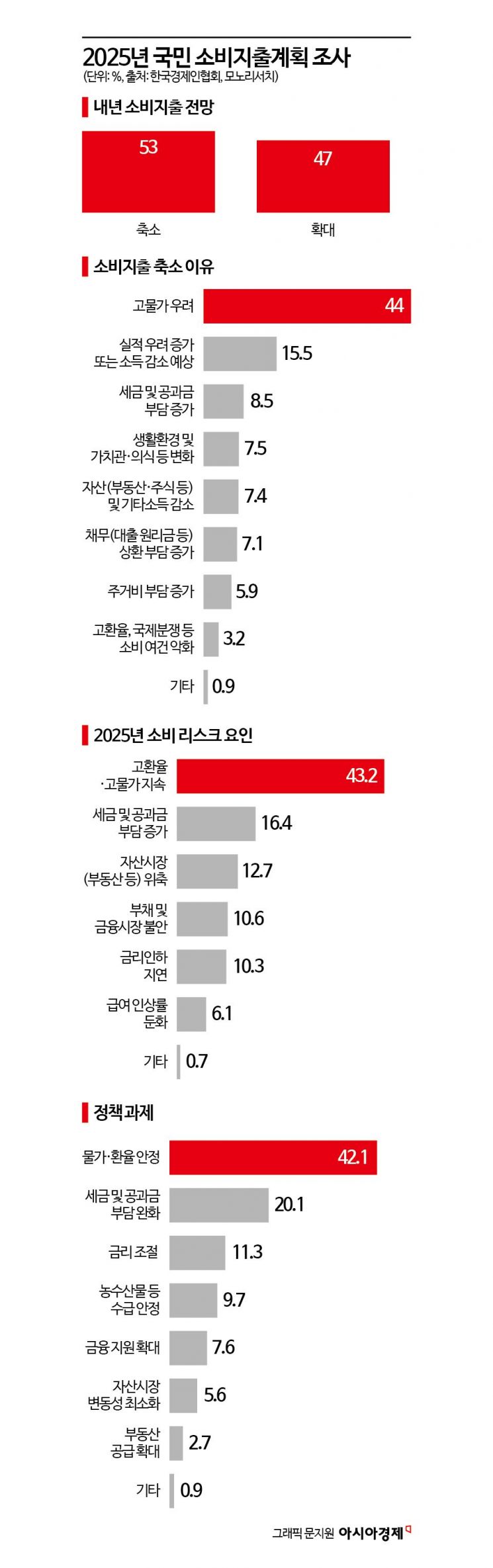

According to the business community on the 19th, the Korea Economic Association (HanKyungHyup) commissioned the public opinion research firm 'MonoResearch' to conduct the '2025 National Consumption Expenditure Plan Survey' from the 13th to the 20th of last month targeting 1,000 citizens aged 18 and over nationwide. The results showed that 53% of respondents plan to reduce their consumption expenditures next year compared to this year. Accordingly, HanKyungHyup estimated that household consumption expenditures will decrease by an average of 1.6% next year compared to this year.

The biggest reason citizens decided to reduce consumption expenditures next year was the 'continued high prices,' mentioned by 44% of respondents. Following that were 'income reduction and performance concerns' at 15.5%, and 'increased burden of taxes and public charges' at 8.5%. Consumption is expected to shrink mainly in areas related to outdoor activities such as 'travel, dining out, and lodging (17.6%)', 'leisure and cultural activities (15.2%)', and 'clothing and footwear (14.9%)'. On the other hand, essential consumer goods with fixed expenditures regardless of economic conditions, such as food and beverages (23.1%), housing costs (rent, electricity, gas, water, etc., 18.0%), and daily necessities (toilet paper, detergents, etc., 11.5%), are expected to see increased consumption expenditures. Consumption is also expected to polarize by income quintile. Respondents in the 1st to 3rd quintiles (lower 60%) said they would reduce consumption next year compared to this year, while those in the 4th and 5th quintiles (upper 40%) responded that they would increase consumption. HanKyungHyup interpreted this as "the lower the income, the more sensitive people are to the effects of high prices and economic recession, showing a tendency for the reduction in consumption expenditures to be inversely proportional to income level."

Meanwhile, citizens identified the biggest risk factor affecting consumption activities next year as 'continued high exchange rates and high prices (43.2%)'. Other respondents pointed to 'increased burden of taxes and public charges (16.4%)' and 'contraction of asset markets (real estate, etc.) (12.7%)'. Additionally, the majority of citizens (75.7%) expected consumption to revive after 2026. On the other hand, a significant portion (35.1%) expressed a negative outlook, saying there is 'no promise' of consumption revival. Only 24.3% responded that consumption has already revived (2.5%) or will revive soon next year (5.8% in the first half, 16.0% in the second half). As the top policy task to improve the difficult consumption environment, 'price and exchange rate stabilization' was the most cited at 42.1%, followed by 'relief of tax and public charge burdens (20.1%)' and 'interest rate adjustment (11.3%)'.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.