Overseas Expat Salaries Cut, 'Gireogi Parents' Strained

Risk Premium Added to Costs in Deals with Korean Companies

Somber National Mood During Year-End Peak Season, Self-Employed in Distress

# "My salary has decreased."

Mr. Kim (38), a family member of an expatriate living in Wrocław, Poland, said, "The exchange rate of KRW to Zloty (Polish currency) jumped by 2.5% just 1 hour and 30 minutes after the president announced martial law," adding, "I receive my salary in Korean won and convert it to the local currency, so all employees are feeling gloomy." Domestic companies such as POSCO, LG Energy Solution, and LS Cable operate in this area. Each company has a different salary payment method, but families who receive their salary in Korean won and convert it to Zloty have seen their salary decrease by the amount of the exchange rate increase. Expatriates who receive their salary in Zloty also suffer losses because their salary is calculated based on the won value on a specific day each month. He said, "I was working hard at the company, but Polish people saw the news and informed me first," and added, "It's not just about the salary; even though I work hard abroad, I had feelings of longing and pride for Korea, but it hurts so much to see our country's image deteriorate."

On the 4th, when President Yoon Seok-yeol announced the lifting of martial law, officials in the dealing room of Hana Bank in Jung-gu wore stern expressions.

On the 4th, when President Yoon Seok-yeol announced the lifting of martial law, officials in the dealing room of Hana Bank in Jung-gu wore stern expressions.

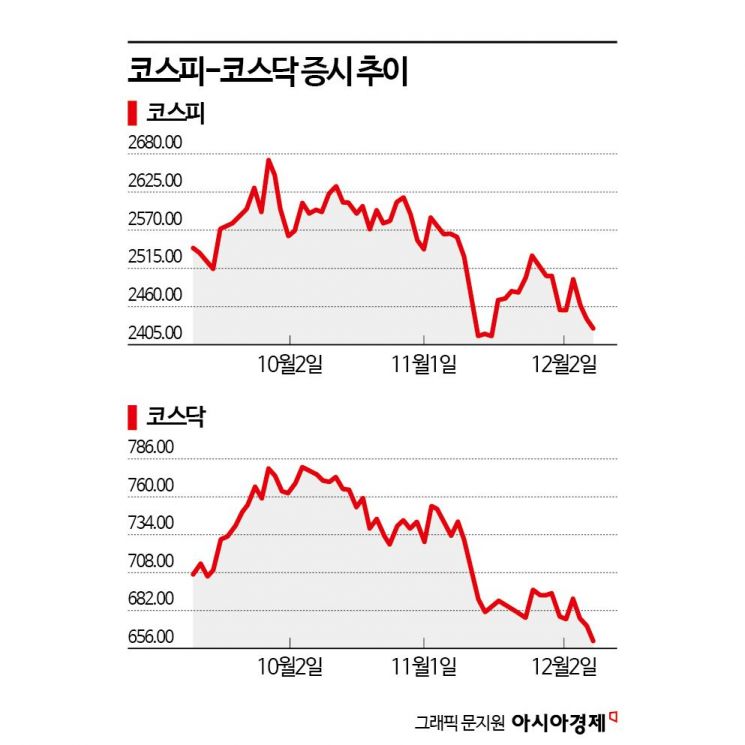

Market Chaos... KOSPI Market Cap Vanishes by 58 Trillion Won in Three Days

The political turmoil triggered by President Yoon Suk-yeol's declaration of martial law is prolonging, causing astronomical national losses due to instability in financial markets such as exchange rates and stock markets. The precarious domestic political situation has added a country risk premium to Korean companies in overseas transactions. Comprehensive damages are observed, from derivative losses to small business recessions. The social and economic costs caused by the president's unconstitutional martial law declaration are being borne by the public.

According to the Korea Exchange on the 9th, the KOSPI index closed at 2,428.16 on the 6th, down 71.94 points (2.87%) from the closing price of 2,500.10 on the 3rd, before President Yoon's martial law declaration. The KOSPI market capitalization fell from 2,046.261 trillion won on the 3rd to 1,988.510 trillion won on the 6th, erasing about 58 trillion won in three days.

The domestic virtual asset market also experienced significant turmoil. Bitcoin, which had maintained around 130 million won, plummeted to the 80 million won range on domestic exchanges in less than an hour after the martial law declaration. Amid the 'martial law shock' causing a sharp drop in virtual asset prices, some exchanges even blocked user access. As investors tried to access apps en masse during the crash, exchange systems were paralyzed, causing delays of one to two hours in app access for Upbit and Bithumb. Fortunately, coin prices recovered and the market stabilized, but the situation was precarious as investor losses due to failed sales could have escalated uncontrollably.

Industry and Financial Sectors Cry Out as 'Exchange Rate Defense and Political Strikes' Costs Add to Recession

Due to political instability, the KRW-USD exchange rate briefly surged to 1,446 won before settling back to the 1,420 won range, still at a high level. Companies with a high proportion of raw material imports are struggling to minimize the impact of exchange rate volatility. Domestic major airlines lease about half of their aircraft, and low-cost carriers lease most of theirs, incurring large lease fees. Additionally, about 30% of their cost of sales is spent on fuel. Since all these costs are paid in dollars, an increase in the exchange rate significantly raises fixed costs.

Export-oriented industries see increased sales when the exchange rate rises, but raw material purchases and overseas facility investment costs also increase, adding to the burden in the mid to long term. Especially for domestic battery companies investing in the trillion-won range, rising exchange rates can sharply increase investment costs. Companies that import raw materials in dollars but export in other currencies such as yen, yuan, or euro are even more exposed to exchange rate volatility.

A financial sector official said, "For our export-oriented companies, a moderate and gradual rise in the exchange rate would improve exports, but the current exchange rate situation is too volatile and unpredictable," adding, "Our companies and financial institutions have to spend a lot on managing exchange rate risks." He explained, "Banks have to trade foreign exchange, and managing this exchange risk incurs significant costs."

The country risk premium has made price negotiations with overseas partners unfavorable, and financing costs have increased. A securities firm official said, "If political instability prolongs, the cost of raising foreign currency bonds will increase," adding, "Companies issuing foreign currency bonds have to refinance at higher costs, so many companies are currently burdened." Concerns about losses from derivatives linked to exchange rates or domestic indices have also grown.

Private bankers (PBs) at securities firms are also struggling with customer management due to unexpected political risks. A PB at securities firm A said, "Our government bonds, recently included in the World Government Bond Index (WGBI), finally had a chance to be properly evaluated, but this may be disrupted," adding, "We are considering the worst-case scenarios, including a downgrade in national credit rating." He said, "Foreigners sold Samsung Electronics shares but were interested in value-up, and the KOSDAQ was just starting to rise, so it's unfortunate."

'Martial Law Bill' Delivered to Personal Lives... Series of 'Reservation Cancellations' During Year-End Peak Season

The 'martial law costs' passed on to individuals feel even more significant. Exchange rate volatility has increased the burden on travelers planning overseas trips at year-end. With the domestic economy in recession, wallets have tightened further. The martial law and its aftermath are a fatal blow to small business owners who have been waiting for the year-end peak season. Mr. A, in his 30s, who runs a pub in Yongsan, said, "After the martial law incident, all group reservations were canceled, and small business owners in this neighborhood are struggling," adding, "With the country in this state, business this year is ruined." Meanwhile, according to the Bank of Korea and others, private consumption in Q1 2004 decreased by 0.1% quarter-on-quarter following the impeachment motion against former President Roh Moo-hyun. This was the first negative turn in three quarters since Q2 2003 (-0.6%). Consumption also slowed in Q4 2016, when suspicions about former President Park Geun-hye's secret confidante first arose. The private consumption growth rate in Q4 2016 was 0.2%, lower than 0.8% in Q2 and 0.4% in Q3 of the same year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)