Loan Interest Rates Soared to 7-8% After Legoland Incident, Lowest Since

Political Uncertainty Completely Freezes Buying Sentiment

Due to President Yoon Suk-yeol's declaration of martial law and the ensuing impeachment political turmoil, it has been observed that buying sentiment in the real estate market has frozen this month. Not only investors but also actual demanders have turned to a wait-and-see stance. The real estate market is closely linked to related laws and policies, thus it is influenced by political and administrative situations. Despite the decline in housing prices, polarization by region continues, according to investigations.

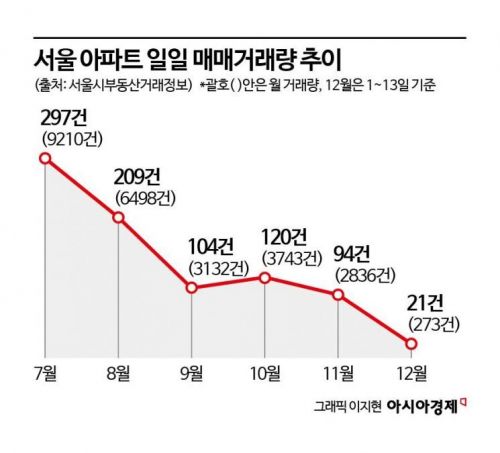

21 Transactions Per Day on Average... Lowest Since the Legoland Incident

According to the Seoul Metropolitan Government Real Estate Information Plaza on the 16th, the number of apartment sales transactions in Seoul from December 1 to 13 totaled 273. On average, this amounts to only 21 transactions per day. This is the lowest level since October 2022, when the Legoland incident, which shook the domestic financial market, occurred. At that time, mortgage loan interest rates at commercial banks soared to 7-8%, and the average daily number of apartment sales transactions in Seoul was about 18. The average daily transaction volume had significantly decreased from the peak of 297 transactions in July this year to 94 in November. Even so, compared to that, December is expected to reach the lowest level this year.

Park Won-gap, Senior Real Estate Specialist at KB Real Estate, analyzed, "The real estate market faces many adverse factors such as domestic economic recession and loan regulations, so it will not be easy. Until political uncertainty is resolved, it will be difficult for transaction volumes to increase, and prices may also show weakness."

Transaction Prices Stall... Polarization Remains

As the number of transactions decreases, the upward trend in transaction prices has also stalled. According to the Korea Real Estate Board, apartment prices in the metropolitan area stopped rising after 30 weeks since the third week of May and remained flat. Nationwide apartment transaction prices fell by 0.03% compared to the previous week. Seoul saw a 0.02% increase, but the rate of increase was 0.02 percentage points lower than the previous week.

Meanwhile, regional polarization in transaction prices persists. Comparing the increase rates between Gangnam and Gangbuk areas in Seoul based on KB Real Estate's market trend survey for the second week of December, Gangnam still holds the advantage. Gangbuk rose by 0.03%, while Gangnam rose by 0.06% compared to the previous week. A KB Real Estate official explained, "Although the superiority of Gangnam's increase rate has weakened significantly compared to before October, the gap in increase rates between Gangnam and Gangbuk continues."

According to the KB Real Estate Weekly KB Apartment Market Trend report, last week Seoul apartment sale prices surged by 0.22% in just one week, with apartment sale and jeonse prices listed on May 5th in Mapo-gu, Seoul. Photo by Jinhyung Kang aymsdream@

According to the KB Real Estate Weekly KB Apartment Market Trend report, last week Seoul apartment sale prices surged by 0.22% in just one week, with apartment sale and jeonse prices listed on May 5th in Mapo-gu, Seoul. Photo by Jinhyung Kang aymsdream@

Experts predict that polarization such as 'Metropolitan Area vs. Provinces' and 'Gangnam vs. Gangbuk' will continue next year. The Korea Construction Industry Research Institute expects, "Housing prices in the metropolitan area will rise by 1% next year, but prices in the provinces will fall by 2%." The Korea Institute of Construction Policy also forecasts, "Housing prices in the metropolitan area will increase by 1% next year, while prices in the provinces will remain flat."

The polarization phenomenon is also clearly evident in Gyeonggi Province. Specialist Park analyzed, "Looking at the apartment actual transaction price index in Gyeonggi Province, it rose by an average of 3.35% until the third quarter of this year (compared to December 2023), but there were significant temperature differences by region." Gwacheon rose by 10.2%, but Anseong (-4.7%) and Pyeongtaek (-3.8%) sharply declined. Park added, "Next year, the pattern of separate movements by region, like individual battles, will continue. There is a case to be made that the housing market should be viewed not by administrative districts but by living zones."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)