Publication of "Corporate Governance Insight" Issue No. 8

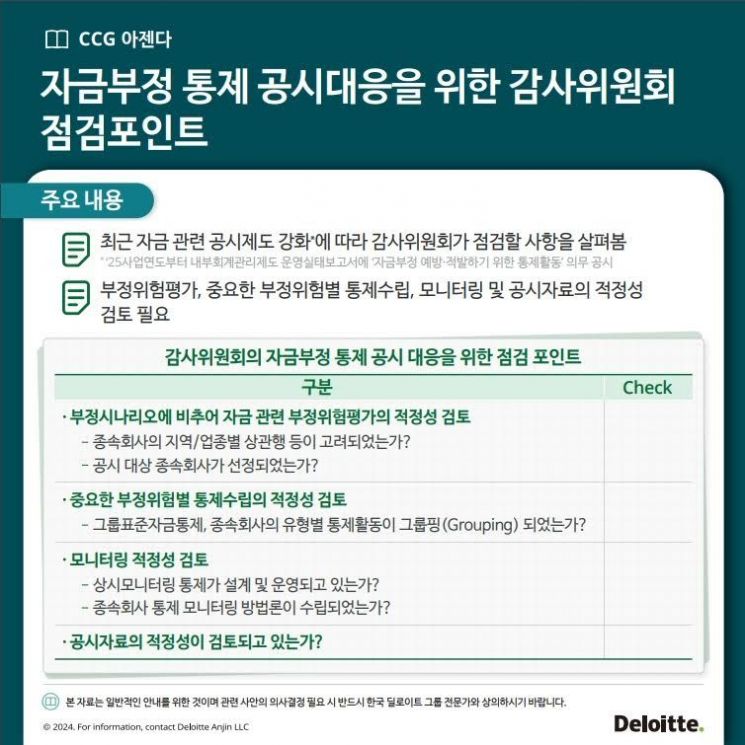

The Korea Deloitte Group Governance Development Center announced on the 9th that it has published the 8th issue of "Corporate Governance Insights" and presented key checklist items related to the audit committee's response measures within the board of directors for the 'Disclosure of Controls over Misappropriation of Funds' system, which will be mandatory starting next year.

From the 2025 fiscal year, listed companies and large unlisted companies must additionally disclose "control activities to prevent and detect misappropriation of funds such as embezzlement" in their internal accounting management system operation status reports. This is in line with the recent policy trend of regulatory authorities strengthening disclosure systems related to funds.

The report presented the audit committee's enhanced role and key checklist items for responding to the disclosure of controls over misappropriation of funds, including ▲fraud risk assessment ▲establishment of controls for major fraud risks ▲monitoring and review of the appropriateness of disclosure materials. The report stated, "As of the 2023 fiscal year, a total of 87 companies received adverse audit and review opinions on their internal accounting management systems, of which 16 companies (18.4%) received adverse opinions due to fund-related reasons," and emphasized, "strengthened responses for controls over misappropriation of funds are necessary."

The audit committee also needs to check whether the control activities of subsidiaries are appropriate based on fraud risk assessments and review whether the establishment of control activities by type and region is adequate. In particular, subsidiaries should closely monitor the risk of fund incidents, considering that internal control design and operation may be insufficient due to a lack of human and physical infrastructure and resources.

Jung Hyun, Head of the Internal Accounting Management System CoE (Center of Excellence) at the Korea Deloitte Group Audit Division, stated, "Formal risk assessments lead to formal internal control operations, so it is necessary to check the effectiveness of control activities led by the headquarters at the group level," and added, "It is essential to question whether the control activities currently designed and operated within companies are sufficient and effective for actual risk management, and to verify the effectiveness of control activities through substantive and precise risk assessments."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)