The global electric vehicle market, excluding China, experienced slight growth. While Tesla, Volkswagen, and Hyundai Motor Group dominated the top sales rankings, the rapid growth of Chinese automakers such as BYD and Geely Automobile was also notable in markets across North America, Europe, and Asia.

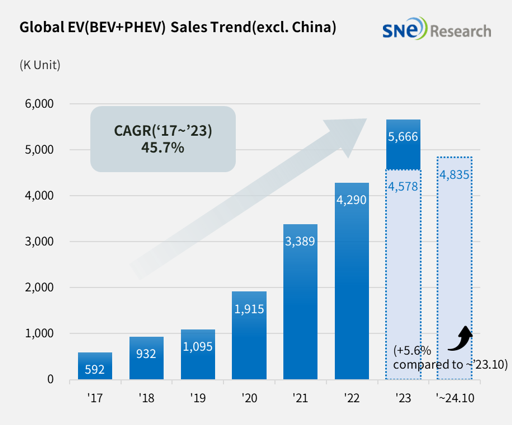

According to SNE Research on the 10th, the number of global electric vehicle (including BEV and PHEV) registrations from January to October this year, excluding China, reached 4.835 million units, a 5.6% increase compared to the same period last year.

In terms of sales volume rankings, Tesla recorded a decline but maintained the top position. Tesla’s sales of Model 3 and Model Y, which account for about 95% of total sales, decreased by 5% year-on-year. In particular, sales in Europe dropped by about 10%, and in North America by about 3%. On the other hand, Tesla’s operating profit in the third quarter was approximately $2.7 billion, a 54% increase from the previous year. An SNE Research official analyzed, "Tesla’s high net profit in the third quarter is due to the sale of regulatory credits from carbon emission reductions and the effect of reduced vehicle production costs."

The Volkswagen Group, which includes Audi, Porsche, and Skoda, ranked second with 611,000 units sold, a 1.3% decrease from the previous year. Next, Hyundai Motor and Kia took third place with 450,000 units sold.

Meanwhile, the rise of Chinese automakers such as Geely Automobile and BYD stood out in this ranking. During the same period, Geely Automobile sold 324,000 units, a 21% increase year-on-year, and BYD sold 192,000 units, a 140% increase compared to the previous year.

Looking at the regions, the growth rate in the European market slowed down. Europe recorded a 0.9% decline but accounted for more than half of the market share outside China. The North American region recorded an 8.4% growth rate compared to the same period last year. This was due to the continued slowdown in electric vehicle demand despite the implementation of the Inflation Reduction Act (IRA) subsidy policy and a surge in demand for hybrid vehicles.

Hyundai Motor Group, ranked second in the North American market, grew significantly by 31.8%. Several automakers, including Hyundai Motor Group, have announced the development of Extended-Range Electric Vehicles (EREV) to actively respond to the demand for hybrids.

The Asia (excluding China) region recorded a 15.5% growth rate year-on-year due to increased sales by automakers expanding overseas such as BYD, Shanghai Automotive Industry Corporation (SAIC), and VinFast. Outside China, Chinese automaker Geely Automobile Group increased its market share through strong sales of the Volvo brand in Europe, while BYD raised its share by selling competitively priced vehicles in emerging markets in Southeast Asia and Latin America, including Thailand and Brazil.

An SNE Research official said, "Chinese companies that have aggressively invested overseas, including emerging countries, are showing strong growth," adding, "As uncertainties increase in major demand regions for Korean companies such as North America and Europe due to carbon regulation easing and the potential repeal of the IRA, it is becoming increasingly important to have strategies and policy directions that align with the political situations of each country."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)