FuturePlay unveiled an infographic summarizing this year’s achievements, titled ‘FuturePlay 2024, a Growth Partner Connecting the Future from Seed,’ on the 16th.

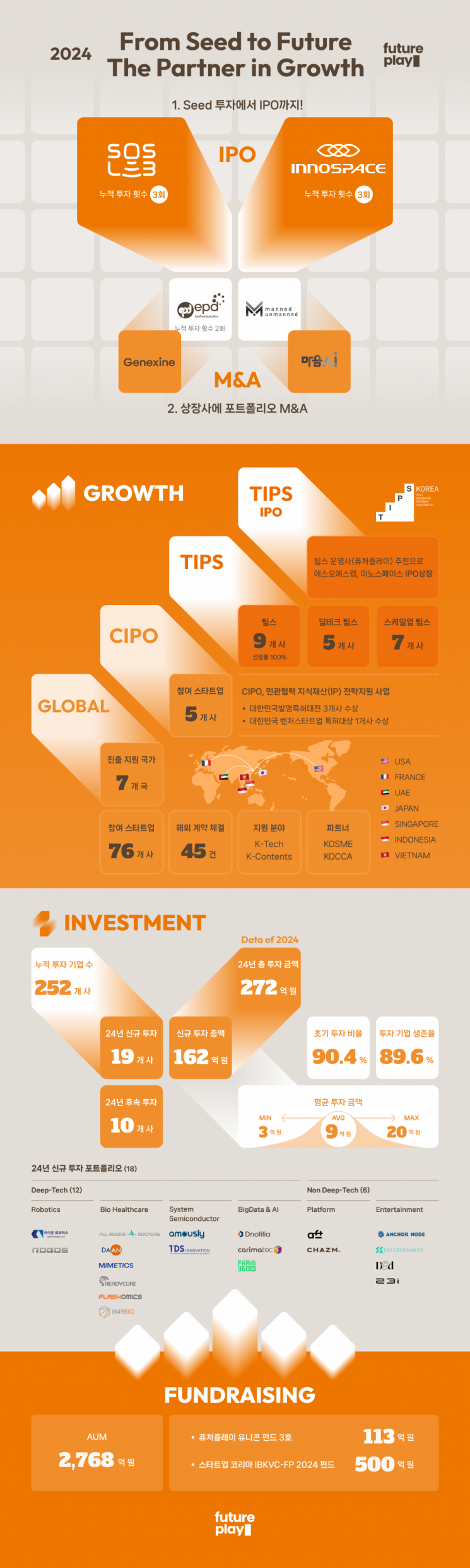

Despite the continued uncertainty in the domestic and international investment environment this year, FuturePlay achieved remarkable results through major portfolio company initial public offerings (IPOs) and mergers and acquisitions (M&A). Notably, even though the domestic IPO market shrank by about 30% compared to the previous year, SOSLAB and Innospace succeeded in going public one after another.

In particular, SOSLAB (3D LiDAR development) and Innospace (hybrid space launch vehicle development) successfully listed on KOSDAQ after 8 and 7 years since their establishment, respectively, significantly shortening the average IPO period for domestic startups (13 years). EPD Biotherapeutics and MandOnMand were acquired by Genexine and Maum AI, respectively, securing stronger growth momentum through M&A.

As an operator of TIPS (Tech Incubator Program for Startup) under the Ministry of SMEs and Startups, FuturePlay achieved the selection of 9 TIPS companies, 5 deep-tech TIPS companies, and 7 scale-up TIPS companies this year. In particular, it recorded a 100% recommendation selection rate for TIPS and actively provided follow-up support. To support the overall growth of portfolio companies, a Value-Up team was newly established. Through support across the entire lifecycle of startups, it plans to promote long-term growth and help them gain competitiveness in the global market.

This year, FuturePlay diversified its investment areas by executing a total investment of 27.2 billion KRW. It recorded 19 new investments and 10 follow-up investments, with an average investment amount of 900 million KRW for the 19 new investments. Among them, it invested 1.5 billion KRW in Design & Practice, a spin-off company of Finda. Follow-up investments also expanded in scale, with up to 2 billion KRW invested in Nabipra and MediInTech. Additionally, by expanding investment areas from deep tech (robotics, bio healthcare, semiconductors) to entertainment and platforms, FuturePlay further strengthened its position as a comprehensive investment firm.

Assets under management (AUM) also reached a record high of 276.8 billion KRW. Through the ‘FuturePlay Unicorn Fund No.3,’ it secured 11.3 billion KRW, and notably, it closed the ‘Startup Korea IBKVC-FP 2024 Fund,’ created jointly with IBKVC, at 50 billion KRW.

Kwon Oh-hyung, CEO of FuturePlay, said, “Beyond being a simple investment firm, we provide customized support as a partner throughout the entire lifecycle of portfolio companies, and we will work together on strategizing and executing global expansion.” He added, “We will continue to provide close support so that innovative startups can successfully establish themselves in domestic and international markets.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.