36.1% in Q3, Highest Since Establishment

High-Value Ultra-High Voltage Transformer Market Position Up

The North American (United States, Canada) performance share of domestic transformer companies, which are experiencing a boom in power equipment, has recorded the highest quarterly level ever. Some companies have secured orders through 2030.

At the completion ceremony of the transformer specialized storage facility held on July 26 (local time) at HD Hyundai Electric's production subsidiary in Alabama, USA, officials are taking a commemorative photo. From the left, Seosangpyo, Consul General of Atlanta; Son Chang-gon, Head of HD Hyundai Electric's US production subsidiary; and Jo Seok, Vice Chairman of HD Hyundai Electric (then President). Photo by HD Hyundai Electric

At the completion ceremony of the transformer specialized storage facility held on July 26 (local time) at HD Hyundai Electric's production subsidiary in Alabama, USA, officials are taking a commemorative photo. From the left, Seosangpyo, Consul General of Atlanta; Son Chang-gon, Head of HD Hyundai Electric's US production subsidiary; and Jo Seok, Vice Chairman of HD Hyundai Electric (then President). Photo by HD Hyundai Electric

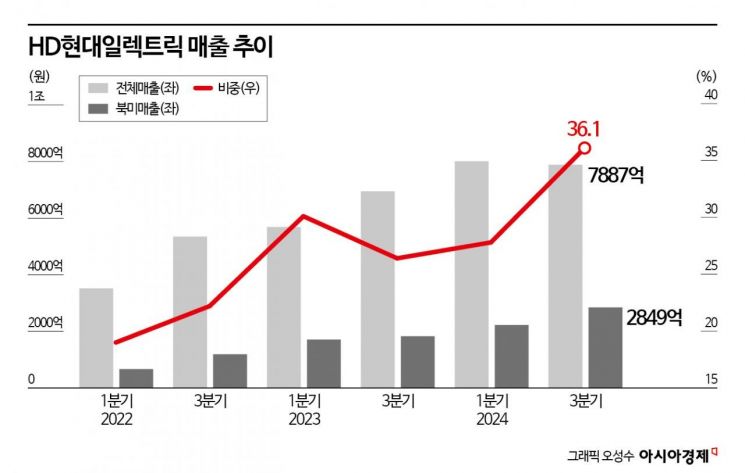

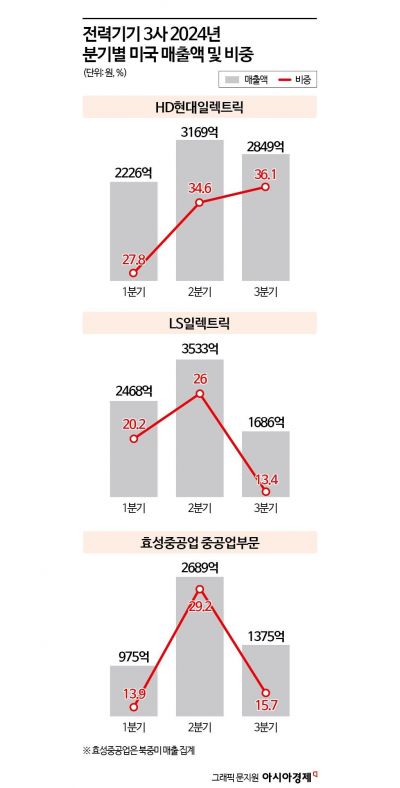

According to the industry on the 11th, HD Hyundai Electric, the No. 1 power equipment company in Korea, recorded its highest-ever North American sales share of 36.1% (284.9 billion KRW) in the third quarter. Compared to the first quarter of 2022, when sales began to increase sharply, it grew 4.3 times (66.9 billion KRW → 284.9 billion KRW). HD Hyundai Electric is reported to have secured orders in the North American market through 2030.

The boom in the North American market is due to the remarkable market growth and timely introduction of desired products. According to global market research firm Global Market Insights (GMI), the North American power service market size is approximately 158.5 billion USD (about 227 trillion KRW) this year and is expected to grow to about 252.8 billion USD (about 362 trillion KRW) by 2032.

HD Hyundai Electric mainly sells high value-added products such as extra-high voltage transformers in the North American market. Although extra-high voltage transformers have a high unit price, the higher the voltage, the better the electrical transmission efficiency. Transformers for artificial intelligence (AI) data centers cost between 2 billion and 4 billion KRW per unit.

KOTRA stated at the '2025 Global Market Entry Strategy Briefing' earlier this month, "With the increase in power demand, investments in power infrastructure such as nuclear power plants, small modular reactors (SMR), and transmission and distribution networks are expected to become active," adding, "In particular, the United States plans to invest 1.5 billion USD (about 2.15 trillion KRW) to improve transmission and distribution networks."

LS Electric and Hyosung Heavy Industries are also accelerating efforts to enhance their order competitiveness. Hyosung Heavy Industries doubled its production capacity by completing the expansion of its extra-high voltage transformer factory in Memphis last June.

LS Electric acquired the small and medium-sized enterprise KOC Electric and plans to increase the production capacity of its Busan and Ulsan plants to about 700 billion KRW annually by 2026, and to establish a mass production system at its factory in Bastrop, Texas, starting from September next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.