CEO Score, Top 10 Companies by Market Cap in 4 Countries

Comparative Analysis of Performance and Stock Prices Over the Last 4 Years

Korean Companies' Market Cap Down 13% and Operating Profit Down 20%

When comparing the operating profits and stock prices of the top 10 companies by market capitalization in South Korea, the United States, Japan, and Taiwan, only South Korean companies showed a decline compared to four years ago. While the market capitalization of companies in the US, Japan, and Taiwan increased by 53% to 107%, South Korea's decreased by about 13%, and while operating profits rose by 116% to 123% in the other countries, South Korea's fell by 20%. The recent emergency martial law incident and impeachment political turmoil are expected to widen this gap further.

According to CEO Score, a corporate data research institute, on the 11th, an investigation into the market capitalization and performance of the top 10 companies (excluding financial firms) by market capitalization in the four countries over the past four years showed that as of the end of last month, the market capitalization of the top 10 South Korean companies was KRW 735.42 trillion, down 12.7% from KRW 842.88 trillion at the end of 2020. During the same period, the market capitalization of the top 10 companies in the US, Japan, and Taiwan increased significantly.

US companies' market capitalization rose from USD 9.2749 trillion to USD 19.1891 trillion, an increase of 106.9%. Japanese companies increased from JPY 114.6357 trillion to JPY 175.7745 trillion, up 53.3%. Taiwanese companies grew from TWD 19.5653 trillion to TWD 35.7789 trillion, an 82.9% increase.

In the case of Taiwan, when converted to Korean won, the market capitalization of the top 10 companies at the end of 2020 was KRW 756.59 trillion, which was 10.2% smaller than South Korea's KRW 842.88 trillion, but by the end of last month, it surged to KRW 1,534.56 trillion, more than double South Korea's.

Operating profits (based on each company's most recent fiscal year over five years) also declined only in South Korea. The total operating profit of the top 10 South Korean companies by market capitalization decreased by 20.3%, from KRW 44.31 trillion in 2020 to KRW 35.31 trillion this year.

US companies' operating profits increased from USD 223.8 billion to USD 492.1 billion, a 119.9% rise. Japanese companies' operating profits grew from JPY 5.4889 trillion to JPY 11.8714 trillion, up 116.3%. Taiwanese companies also saw an increase from TWD 651.7 billion to TWD 1.4523 trillion, a 122.8% rise.

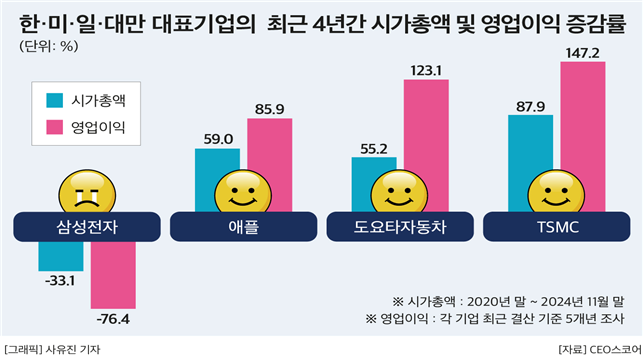

The analysis of the top company by market capitalization showed similar results.

South Korea's top company, Samsung Electronics, saw its market capitalization decrease by 33.1%, from KRW 483.55 trillion in 2020 to KRW 323.56 trillion at the end of last month. Its operating profit also dropped by 76.4%, from KRW 27.77 trillion to KRW 6.57 trillion.

Apple's market capitalization in the US increased by 59.0%, from USD 2.256 trillion to USD 3.587 trillion. During the same period, its operating profit rose by 85.9%, from USD 66.3 billion to USD 123.2 billion. Toyota Motor Corporation in Japan saw its market capitalization grow by 55.2%, from JPY 25.9637 trillion to JPY 40.3009 trillion. Its operating profit also increased by 123.1%, from JPY 2.3992 trillion to JPY 5.3529 trillion.

TSMC in Taiwan experienced an 87.9% increase in market capitalization, from TWD 13.7431 trillion to TWD 25.829 trillion. Its operating profit surged by 147.2%, from TWD 372.7 billion to TWD 921.5 billion.

Jo Won-man, CEO of CEO Score, said, "While undervaluation has been pointed out as a chronic problem in the Korean stock market, Korean companies are currently caught in an even more serious low-growth trap. The recent '12·3 emergency martial law incident' and the subsequent impeachment political turmoil are expected to act as nuclear bomb-level adverse factors for already vulnerable Korean companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.